She was quoted $351 for a breast MRI. Then she was charged $4,650

Bette Popiel shopped around for the best cash price for a breast MRI and got a bill for thousands more, showing how even the savviest of health-care consumers struggle to navigate the system.

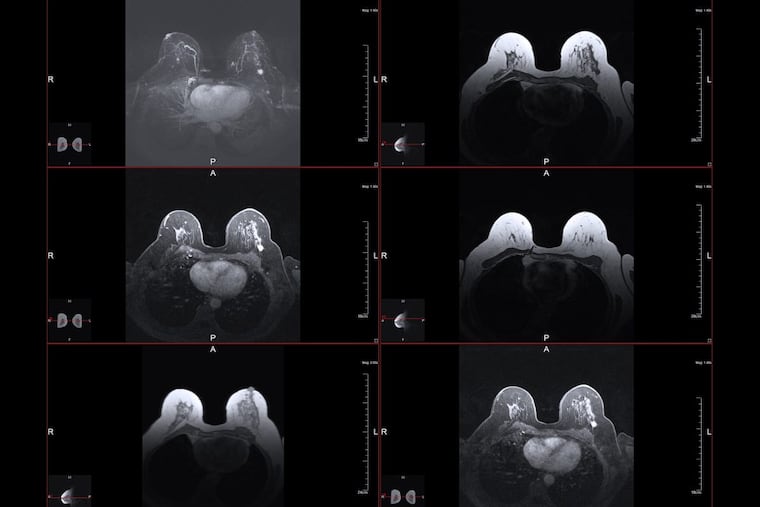

Bette Popiel knew the breast MRI she wanted to detect possible tumors hidden by dense tissue wouldn't be covered by Medicare, so she would have to pay cash.

She called a handful of providers, found the best price, and booked the appointment.

But what began as an exercise in smart shopping turned into a cautionary tale when Popiel received a bill for thousands of dollars more than what she had been told to expect. Even the savviest of health-care shoppers struggle to navigate the system.

"Lesson learned," said Popiel, 66, of Thornton, in Delaware County. "Keep volumes of notes of everyone you speak to and always get the quoted price in writing."

Popiel has denser than average breast tissue, which is difficult to see through on a mammogram, the standard screening for breast cancer. Doctors often recommend patients with dense breasts have a second scan, such as an ultrasound or MRI to detect abnormalities that may have been obstructed.

Popiel's doctor wrote a script for the breast MRI, but she knew it wouldn't meet Medicare's coverage requirement of being medically necessary. She had had one in the past and wanted the peace of mind the scan would offer, she said.

After receiving a $6,000 quote from a Main Line Health provider, Popiel settled on a nearby facility that is part of the Crozer-Keystone Health System.

Crozer quoted a cash price of $351 for a breast MRI, plus an $88 reading fee, Popiel said.

She had the scan on Aug. 18 and felt reassured after learning the MRI had shown no abnormalities.

Her good mood changed when she received the bill in early September: $4,650.

The bill showed that Popiel had paid $351 up front, but indicated she still owed $4,299. The reading fee had been billed separately.

"I called right away," Popiel said.

The billing department assured her the mistake would be corrected and she'd be sent a new bill.

Another bill came, and then a third — both seeking $4,299 and each more aggressively worded than the last.

"We have been unsuccessful in our attempts to reach you and discuss your outstanding balance," read the bill that came in November.

After informing Popiel of Crozer's financial assistance program, the message on her bill continued, "Unless payment is received or you contact our Patient Accounts Office within 30 days from the date of this letter, your account may be assigned to a collection agency."

Sean M. Fitzpatrick, a vice president and the chief financial officer at Crozer, said the health system works with patients to correct errors and resubmit bills to their insurers.

"Our goal is to minimize surprises," Fitzpatrick said in a statement. "However, if something unexpected happens, like a bill that's higher than anticipated, we work with patients to investigate and resolve the issue."

Popiel said she appreciated that Crozer seemed committed to resolving her issue every time she called, but after a few months, she was getting weary.

"I want to get this resolved," Popiel recalled thinking as the bills kept coming. "I don't want this to go to collections and mess up my credit."

She had no idea it would ultimately take four months to get action on her problem.

Risking your credit score

Damaged credit is a fear that often discourages people from fighting medical bills.

When the dispute drags on for months, patients may have to make a decision between what looks to them like overpaying for a health-care service or risking their credit rating if the bill is sent to a collection agency for further action, said Liz Weston, a certified financial planner and columnist for the personal finance website NerdWallet.

"Medical debt can really hurt your credit," she said. "Staying on top of that process, when the bills are bouncing back between the insurer and provider, is important."

FICO, the most commonly used credit agency, has updated its formula to lessen the impact that medical debt has on an individual's credit rating, Weston said.

A credit rating is intended to assess the likelihood that a borrower will default on a loan. Research has shown that borrowers with medical debt are less likely to default than borrowers with other kinds of debt, such as unpaid credit card bills.

But many banks and lending institutions are still using old versions of FICO's credit score that count the failure to pay for a medical crisis just as they consider unpaid vacations or spa visits on a credit card.

Though it may sound counterintuitive, Weston said, unpaid medical bills can be most damaging to people with very good credit.

"The higher your score, the farther you have to fall if anything goes wrong," she said. "If you've already defaulted on a bunch of loans, what's one more?"

‘Get it on paper’

Popiel said she felt confident in her ability to continue fighting her bill because Crozer had been responsive to her calls. The error was eventually corrected and Popiel credits Crozer with upholding the price she originally was quoted.

She said she brought the bill to Philly Health Costs, a health-care price transparency project of the Philadelphia Inquirer and 6ABC Action News, because she worries about people who don't think they can fight or who don't realize they've been overcharged.

"There are plenty of seniors who would just pay the bill and it breaks my heart," Popiel said.

Too often, patients decide against disputing an incorrect charge because they have no idea how to go about contesting a bill. "They just pay it," said Adria Gross, a New York-based patient advocate. "They don't want to get into this."

Many patients, especially seniors, fear that fighting a charge will negatively impact their care, or that their doctors will no longer want to see them, she said.

Gross has four words of advice for avoiding a messy fight: "Get it on paper."

It was Popiel's diligent record-keeping that got her the MRI at the price she was promised, exactly the advice offered by the Inquirer's partner in the price project, Clear Health Costs.

She had written down the name of everyone she spoke to and recorded every call. She even knew the name of Crozer's electronic system used to code and price services. Popiel had everything except a written quote from Crozer.

She won't make that mistake again.

Please share your medical billing experiences with the Inquirer through our online tool at philly.com/healthcosts.