Software update: Exton-based AGI sold for $700M, Pa. probes Unisys outage, SAP shares down

Software roundup: Simulations software merger joins Pittsburgh and Philly developers. Pennsylvania weighs losses from Unisys outage while SAP stock drops

Ansys, a software simulations maker in the Pittsburgh suburb of Canonsburg, will pay $700 million for Analytical Graphics Inc. (AGI), an Exton-based maker of “mission simulations” that warn satellite operators when their products might hit burned-out rockets and other debris orbiting Earth.

Both companies sell to U.S. military, intelligence, space, and commercial buyers. Ansys, with $1.5 billion in annual sales, is a publicly traded company founded by Pittsburgh engineer John A. Swanson. Taken public in a 1996 deal that inspired a generation of Pennsylvania software company founders, it will pay one-third of the price by issuing AGI owners new stock with the rest in cash, which it will borrow.

AGI, with $80 million in annual sales, employs 221. It is headed by chief executive Paul Graziani, who led a group of his former colleagues from General Electric’s satellite and missile center in nearby King of Prussia to start AGI 30 years ago. All will keep their jobs, and the company will remain in Exton as an Ansys unit, confirmed Ansys spokesperson Matt Zack.

“We are thrilled to become part of Ansys," so AGI systems can be sold to more users, such as AGI’s robotics, automotive, and telecommunications clients, Graziani said in a statement.

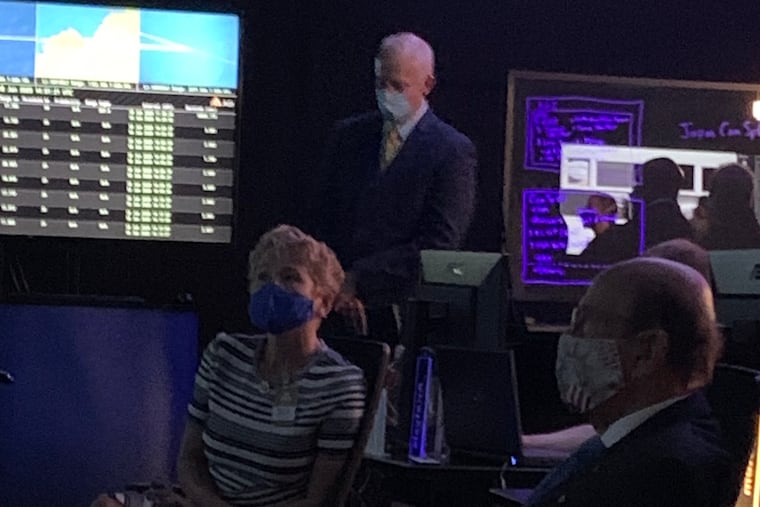

On a visit last summer by U.S. Commerce Secretary Wilbur Ross to AGI in Exton, where rows of operators track satellites and debris, Graziani and other AGI officials said their software warns space users faster and more accurately than a U.S. military system. That’s because it draws from data from more sources -- telescopes, satellites, and airborne global-positioning systems..

“We are excited to welcome the expert AGI team – and to expand the reach of their world-class technology to industries outside of aerospace, including for autonomy and 5G applications" so clients can simulate entire flights using company software, said Ansys chief executive Ajei Gopal in a statement.

Ansys predicted demand for AGI systems will increase as an expected 10,000 new satellites are launched to orbit around Earth in the next several years.

The two companies already work together, with AGI space mission simulations connecting to Ansys' larger simulation platform. Ansys already does simulations in industries ranging from health care to electric cars. The deal is expected to close by the end of the year.

After the crash

Shares of Unisys, the Blue Bell business software company with $2 billion in yearly sales, dipped in pre-market trading after the company posted a quarterly loss Monday but rose sharply in the morning, topping $13 for the first time since June, after CEO Peter Altabef said the company’s news sales software would boost revenue.

In a meeting with investors Tuesday morning, Altabef said the firm was gaining orders from state, local, and foreign governments in its cloud-based and software-infrastructure products. Unisys sold its U.S. government services unit to SAIC Corp. for $1.2 billion earlier this year, pledging proceeds to reduce bank and pension debt.

Unisys did not disclose any costs for an Oct. 3 hardware breakdown at an Ashburn, Va., data center that interrupted online service for four Pennsylvania state agencies, temporarily taking Department of State voter registration and professional licensing sites offline along with Department of Revenue, Pennsylvania Liquor Control Board, and Department of Human Services sites.

Services were restored by early the following week, said Dan Egan, spokesperson for the Office of Administration that oversees state government’s $1.1 billion in annual information-technology spending. He said Unisys repaired its system “under our existing agreement at no cost to the Commonwealth.”

What happened to state data when the system went out? “There is no evidence that any of the data stored at the data center at the time of the outage was lost,” Egan said. "However, transactions that were in-progress at the time of the outage may not have gone through for Professional Licensing, Revenue, Human Services and PLCB transactions that were partly completed when Unisys went down.”

“There were no impacts to voter registration data,” Egan added. “The rare hardware failure affected other parts of the election management system, causing the entire system to be temporarily unavailable. However, there is no evidence that the voter registration database itself was affected. Voters should be assured that their registration data is safe and intact.”

In all, Unisys provides remote data services for 15 Pennsylvania state agencies, including PennDot, the State Police, and nine others that state officials say were unaffected by the crash. Under a contract signed by then-Gov. Tom Corbett’s administration in 2014 and renewed under Gov. Tom Wolf last year, the state outsourced data systems formerly housed at state-run data centers to remote and cloud locations, paying Unisys around $90 million a year. In all the state spends $591 million, or more than half, of this year’s $1.126 billion information-technology budget on outside contractors.

State officials declined to estimate how much, if anything, Unisys would pay to compensate the state for the loss of services and applications. “We continue to work with Unisys on an after-action review of the incident and potential next steps including possible remedies,” Egan added.

SAP tumbles

Shares of SAP AG fell 23% Monday, to $113.02, wiping out $41 billion the stock had regained since a worse plunge amid the coronavirus shutdowns last spring. The drop came after the German software giant, which employs around 3,000 at its North American headquarters in Newtown Square, reported disappointing profits and chief executive Christian Klein warned of lower sales in the months ahead. Rivals Oracle and Salesforce also dropped.

“The company took a bath,” analyst Brian Schwartz wrote in a report to clients of Oppenheimer & Co. But “we don’t believe SAP’s results are a harbinger of bad things to come,” since he expects “significant economic benefits” from pent-up demand for SAP’s cloud-based software once the epidemic passes and big companies feel more confident closing large software deals.

Still, Schwartz reduced his SAP stock price target over the next year to $130, from his former $172.