Clair Global, the Lancaster Co. concert firm, gets nation’s biggest Main Street loan: $71M.

Clair Global last year provided sound and support services to all of the Top 10 grossing concert tours. This year, the industry is in tatters.

Clair Global of Lancaster County, which provides amplification and tour support to the world’s biggest rock acts and music festivals, has some news it would rather you not hear.

This week, the Federal Reserve revealed it had granted a $71 million loan to the concert behemoth under the Main Street Lending Program. The loan is the largest of its kind in the country.

The $600 billion program was designed to help businesses that were in good financial shape before the COVID-19 pandemic struck, but need loans to help sustain them until they recover from the economic disruption.

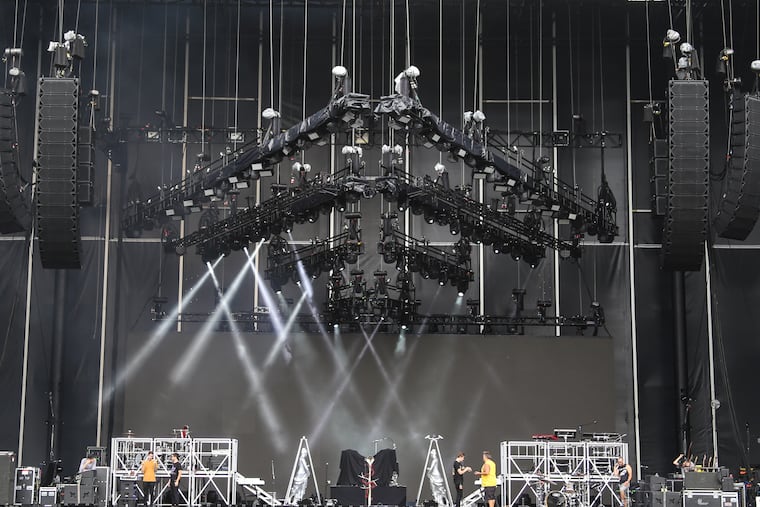

Clair Global last year provided sound and support services to all of the Top 10 grossing concert tours: the Rolling Stones; Elton John; Bob Seger; Pink; and Ariana Grande, among others. Clair was also a key participant in the Made in America festival on the Benjamin Franklin Parkway, where it supplied amplification and WiFi for 130,000 attendees.

There were few sectors hit as hard by the coronavirus as the network of firms providing infrastructure for live entertainment events.

According to the industry consortium We Make Events, 95% of live shows were canceled due to COVID-19. That included stadium and arena tours by notable Clair clients including K-Pop sensations BTS and country music superstar Kenny Chesney.

Across the $877 billion events industry, 96% of companies cut staff or wages.

Clair, which is headquartered in Lititz, acknowledged that it had suffered during the health crisis. But it would not divulge even a whisper about how the pandemic had affected its bottom line or how it would deploy the $71 million government-backed loan.

Troy Clair, president and CEO of Clair Global, said in a statement that “the loan is proportional to the devastation the industry has felt over the last seven months.”

The company employs about 650 worldwide, but refused to disclose how many of those workers are based in the United States. According to reports in trade journals, some Clair employees were deployed to build temporary disaster relief structures and create wireless computer networks, mobile office setups, network security, and communications relays for emergency personnel.

Clair is not required to disclose its financial data because it is privately held.

The loan was processed by Fulton Bank, also of Lancaster County. In the event of a default, it’s mostly the taxpayers' money, not the bank’s, that runs the risk of not being repaid.

The Main Street Lending Program was devised as part of financial rescue legislation in the spring to help businesses that are too big to qualify for the better known Paycheck Protection Program, but too small to benefit from the Federal Reserve’s big purchases of corporate debt.

Unlike the PPP program’s forgivable loans, funds from the Main Street program must be repaid. Loan standards are also more selective, requiring participants to have been in good financial shape with manageable debt before the pandemic.

Banks write loans under the program, but are then able to hand 95% of that debt off to the Fed, so they have fewer assets at risk.

Clair Global also got between $5 million and $10 million in a PPP loan, records show.