Philly high schoolers created an app to help classmates understand student loans and plan how to pay for college

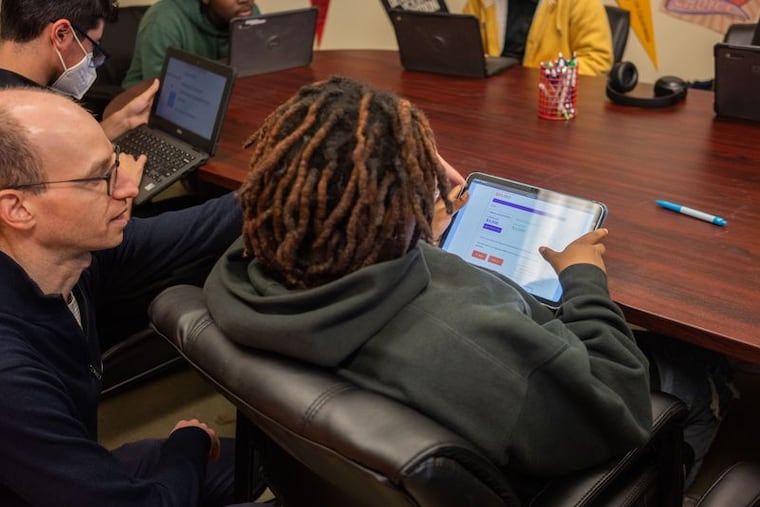

Finiverse, an online tool made by Philadelphia high schoolers working with the Wharton School, helps their peers weigh the financial risks of a college education against the potential rewards.

When Rafsyn Begum started looking at colleges, she had a hard time making sense of the different types of loans and aid for which she might be eligible.

The West Philadelphia 17-year-old feels more confident now, however, thanks to an online tool called Finiverse. Begum helped create the app with other Philadelphia high schoolers through a program at the Wharton School of the University of Pennsylvania.

“It’s really easy on the eye and easy to read,” said Begum, a senior at George Washington Carver High School of Engineering and Science. Especially for “someone like me who doesn’t have a lot of experience” with student loans and financial aid.

The free app lays out the all-in cost of individual colleges, estimates how much financial aid a student may be eligible for, discusses loan options and repayment plans, and simulates how much money a user could make in the future, given their potential degree at their potential college.

“It’s taking a multiverse view of your life after taking out the loan,” said David Musto, the Wharton finance professor who spearheaded the program. “You take out the loan and all these things can happen.”

“Students who are 17 are making this enormous choice, this huge financial decision,” said Jill Bazelon, a senior associate director at the Wharton School. The former high school teacher oversees the cohorts of students who work on Finiverse every semester. “I feel this tool is so essential for financial literacy.”

» READ MORE: Personal finance will soon be a high school graduation requirement in Pa. Can you pass a quiz on the subject?

Since 2022, more than 150 high school interns have worked on the app, doing everything from coding to design to marketing. This fall’s cohort has upward of 80 students, the largest group ever and a steep increase from about 10 students at the program’s start.

Wharton staff credit word-of-mouth for the increasing interest in the program, which is run out of Wharton’s Stevens Center for Innovation in Finance.

“We don’t publicize it. We made one flier and we sent it to [Masterman School],” Bazelon said. “I believe it’s the experience students are having and they’re telling each other, ‘This is really cool, you should check it out.’”

The Finiverse internship program is open to Philadelphia residents who are under the age of 25. Interns are paid about $1,500 a semester through WorkReady stipends.

The Wharton team also accepts remote and in-person volunteers, of any age, if someone wants to be involved but does not meet the requirements for the WorkReady stipends. No prior experience or specific expertise is required.

Winnie Yang said she had limited coding ability and marketing experience when she started working on Finiverse three years ago. Then, she was a senior at Central High School. The 20-year-old has since helped craft Finiverse’s marketing strategy.

“What I’ve learned most [from] it is don’t be afraid of something you don’t know how to do,” said Yang, a third-year student at the University of Pennsylvania. “Go for it.”

College financial planning made easier, maybe even fun

The Finiverse app encourages users to “go for it” in other ways, too.

“One thing we’re hoping to get across is the difference between the sticker price and the net cost of the school,” Musto said.

While Finiverse’s simulations could discourage some high schoolers from taking out a large loan to pay for a certain school, they could also encourage others to apply to a school where they might be eligible for aid or even a free ride.

Users can also gauge the risk of other potential outcomes, such as what happens if they don’t finish their degree or select a major with a higher or lower earning potential.

“How do you calculate that diversity of possible outcomes and how do you present it to the user in a way that they can digest?” Musto said. “That’s been the intellectual challenge.”

The application is currently only available on desktop and mobile browsers at Finiverse.org, and allows users to select only four-year colleges. In the future, Musto said, Wharton staff and students would like to see two-year colleges added, and perhaps make the app downloadable on smartphones.

In the nearer term, they’d like to see Finiverse in the hands of as many high school students as possible. The app’s full version was just released this spring, and Wharton staff said it’s too soon to gauge how useful it’s been and to how many users.

Wharton staff who work on Finiverse said they are optimistic that it’s already increased financial literacy among high school students, many of whom don’t know about different loan repayment options and some of whom are unaware of how much financial aid is available.

“One thing we’ve learned in talking to students is that very few high school students know what income-driven repayment is,” Musto said.

“We could ask students, even at a school full of very ambitious students: ‘Who could tell me how income-driven repayment works?’” Only a couple hands go up, he said.

Hopefully, he said, Finiverse can change that.