Norcross family is betting millions on another Pa. bank after Republic’s collapse

A trust set up for George Norcross' daughter and son has invested in Mid Penn Bancorp, which has branches in Bucks, Chester, and Montgomery Counties.

Less than a year after a group led by South Jersey’s Norcross family lost its multimillion-dollar Republic Bank investment in that Philadelphia lender’s financial collapse, a trust fund for business and political leader George E. Norcross III’s children has made a big bet on another Pennsylvania bank.

On Nov. 4, Palm Beach, Fla.-based General American Capital LLC paid a net $25 million for new shares of Mid Penn Bancorp, a $5 billion-asset lender based in Harrisburg with branches in Bucks, Chester, and Montgomery Counties, according to Securities and Exchange Commission filings.

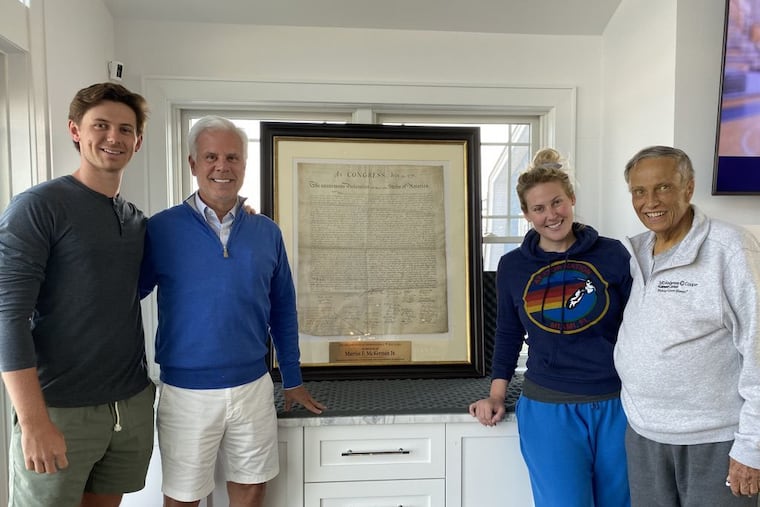

General American is wholly owned by Indiana Pacific General Trust, which was set up to “provide for the security and well-being” of Norcross’ daughter Lexie, founder of the PhillyVoice website, and son Alex, according to the filing. The family group has invested in other assets over the years, including property in Camden and private businesses, according to public records.

Alex Norcross joined Mid Penn’s manager-training program in 2023 and this past June was named Mid Penn’s private banker serving wealthy clients in the Philadelphia metro region. He graduated from Drexel University in 2020 after internships with Comcast and the 76ers and completed his Drexel MBA last spring.

General American is managed by Susan Hudson, former managing director and currently chair of George Norcross’ insurance agency, Conner Strong & Buckelew. She has worked for the Norcross family “for over 40 years and is its most trusted executive,” said Dan Fee, a spokesperson for the Norcrosses. The assistant manager is his brother, Camden-based attorney Philip A. Norcross.

Along with shares General American bought earlier this year, this latest investment brought the Norcrosses’ total investment in Mid Penn to over 6%, worth more than $56 million at recent trading prices. With share prices rising, “regional banks have been attractive investments,” especially those not burdened by expensive legacy branch networks, Fee said. The Norcrosses are among Mid Penn’s largest owners.

In contrast with Republic, where the Norcrosses warred with managers and shareholders over whether to expand or shrink the bank and who ought to hold top executive posts, family members have made no demands that Mid Penn change course, chief executive Rory G. Ritrievi said Monday.

The Norcross family fund began buying Mid Penn shares only “after Alex came to us,” Ritrievi said. “He didn’t want to be a lender. He wanted to go on the wealth side.”

Observing the bank and its plans, Alex “wanted to invest in the bank” and his sister joined him, said Fee, adding that the Norcrosses see their Mid Penn investment as “passive.”

“Alex, because of the family he comes from, knew more about the inner workings of a bank than the standard recent college grad,” Ritrievi said. “His last name means something throughout New Jersey, particularly South Jersey. Some of that’s good, some of it’s bad, but Alex is his own guy. Alex didn’t get his job because of George.”

George Norcross, namesake of the late Camden-Gloucester County AFL-CIO leader, and his brother, Philip, are currently fighting state prosecutors’ attempt to try them on racketeering and extortion charges stemming from business deals involving real estate development in Camden.

Before joining Mid Penn in 2005, Ritrievi was an executive of the former Commerce Bank of Pennsylvania, a franchise-like affiliate of the former Marlton-based Commerce Bancorp. Ritrievi said he dealt often with Commerce Bancorp founder and chief executive Vernon Hill but had never met George Norcross, who was Commerce’s vice chairman, until last year, around the time Alex was hired.

The Norcrosses’ latest investment in Mid Penn was part of a more than $80 million share sale by the bank to several large investors. That sale was designed to raise capital for Mid Penn to fund its latest pending acquisition, the $127 million purchase of Bucks County-based William Penn Bank.

Ritrievi says Mid Penn plans to continue expanding in the Philadelphia area and South Jersey, where dozens of community banks have been acquired by out-of-town rivals since the late 1990s.

“We are going to keep our eyes open for additional acquisition opportunities,” he said.