Hahnemann is not the only former Tenet hospital to close, file for bankruptcy

Hahnemann University Hospital owner Joel Freedman used to be partners with the owners of a company that is closing a former Tenet Healthcare Corp. hospital near Chicago.

Six weeks after Hahnemann University Hospital and St. Christopher’s Hospital for Children filed for bankruptcy, another hospital lost its battle to financial troubles.

That hospital, too, was sold by Tenet Healthcare Corp. and bought by an investment group with ties to Joel Freedman, who bought Hahnemann and St. Chris from Tenet in 2017.

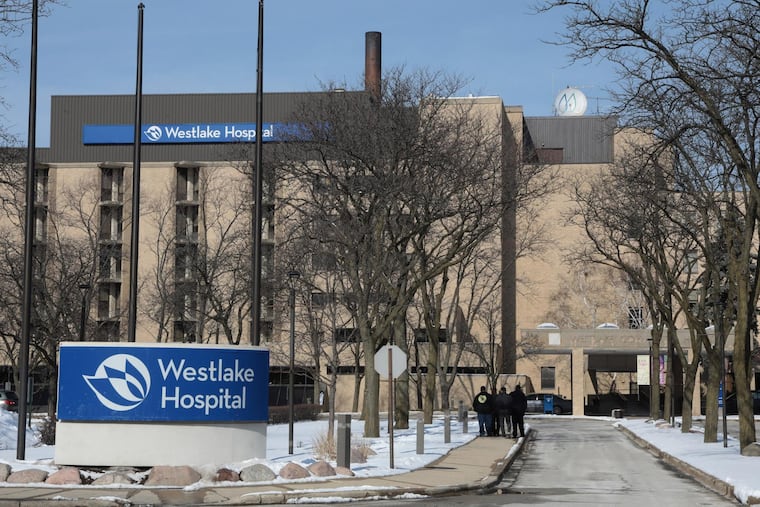

In January, Pipeline Health LLC, bought three Chicago-area hospitals from Tenet for $70 million. Just weeks later, the private investment company from El Segundo, Calif., decided to close one of them, the 230-bed Westlake Hospital in Melrose Park, Ill., citing a declining number of patients and a loss of more than $1 million a month.

Last week, Westlake joined former Tenet facilities in Philadelphia in bankruptcy court in Wilmington.

“The competitive health-care environment in the Chicago area — there are three hospitals in a seven-mile radius of Westlake — along with a decrease in patient demand at Westlake that have resulted in an unsustainable financial strain on the hospital for many years, one that has accelerated in recent weeks,” Pipeline said in a Feb. 18 statement announcing its plan to close Westlake, less than a month into its ownership.

In an Aug. 6 affidavit, Jim Edwards, the chief executive of Westlake’s parent company, said that “the continued losses by Westlake also imperiled the survival of Weiss Hospital and West Suburban Hospital,” the two other Chicago-area hospitals Pipeline acquired. Edwards was employed by Freedman’s Paladin Healthcare as CEO of Howard University Hospital when Paladin had a contract to manage the in Washington facility.

Freedman acquired Tenet’s former Philadelphia hospitals for $170 million in January 2018.

Similarly, when Freedman’s Philadelphia Academic Health System filed for bankruptcy, his chief restructuring officer, Allen Wilen, said one of the reasons to close Hahnemann was to preserve St. Christopher’s.

Until January, Freedman and at least some of the people behind the Pipeline deal in Chicago were partners in Avanti Hospitals, which operates four small Southern California facilities and gave Freedman a taste for owning safety-net hospitals. Freedman’s partners bought him out in January for an undisclosed price.

The wrangling over the closures of Westlake and Hahnemann has taken different forms.

Illinois is among the more than 30 states that have health planning boards that are supposed to determine whether health-care facilities are needed or not. The seven-member Illinois Health Facilities and Services Review Board approved Westlake’s closure unanimously on April 30, despite an appeal by Melrose Park’s mayor decrying the loss of the hospital safety net, more than 600 jobs, and taxes.

The mayor then appealed to state court, seeking to block the closure. That fight continues in the Circuit Court of Cook County, according to a filing Monday in the Westlake bankruptcy.

In Pennsylvania, by contrast, a hospital needs only to get a closure plan approved by the Department of Health and to provide 90 days’ notice (a time frame that Hahnemann missed) to close a hospital. The themes regarding vulnerable patients and job losses might also ring loudly in Pennsylvania, but no formal appeals process exists.

Tenet’s hospital sales in Chicago and Philadelphia contributed to a reduction in the number of hospitals the Dallas company operates to 65 in June from 80 at the end of 2014.

Editor’s note: This article was updated at 12:12 p.m. on August 14 to clarify that Jim Edwards was employed by Joel Freedman’s Paladin Healthcare when it had a contract to manage Howard University Hospital in Washington.