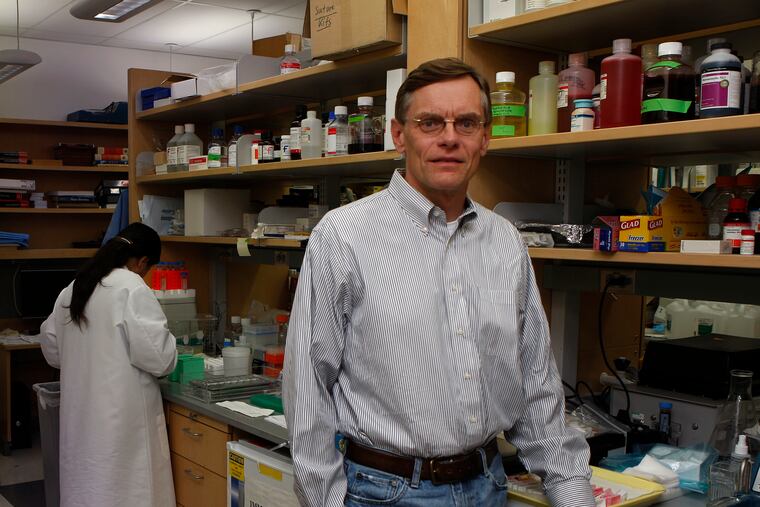

Penn gene therapy pioneer Jim Wilson’s Passage Bio plans IPO

Penn gene therapy pioneer Jim Wilson's Passage Bio is planning to go public.

Philadelphia-based Passage Bio plans to raise as much as $125 million selling stock shares to the public through an initial public offering (IPO), the Philadelphia-based firm told the Securities and Exchange Commission in a public filing Monday.

Passage Bio, based on gene therapy technology developed by University of Pennsylvania biotech pioneer James Wilson, says it will use proceeds from the sale to clinically test its initial therapies and bring them closer to market.

The firm, which employs 20, is developing treatments for rare single-gene disorders of the central nervous system, including Krabbe disease, GM1 gangliosidosis, and frontotemporal dementia. It hopes to have all three in clinical testing programs over the next two years, and has “exclusive rights” to a total of 12 treatments under development at Penn, but adds that “it will be several years, if ever," before Passage Bio’s medicines hit the market.

Despite that warning, the company says its goal is to become “the premier genetic medicines company” in collaboration with Penn’s Gene Therapy Program (GTP), which Wilson heads. The company’s “scientific founders” include doctors Stephen Squinto and Tadataka Yamada, along with Wilson; staff has worked at companies including Biogen, GlaxoSmithKline, Merck & Co., and other cell and gene therapy pioneers.

“We expect to establish our own manufacturing facility for long-term commercial market supply,” the company added in its SEC filing. That puts Passage Bio in the market with Roche’s Spark Therapeutics and other Philadelphia firms scouting the city and its suburbs for clean-room manufacturing sites or contractors.

For now, Passage Bio has contracted with Baltimore-based Paragon Gene Therapy, a unit of Catalent Biologics Inc., to do its manufacturing.

Investors can’t seem to make enough bets on potential gene therapy profits. PassageBio, started in 2018, is the latest in a two-year wave of dozens of cell and gene therapy start-ups to go public before they have products on the market.

Passage Bio raised $225 million since 2018 from private investors including OrbiMed Advisors, Versant Ventures, Frazier Live Sciences, LAV Prescience Limited, New Leaf Ventures, Vivo Capital, Access Industries, Boxer Capital, Highline Capital, Logos Capital and Sphera Global Healthcare.

Despite spending down $46 million last year and $13 million in 2018, Passage Bio still had $159 million on hand as of Dec. 3. But even with new money from a public stock offering “we will need to raise substantial additional capital to complete the development and commercialization of our product candidates,” the company warned investors in its SEC filing.

Other companies that use technology developed by Wilson include Maryland-based Regenxbio, which is developing gene therapy delivery systems for patients, and Philadelphia-based Scout Bio, which is working on ways to deliver gene therapies for pets.

The road to hopeful start-ups such as Passage Bio has included blind alleys and reversals. In 2000, the FDA suspended research at Penn’s Institute for Human Gene Therapy, developed by Wilson, after the death a year before of Jesse Gelsinger, a patient in a gene therapy trial. The university later paid a half-million-dollar fine, and a private settlement to the patient’s family.