New Jersey tax credit investigation: Firms could face criminal penalties if they lied to get millions

The warning came during a public hearing held by the special task force investigating the state’s multi-billion-dollar tax-credit programs for businesses. Current and former officials from the troubled agency that oversees those tax credits.

Companies that moved to Camden after getting millions of dollars in grants could face criminal penalties if they lied in order to receive those incentives, according to officials looking into alleged abuse of New Jersey’s tax credit programs.

The warning came during a hearing held by the special task force investigating the state’s multibillion-dollar tax-credit incentives for attracting businesses to specific areas. Current and former officials from the agency that oversees those credits — the Economic Development Authority (EDA) — were called to testify by the task force, chaired by Rutgers University law professor Ronald Chen.

“There is real criminal exposure for companies that lie to the EDA” and thereby deprive the state of tax revenue, said Pablo Quinones, one of the outside lawyers serving as special counsel to the task force created by Gov. Phil Murphy in January.

The investigation puts a spotlight on New Jersey’s practice of using tax dollars to attract or retain businesses and create jobs. Thursday’s testimony comes after a tumultuous few weeks of political wrangling over the appointees to the EDA’s board, and media reports examining the beneficiaries of tax breaks, and the people who allegedly influenced the related legislation behind the scenes. The task force has already made one criminal referral for unregistered lobbying.

Although investigators did not identify individuals or companies in the first public hearing, they took a markedly different approach during the second hearing held at the Rutgers Law School campus in Newark.

Lawyers on the task force said they were examining information submitted by companies that said they were considering “alternative sites” but would move to Camden as part of the Grow New Jersey tax credit program. Businesses indicating they would relocate to Camden won approval for $1.6 billion in Grow N.J. grants between 2013 and 2017.

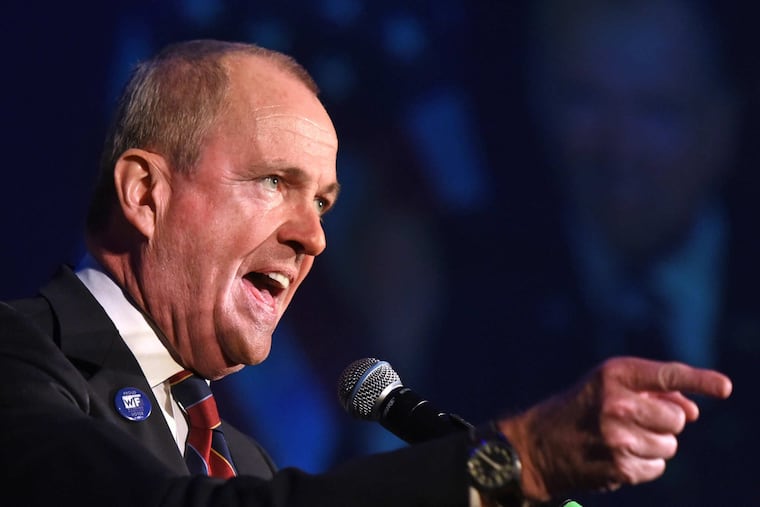

“Every single applicant promising to move jobs from within New Jersey to Camden, actually certified that they were considering an out-of-state location,” said task force special counsel Jim Walden, a former federal prosecutor now in private practice. That list has 31 companies on it.

If it turns out those representations weren’t true, those grants could be terminated or clawed back, and recipients may also face “the potential for criminal enforcement,” Walden said.

Walden cautioned that the task force would not draw any conclusions on Thursday.

“We are not directly or indirectly insinuating that anyone broke the law,” he said.

Questionable applications

Conner Strong & Buckelew, NFI, and the Michaels Organization won approval in 2017 for $245 million worth of tax credits to build an officer tower in Camden. An EDA official testified Thursday that information in their applications raised concerns, and that he would have asked questions about them.

Each of the companies submitted proposals to show that it was considering a location across the river in Philadelphia, but those proposals for office space in Philly had actually expired, according to the testimony.

“That’s unusual,” said David Lawyer, a manager of the agency’s underwriting section, who joined the EDA after the applications were granted. Asked why, he said: “Because it casts doubt on whether that site was available.”

A spokesperson for Conner Strong, an insurance brokerage, said that it’s typical for quotes on an offer to expire and that they were not a requirement to be eligible for the tax credit.

“As anyone who has ever entered a contract knows, there are expirations on the offer and that was true here, as well,” the spokesperson said. “No private landlords would ever agree to hold open an offer for as long as government decides to take to review an application.”

NFI and the Michaels Organization could not be reached after business hours Thursday.

Each of the companies used the same consultant for its applications, the testimony revealed: Kevin Sheehan, a lawyer for Parker McCay. The firm is headed by Philip Norcross, the brother of South Jersey political powerbroker George Norcross III, who is executive chairman of Conner Strong.

The use of the same consultant across those applications raised additional concerns, Lawyer testified. “I think there’s a pattern,” he said a few minutes later.

It wasn’t the only time during the hearing that Kevin Sheehan or Parker McCay came up.

During questioning of another witness – a former EDA official – Walden showed slides of at least a half-dozen changes made by Sheehan to draft legislation for tax credits. Walden’s questions focused, in part, on whether certain changes benefited any specific clients or companies.

Tim Lizura, the agency’s former chief operating officer, said he did not know.

A spokesperson for Parker McCay said the firm was proud of its efforts to “strengthen Camden’s revitalization and our regional economy.”

“No one at our law firm was engaged to lobby or paid by any party with respect to those activities," the firm said in a statement. "Parker McCay has always complied with the laws governing the practice of law and lobbying and this instance is no exception.”

Another witness who testified Thursday was Frederick Cole, the senior vice president of operations at the EDA.

Cole was questioned about a whistleblower lawsuit, filed in 2015, in which a former EDA employee alleged various policy violations at the agency – such as “phantom” alternative locations in applications, and cost information that was manipulated or altered so a company could qualify for a credit.

Cole testified that he did not alert the state comptroller to the lawsuit or the allegations during an audit of the EDA. No one pressured him to withhold the suit, he said.

“It was something that didn’t occur to me that it was something they were looking for,” Cole said. Looking back, he said, he would have told the comptroller about the litigation.

‘Deeply troubling’

An investigation, published Wednesday by WNYC and ProPublica, found that out of $1.6 billion in tax credits designated for companies investing in Camden, $1.1 billion went to organizations with ties to George Norcross, and to clients of his brother, Philip, a lawyer and lobbyist. Those companies include American Water, Holtec International, and the 76ers.

Another article, by the New York Times, reported that a lawyer who worked for the law firm led by Philip Norcross made undisclosed changes to the 2013 tax credit legislation — including a change that helped a client get approval for a $260 million credit. The law firm, Parker McCay, said policymakers had asked for its “input and suggestions” and said the activities did not constitute “unregistered lobbying.”

Gov. Phil Murphy said he was “deeply troubled” by the findings in both reports.

Murphy created the task force in January, after a state audit found “numerous significant deficiencies” in the EDA’s oversight of tax incentives and the job-creation requirements that accompany them.

A whistle-blower testified publicly in March that her former employer, a tax prep firm, lied to get incentives. Last month, the task force made its first criminal referral to law enforcement — without identifying the subject, but citing evidence of “unregistered lobbying on behalf of special interests.”

“Until we’ve taken a good hard look at the entire process, I don’t believe we can be sure that all taxpayer money has been properly spent and accounted for,” Murphy said. “If there was fraud in this program, I expect the task force will uncover it and those individuals will be held accountable.”

In a joint statement released Thursday, Camden Mayor Frank Moran, City Council President Curtis Jenkins, state Sen. Nilsa Cruz-Perez (D., Camden), and Camden County Freeholder Director Louis Cappelli Jr. said they were “deeply appalled” by Murphy and “the blatantly political-leaning task force established by him.”

“We will not be party to nor will we tolerate any efforts to turn back the hard-fought progress that has been made in Camden over the last several years to attract businesses, rebuild our housing inventory, improve public safety, and our K-12 education system,” the statement said.