Norcross group speeds Republic takeover after FDIC was reported seeking a buyer for the Philly bank

The FDIC was reported to be seeking bidders for Republic, the largest bank still based in Philadelphia.

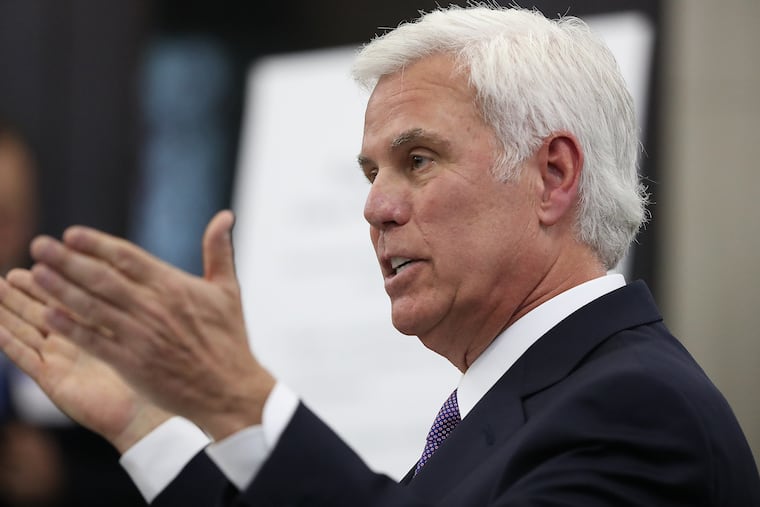

Just a month after rival factions signed a truce and agreed to a likely financial path forward for Philadelphia’s Republic Bank, the winning group, led by South Jersey business and political power broker George E. Norcross III, has invested $35 million to strengthen the lender and take control of the board of the 33-branch, $6 billion-asset lender.

The Norcross group moved faster than expected after reports that the Federal Deposit Insurance Corp. on Oct. 23 began seeking bidders for the money-losing bank, a sign that regulators wanted to reduce any likelihood that the bank would run out of capital and end up in a federal takeover. Bloomberg reported the FDIC’s move in a story Sunday.

In a statement, Norcross, also the longtime chairman of the Cooper University Health Care board in Camden, said the move would help the bank’s customers, depositors, and shareholders.

“This investment and new leadership on the board is the next step of what will be the new Republic First,” his statement said. The investors will receive convertible securities.

Shares traded up to 30 cents by Monday at the close of trading, from 8 cents Friday. That put the company’s market capitalization to around $21 million. The stock had been worth over $5 a share, or nearly half a billion dollars in all, as recently as February of last year.

Thomas X. Geisel, the veteran South Jersey banker who replaced Vernon Hill as chief executive last year, remains in that job. He is also a director.

New Norcross-backed directors include former TD Bank U.S. CEO Greg Braca and Parker McKay CEO Philip Norcross, George’s brother, who will serve as board chairman. Two other Norcross supporters are expected to take additional seats on the board of Republic’s parent company, Republic First Bancorp, the largest bank still based in Philadelphia.

Departing the board are New York investor Andrew B. Cohen, Republic founder Harry Madonna, and two of their allies, who stepped down under terms of the September agreement. Those directors served under Hill before the four joined forces to oust Hill last year and to end his costly expansion plans. Hill, an innovative retailer, previously founded and was ousted from Commerce Bancorp and Metro Bank (UK) PLC.

Two other directors appointed while the Cohen faction ran the bank will remain. Bank leaders plan to raise at least $40 million more and add the additional directors under terms of the September pact.