‘Taxes be killin’ me!’ These Philly high schoolers get $500 to learn about investing, becoming millionaires

Olney High School students work, earn between $50 and $5,000 and take personal finance classes with Dan LaSalle. It's so popular he wants funding to expand the program to an entire class.

Personal finance classes in high school? Lots of adults like the idea, and students love learning with real money.

A Philly high school teacher is introducing teenagers to the world of stocks, bonds, the dangers of credit cards, and the thrill of investing over the long-term to become a millionaire – at Olney Charter High School in the Olney section of the city.

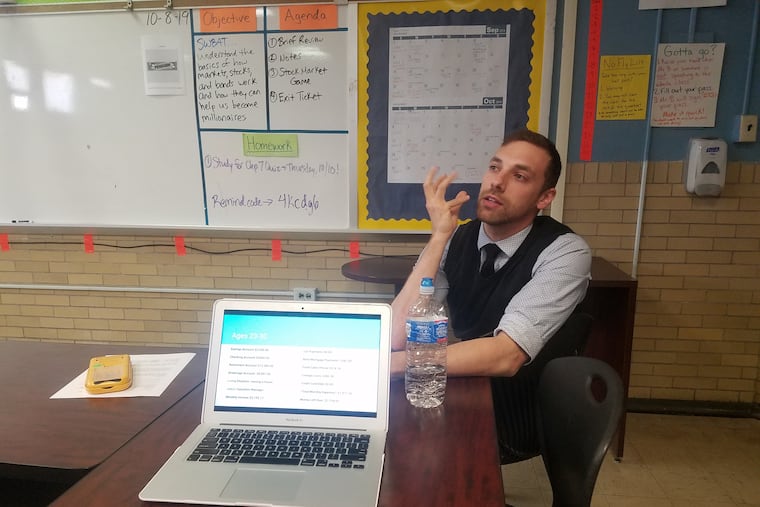

Dan LaSalle, 30, is teaching his Olney students to invest by paying them – yes, real money. They open bank and brokerage accounts and learn how to save and invest. It’s an idea that even state legislators have backed.

LaSalle initially entered a teacher grant competition and won $15,000 from the Philadelphia Academy of School Leaders to start the program. LaSalle started as an English teacher and is now assistant vice principal at Olney Charter High School.

For this year, LaSalle raised $88,500. And he has raised $100,000 for next year, when he hopes to enroll 200 students in personal finance classes, with an average allotment of $500 per student. Eventually, he wants to raise enough money to be able to enroll 500 kids.

“We need $250,000 to teach every kid and provide them a paycheck and a bank account,” LaSalle said. “You really only learn what you practice. We also talk about how we all want to be millionaires, and how to save and invest to reach that goal. It’s like medical school, but instead of learning on a body, they learn by handling real money."

Students have the option to work as few or as many hours as they can within the school to earn that cash. They can make between $50 and $5,000 during the school year, and work at jobs such as teaching debate, tutoring, or opening and running clubs at the school. Others work outside jobs, too, at local hospitals, restaurants, supermarkets, and furniture stores.

LaSalle divides his students between “spenders” and “savers.”

Christian Puntier opened his first bank account at 15 at the American Heritage Credit Union after taking LaSalle’s class – which is an elective, not a requirement. Outside of school, “I started working at Raymour & Flanagan, and I’ve saved up about $500,” he said. “Taxes be killin’ me!” he joked.

Now 17, Puntier is just one of the hundred or so students who’ve taken LaSalle’s personal finance classes. Puntier even compiled a Powerpoint presentation forecasting his savings needed for a down payment on a house, retirement, and bills during and after college.

“I also want some extra money to help out my mom,” he said.

Melanie Castro, 16, has saved $1,200, and continues to work an in-school job. “She’s a great saver. Others never touch a penny, or spend half and save half.”

Pizza as a company

How can a pizza help teachers with classes about investing?

“Think of a company as a whole pizza. How much is it worth? Twenty dollars? How much would one of 10 slices be worth? Two dollars. That’s how stocks work,” LaSalle told students during his 1:30 p.m. session with 25 students, which he co-teaches with Chris Bishop.

Would you bet on just the Eagles football team winning, or on all of football? That’s the difference between buying one stock and the entire stock market, he explains. “Betting on all the teams in the NFL is the same as buying an index fund,” he said.

He goes over the differences in returns between equities and bonds – approximately 6% annually for stocks and 4% for bonds – over many decades.

“What’s the hedonic treadmill? Anyone?"

“It’s when you buy things you don’t need, and over time your happiness decreases,” says Cheyanne Fleming.

LaSalle wrote his own textbook for the class, and also uses the Next Gen Personal Finance curriculum. If you’re looking for free teaching tools and curriculum ideas, check out Next Gen’s website: https://www.ngpf.org.

He and the kids also play a game called “Build Your $tax,” which the kids love because they can play it on their phones or computers.

If he ever raises well above $200,000, LaSalle wants to repeat this program for the Philadelphia Power Corps, which serves young adults re-entering society after incarceration.

“I observed their trainings and met their team and they are super cool,” he said.

For now, he’s sticking to Olney High.

For anyone wishing to donate, LaSalle has set up a website and independent nonprofit “because it’s easier to pay students this way than through the school like we have done in years past.” That website is: http://nicheclinic.org.