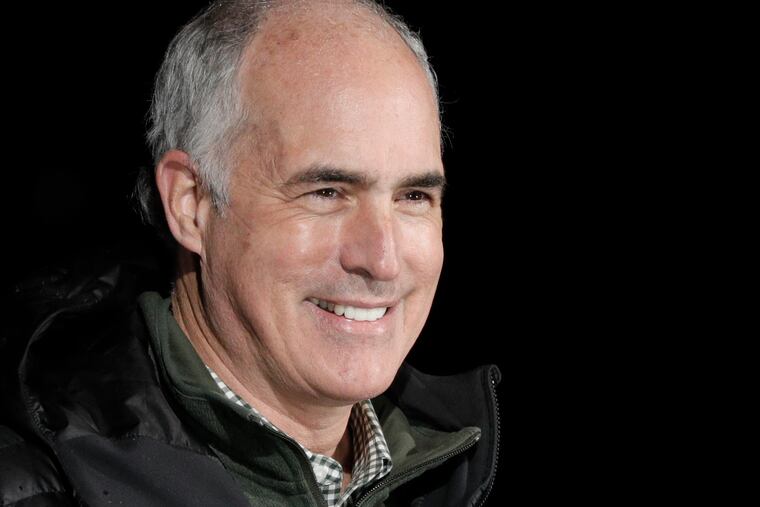

Bob Casey aims to raise ABLE savings account opening age limit to 46 years old from 26 years

An additional 6 million Americans would be eligible, including 1 million veterans, under a bill sponsored by the senator.

U.S. Sen. Bob Casey (D., Pa.) wants to raise the age to 46 for Americans with disabilities to open special savings accounts, allowing six million more people who might not otherwise be eligible.

Casey is sponsoring the ABLE Age Adjustment Act, along with 12 other senators from both sides of the aisle including U.S. Sen. Pat Toomey (R., Pa.).

The accounts, established under the Achieving a Better Life Experience Act of 2014, can be used for a range of expenses, including housing, education and legal fees.

“Many people experience the onset of a disability over the age of 26, and that includes six million more Americans,” Casey said in an interview. “The new age of 46 covers a lot of people.”

Casey expects that Congress will debate the proposal later this year, and wants to include the new ABLE bill as part of a bipartisan retirement package being considered in the Senate Finance Committee.

“It makes sense to have the ABLE Act included as a part of that,” Casey said.

The other Republican co-sponsors are Jerry Moran (R., Kan.), John Boozman (R., Ark.), Lisa Murkowski (R., Alaska), and Roger Marshall (R., Kan.). Democratic co-sponsors are Ron Wyden (D., Ore.), Chris Van Hollen (D., Md.), Richard Blumenthal (D., Conn.), Patrick Leahy (D., Vt.), Amy Klobuchar (D., Minn.), Jack Reed (D., R.I.) and Ben Cardin (D., Md.).

ABLE accounts are tax free savings vehicle for those with disabilities. These serve a purpose similar to trusts set up to help children with disabilities, without disqualifying them from government benefits such as SSI, Medicaid and means-tested programs such as HUD and SNAP/food stamps.

“Nationally, we’re getting close to 100,000 ABLE accounts, but we need more people to open them up,” Casey said.

Currently, people with a disability with an onset date before their 26th birthday can open ABLE accounts. The ABLE Age Adjustment Act would raise the age limit to 46, allowing more Americans to save while not risking the loss of their federal benefits.

With ABLE accounts in 43 states, about 91,000 Americans have saved more than $759 million, an average of more than $8,300, according to Casey’s office.

Contribution limits vary by state, and Pennsylvanians can save as much as $100,000, and deduct ABLE contributions on state income tax returns. In New Jersey, the account limit is $315,000.

Pennsylvania Treasurer Stacy Garrity, a Republican, also supports raising the age limit to 46.

Pennsylvanians have opened 5,300 accounts as of July 2021, since their debut in 2017, with about $50 million in assets, Garrity estimated.

“As a veteran myself, I’d like to see the age limit raised” under the proposed bill, Garrity said, as more post-9/11 veterans with disabilities such as PTSD or traumatic brain injury will qualify. The jobless rate for post-9/11 veterans spiked to double digits during the first surge of the COVID-19 pandemic in 2020 but gradually came down to 4.1% in July 2021, according to the Bureau of Labor Statistics.

For more information on PA ABLE accounts, go to the commonwealth’s website: www.paable.gov. New Jersey also has its own website: savewithable.com/nj/home.html.

Americans can also choose plans from out of state; to learn more, visit the National ABLE Alliance website: savewithable.com.

Take the ABLE quiz

Are you eligible to open an ABLE account? You must have a qualifying disability. Qualifications for PA ABLE are available on the website: paable.gov/eligibility.

Savers are still entitled to benefits based on disability under the Social Security Disability Insurance program, or SSI. Certification must include a copy of the individual’s diagnosis relating to the impairment, signed by a licensed physician.

You can use your account to pay for qualified disability expenses. These include education; transportation; housing; health and wellness services; financial management and administrative services; legal fees; oversight and monitoring; funeral and burial expenses; and other expenses approved under Internal Revenue Service regulations.