Par Funding overseer is collecting millions for investors two years after the fraud case began

The receiver's legal team has clawed back millions. The lawyers are also going after Par Funding's borrowers

Now that the Par Funding scandal has just about reached its end, what’s the bottom line for more than 1,000 investors whom federal regulators say were defrauded by the Philadelphia lender?

A new accounting from the receiver who has taken charge of the defunct firm suggests investors could get back much of the $250 million they are owed and maybe more.

In rulings last month and earlier, a federal judge ordered the firm’s owners and salespeople to repay that amount to investors. Most of the money would come from the Main Line couple who started the lender in Old City and hid the fact that founder Joseph LaForte was a twice-convicted fraudster.

For about a decade Par Funding raised millions of dollars from investors to make hundreds of cash loans at high payback rates to struggling merchants. The U.S. Securities and Exchange Commission filed a sweeping fraud lawsuit against the firm, its owners and pitchmen in 2020, shortly after Par imposed a halt in payments to investors.

Moreover, in the report filed with the judge in the case Monday, lawyers for receiver Ryan K. Stumphauzer say that Par Funding is still owed $190 million in loans, some of which they may be able to collect.

That’s less than half the $420 million Par claimed it was owed before the company was seized under a 2020 court order. Significant collections could give the receiver enough, with the other disgorged assets, to pay back investors the principal they put in. Best case, the investors might even get something extra — a bit of the promised return on their cloudy investment.

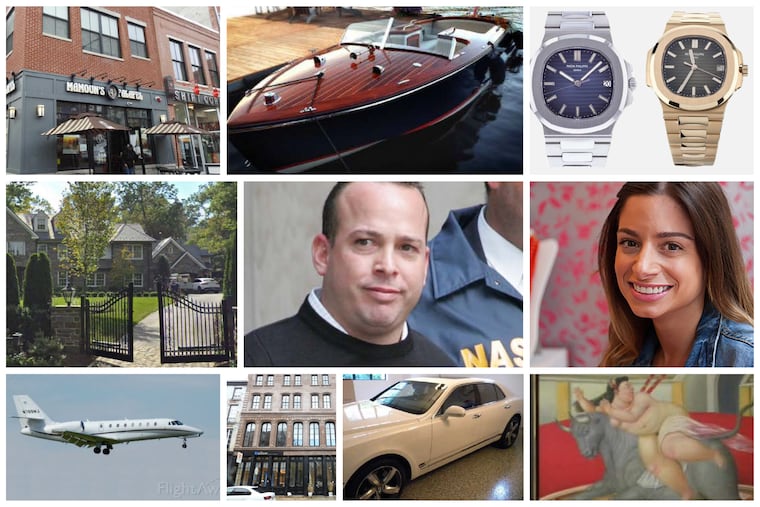

As for LaForte and his wife, nail salon operator Lisa McElhone, the receiver has already seized $160 million in cash and goods from them, their company, and their fellow Par owners. The haul from the couple includes 25 properties worth $55 million, including their luxury homes in Haverford, the Poconos, and Florida’s Atlantic Coast, plus $3 million in boats, cars, paintings and top-end watches and other trinkets.

Their violations, Ruiz wrote last month, were “egregious.” He added: “At every turn, LaForte and McElhone ... materially misled investors. They withheld or lied about critical information that investors rely on in making investment decisions, thereby placing the money of the investing public at risk.”

Lawyers for the couple haven’t responded to inquiries whether they can cover the entire $219 million the judge ordered them to pay.

Besides assets seized from the owners and their company, the receiver has been awarded about $15 million from other players in the scandal.

In the merciless language of their report, the receiver’s lawyers note that they recently sold off two Shore homes seized from a key salesmen and former Par official, Perry Abbonizio. The homes, in Stone Harbor and Avalon, netted about $4 million in all, after paying off their mortgages.

Abbonizio, along with LaForte, McElone and others, agreed to settle civil fraud charges brought by the U.S. Securities and Exchange Commission for failing to register Par investments as securities, for falsely downplaying the risks facing investors, and for other lies and omissions. However, a parallel FBI criminal investigation into Par Funding remains active.

Still, in their fiscal report Monday, the receiver’s legal team — led by Philadelphia lawyer Gaetan Alfano and Florida lawyer Timothy Kolaya — cautioned that it remained too early to say how big the final payout would be, let alone how much any investor would receive.

They did suggest, however, that Judge Ruiz approve giving the money out in stages as it comes in. The SEC says it usually waits until all the money is in hand and makes one payment to each investor.

The team’s filing also included a breakdown of how much has been charged so far by the receiver, the law firms and the other experts brought on to assist the judge in the SEC lawsuit and to keep Par up and running. So far that tally is about $16 million for experts, plus $8 million in payroll and other costs.

In a recent interview, Joe Brock, a former Teamsters union official who sunk $200,000 into Par and has followed the SEC lawsuit closely, questioned whether the owners still have enough money left “to make investors whole,” but added that he was glad the receiver was still collecting cash from borrowers and others.

Even so, Stumphauzer and his legal team have had to write off loans to hundreds of borrowers. Just in the last six month, Alfano and Kolaya said in the new filing, they identified a whopping $156 million in loans unlikely ever to be collected.

They warned that even after discounting those loans, debt collectors were still checking for “additional amounts that are not likely to be collected.”

Some loans should have been abandoned years ago, they said. They were actually uncollectible “according to the company’s own existing policies” since at least 2019, though Par failed to write them down, the report said. These included money lent to businesses that had “ceased operations” and others whose debts have been wiped out in bankruptcies.

Par has insisted it was profitable and even paid federal taxes in 2018 and 2019. But a careful review of the books shows the company was actually a money loser in those years, after considering all the uncollectible loans, the report found.

Ironically, those losses may entitle the receiver to millions in IRS refunds, according to the report. That could make additional money available for investors.