Internet gambling: Pennsylvania sets target date for casinos, others to go live

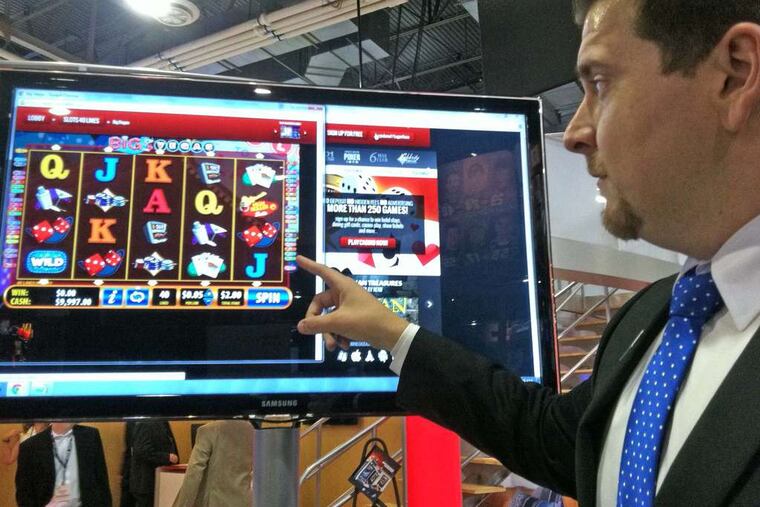

The state plans to go live in July with i-Gaming. NJ launched internet gaming in 2013, and it generated $44.9M in tax revenue last year.

The Pennsylvania Gaming Control Board told gaming operators this week that the state’s 12 licensed internet operators should be ready to go live with online gambling the week of July 15.

The state plans to conduct a coordinated launch of iGaming “to provide similar market access, to the extent possible, to certificate holders and operators,” Kevin F. O’Toole, the gaming board’s executive director, told operators in a letter Monday.

Internet gaming was approved under the sweeping 2017 expansion of Pennsylvania’s gaming law. Casino operators could buy separate licenses for online slots, casino games, or poker. Most operators paid $10 million license fees to get all three internet gaming licenses. Two out-of-state operators also bought licenses that went unclaimed by Pennsylvania casinos.

O’Toole’s letter was intended to give operators 90 days’ notice to get their internet gaming partners to submit software for review, as required by law. Only three of seven licensed internet gaming operators have submitted their game content to the board for lab testing.

Pennsylvania’s launch is moving forward despite uncertainty about whether the U.S. Department of Justice will follow through on a January legal opinion that reinterprets the federal Wire Act, which prohibits interstate wagering, to apply to any form of gambling that crosses state lines. O’Toole told gaming operators it was their responsibility to comply with federal law.

Internet gaming in New Jersey, which launched in late 2013, has grown robustly and last year accounted for more than 10 percent of casino gaming revenue, and about 19 percent of the $236.5 million in tax revenue the state took in from casinos and sports betting (internet gaming is taxed 15 percent compared with 8 percent for casino games).

Pennsylvania’s new state law sets the tax rate for internet poker games and online table games at 16 percent of the casino’s win, and 54 percent for online slots. The tax rates include 2 percent allotted to local governments that host casinos.

Bettors must be using electronic devices located within the state to participate.

Three of the state’s 13 licensed casinos did not buy any iGaming licenses: Rivers Casino, Lady Luck Casino, and Meadows Racetrack & Casino. MGM Resorts, and Golden Nugget, which operate in New Jersey, bought some licenses that went unsold to Pennsylvania casinos.