Comcast Spectacor boss, ex-New Jersey first lady have joined rebels trying to take over Republic Bank

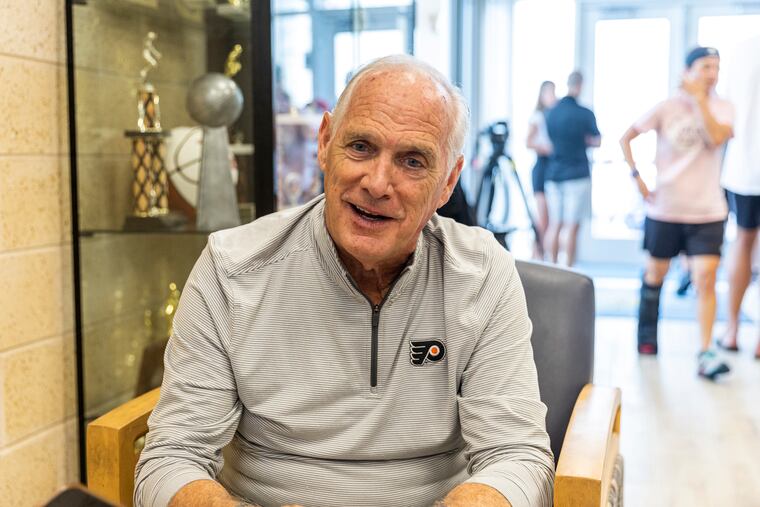

Comcast's Dan Hilferty, former New Jersey first lady Mary Pat Christie, and banker Greg Braca have joined the latest fight for control of the largest bank still based in Philly.

Rebel shareholders have assembled what, by local business standards, is a celebrity team, to take control of Republic First Bancorp, which runs Republic Bank, the largest bank still based in Philadelphia, with 35 branches and $6 billion in loans and other assets.

A shareholder group led by South Jersey power broker George Norcross, his lawyer brother Philip, and banker Gregory Braca is backing Comcast Spectacor (and former Independence Blue Cross) CEO Dan Hilferty, former New Jersey first lady and ex-investment banker Mary Pat Christie, and Braca, who ran TD Bank’s U.S. operations, against a slate backed by board chairman Andy Cohen, a New York investor.

The decision will take place at a long-delayed shareholder meeting, now scheduled for Oct. 5, for shareholders as of Aug. 11. The candidacies were confirmed in an SEC filing earlier this week.

The Norcross-Braca group’s targets include incumbent directors Peter B. Bartholow, a Texas banker who was once a top officer of Wilmington-based credit card giant First USA Inc., and investment banker Benjamin C. Duster IV, both of whom joined the board after Cohen’s faction won control of the bank amid an acrimonious court fight last year. The third seat up for a vote is vacant.

Republic Bank’s difficult road

Such open power struggles are rare at U.S. corporations. But Republic has been down a difficult and unusual road: The October meeting was originally scheduled for the spring of 2022, but was delayed when Cohen and his board faction began an earlier shareholder rebellion against then-Republic boss Vernon Hill II.

Hill, who previously started and was pressured to leave Marlton-based Commerce Bancorp and London-based MetroBank PLC, was forced out at Republic last summer. His ouster came amid a storm of litigation and after a key Hill ally on the company board died, giving Cohen and his allies a majority.

The Norcross-Braca group has said it also wants to oust Harry Madonna, a longtime Republic executive who is allied with Cohen, when his seat comes up for a vote at the 2023 board meeting, which has not yet been scheduled.

Norcross, Braca, Cohen, and other Hill critics were once on the same page, each calling for an end to Hill’s plans to keep building bank branches at a time when most banks were consolidating, as customers went online.

Cohen and his allies have since installed veteran New Jersey banker Thomas X. Geisel as chief executive at Republic First. They curtailed Hill’s expansion plans, shut or canceled new offices in New York and the Philadelphia suburbs, stopped offering home mortgages, and cut branch hours, though the bank’s employee headcount has remained steady at around 560 since last year, according to the Federal Deposit Insurance Corp.

But expense cuts, at a time when soaring interest rates have slowed bank lending, have made it tough for Cohen and Geisel to appeal to impatient shareholders.

Current leaders urge patience

The bank lost money during the first quarter of the year, and the share price has fallen from a 2022 peak of $5 to less than $1 in recent weeks. The Norcross-Braca group has made use of those poor returns in its anti-management propaganda, tying Cohen, who joined the board in 2017, to the former Hill regime.

The bank earlier this summer canceled a plan to raise $125 million in new capital after failing to find an outside partner to help Cohen and allied investors reach that target. The Norcross-Braca group offered to provide the additional money, paying more for shares than the stock’s current value, but they did not reach an agreement with the board and the bank cancelled the plan.

Republic declined to comment on the upcoming board vote. But on July 17, Cohen and Geisel sent shareholders a letter urging patience. “There are no quick fixes or silver bullets,” they wrote.

They noted that board members are also major investors, blamed problems on “the prior executive team’s mistakes and lack of Board oversight,” and said “distracting public campaigns” and “incessant litigation” amid a slowing economy and rising interest rates were causing “once-in-a-generation dislocation.”

They promised renewed focus on consumer and small-business banking; pledged to attract more deposits, reduce the value of loans on the books, and issue long-delayed financial reports; and added that they have hired commercial broker CBRE to weigh the sale of bank property in an attempt to raise more money.