Ex-wife of deceased Philly investor alleges her former husband conspired to pay off his debts with her assets

A new lawsuit revives a struggle over property and losses from the 2000 dot-com stock market collapse that pressured the career and marriage of Warren “Pete” Musser.

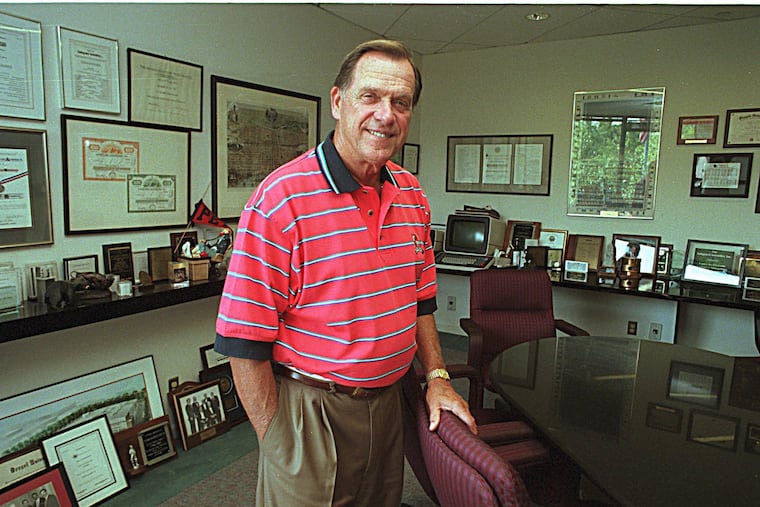

A new lawsuit revives a struggle over property and losses from the 2000 dot-com stock market collapse that pressured the career and marriage of Warren “Pete” Musser, a well-known Philadelphia-area venture capitalist.

Hilary Grinker Musser alleges that her former husband conspired with officials of Safeguard Scientifics of Wayne — the company he headed for 48 years — to pay his multimillion-dollar stock market debts using properties he had promised to her. She says their actions became fully clear only after he died in 2019, and she became executor of his will, gaining access to his papers.

The lawsuit says that starting in 2000, Musser granted Safeguard control of the couple’s homes, building lots, and business assets on the Main Line and in Nantucket, Mass., to repay millions in Musser’s debt, after Safeguard-backed stocks lost most of their value, while enabling him to remain active as a dealmaker — at his wife’s expense.

Hilary Grinker Musser filed the suit in Common Pleas Court in Delaware County last month against Safeguard; Safeguard affiliate Bonfield VII, named for the couple’s Bryn Mawr mansion purchased in 1996; and Robert E. Keith Jr., a longtime collaborator of Musser’s, in his role as Safeguard’s former board chairman.

Officials at Safeguard, a publicly traded company, didn’t respond to calls and emails seeking comment.

“This case involves one company’s greed, deception, and willingness to go to great lengths” to win “financial benefit” for Safeguard, Musser, and other past Safeguard directors, alleges the lawsuit, filed by Philadelphia lawyers Michael van der Veen and Bruce Castor Jr. on Grinker Musser’s behalf.

‘Threats’ and ‘strong arm’-ing

In his 48-year career at Safeguard, Musser had helped find investors and properties for Philadelphia-area companies such as Ralph M. Roberts’ Comcast and Joseph Segel’s Franklin Mint and QVC, along with manufacturing, electronics, and tech firms that never became household names, and several related investment companies that sought to develop Philadelphia as a tech start-up center.

Musser and Grinker Musser met at an event at the Franklin Institute, where she was a fundraiser. In 1996, they began living together at Bonfield. At that time, he was worth around $70 million, according to the suit.

As tech share prices rose sharply in the late 1990s, Musser borrowed $35 million from stockbrokers to buy shares in Safeguard-backed, internet-focused companies such as Internet Capital Group, which was briefly worth $50 billion, and VerticalNet, worth up to $7 billion.

As the value of Musser’s dot-com stocks “skyrocketed” amid the market bubble, the couple added properties far beyond their Main Line base. They set up companies that bought houses near Quidnet Beach on Nantucket, the old whaling center turned high-rent summer resort island. Grinker Musser took over 63 Hooper Farm Rd. on the island as a base for her construction business, Barcley Fine Homes LLC, along with lots she planned to develop in the nearby Juniper Hill section. And she acquired Whitehorse Farm, a horse farm in Willistown, Chester County, where she set up Whitehorse Stables LP.

In early 2000, stock market values for unprofitable dot-com companies began collapsing. By August of that year, Safeguard’s shares, based mostly on its dot-com investments, were down 80% from their peak. Musser’s brokers demanded their money back — or his shares, pledged as collateral.

Musser warned the Safeguard board that the immediate seizure and sale of his shares would flood the market, driving Safeguard’s value down even further. Musser’s debts, according to the suit, “had the potential to ruin Safeguard.”

Safeguard agreed to guarantee Musser’s broker debt, so he could sell the shares in small batches to raise cash, easing pressure on the stock value. The company also lent Musser $10 million, which Safeguard disclosed to its public shareholders months later, along with the $35 million he owed brokers.

According to the lawsuit, the board in exchange demanded Musser provide extra collateral for the risk it was taking on. So the company and Musser, the lawsuit alleges, conspired to “strong-arm” Grinker Musser into giving up her rights to properties the couple had acquired, including those that housed her businesses.

The couple married on Nov. 24, 2000 — having signed a prenuptial agreement the day before, which Safeguard had helped prepare, giving the company claims on some of the properties the couple had jointly acquired.

But when the couple returned from a honeymoon trip, Safeguard pressed them to agree to a revised prenup that mortgaged her own properties to Safeguard — with “a threat” that Musser would be fired from Safeguard, ending his annual salary and bonus of over $1 million, if she refused. “Hilary had no choice,” according to the suit.

Musser was forced out as chief executive two months later — but Safeguard gave him $650,000 a year, plus a secretary and health insurance, for the rest of his life, according to the suit.

The couple started a consulting firm, The Musser Group, led by Musser but owned mostly by Grinker Musser, to help other start-ups. They had a son, born in 2003, and “lived happily” for a time, according to the suit.

‘Playing for the same team’

In 2005, they filed for divorce. That put Musser under another threat of bankruptcy: If Grinker Musser exercised her rights to keep the consulting business and properties, Musser and Safeguard’s lawyers told her, he wouldn’t have enough assets left to cover the Safeguard loan. And if that forced him into bankruptcy, she would lose her alimony

After a year of litigation, she agreed to give up control of the consulting business and the remaining properties. Only years later, after reviewing records of his meetings with Safeguard officials during this period, did she conclude that the bankruptcy threat was made “under false pretenses ... Safeguard never intended to recover assets to cover Pete’s debt” but hoped only to keep Musser in business and its own debt covered, by her assets, according to the suit.

The suit alleges that while pretending to struggle against one another over new terms for their financial relationship, Safeguard and Musser were actually “playing for the same team.” Grinker Musser agreed to their revised terms “under duress,” the suit says, because she feared losing the Bryn Mawr mansion and her remaining assets if her former husband was forced into bankruptcy.

She lost the firm, the farm, and most of the island real estate, hanging onto the mansion and one of the Nantucket properties under the final divorce agreement in 2007. She and her son later moved to Florida. In 2017 she sold a house she designed, across the water from former President Trump’s Mar-a-Lago compound, for $16 million, a record for West Palm Beach, according to news accounts.

The suit asks for compensatory damages, interest, costs, and delay damages.

As of July 10, no answer to the complaint has appeared in the public record, and no trial date has been set.