Accounting software can affect every part of a business. Local experts share tips on choosing the right system.

“The more people you talk to, the better,” one software industry marketing leader said.

Accounting software has evolved over the past two decades, becoming mostly cloud-based, very customizable, and easier to implement. But deciding on the right application is still complicated.

Here are a few things to keep in mind.

Online reviews are good resources, but be careful.

A few online review sites — like G2, PCMag and Software Advice — can provide a great amount of information about the capabilities of different accounting software. However, it’s important to not rely entirely on the information these sites provide.

Scott Hammer, a marketing director at Lumberton-based MilesIT, which makes Striven, a customizable accounting software application, warns that some reviews may actually be “incentivized” reviews.

“I’ve seen where some people get gift cards or other perks to submit reviews,” he said. “It doesn’t mean that they’re either erroneous or disingenuous, but it does mean that you want to take this information with a grain of salt.”

Hammer recommends using sites that offer the ability to speak to consultants. He also recommends asking other business managers in your industry what they use, and getting recommendations from your accountant.

“The more people you talk to, the better,” he said.

It’s important to work with a partner.

Buying and setting up a new accounting system prompts many important questions.

What general ledger accounts are appropriate? How do you migrate data to the new system? Can it integrate with other systems, like your bank or payroll platform? What reports are needed? And more important, what training is necessary?

The accounting software provider can provide some of these answers, but most have partners and consultants who can help you choose and implement your system.

Chris Farrell, a Philadelphia-area vice president at accounting software implementation firm NextTec, said working with an implementation partner is critical.

“You ultimately want somebody that is familiar with your business processes,” he said. “A good partner always has best practices and can help you best understand the strengths and weaknesses of the accounting software you’re evaluating.”

Implementation partners can be recommended by the software vendor or found independently on sites like LinkedIn.

Good partners, according to Hammer, can determine whether the software they represent will be the right fit for your business and, if not, point you in another direction.

“A good partner is going to know your business and care about your business and be more invested in your decision than just your average software vendor,” Hammer said.

Get demos. Lots of demos.

Vendors are used to demonstrating their products multiple times during a prospective customer’s evaluation process. Most software systems offer a free trial.

The vendor should show you the features that will most impact your operations, and you should test the software’s capability on your own.

An effective software demo will include the people who will actually be using the software, Hammer said, and they should come prepared with questions.

“There is an art to giving a software demo, on the sales side, but there’s also an art to receiving a demo,” he said. “As a customer you have to make sure you’re bringing the right people, and that should include both accounting and operational users that will be doing orders, invoicing, purchase orders, and other tasks in the system. They should be going through real life scenarios with the software.”

Farrell said users should also evaluate whether the software vendor they’re considering is well-positioned for their particular needs.

“Transparency is important,” he said. “A vendor may not be able to check all the boxes, but they should be prepared to show why their software solves problems that are unique to their customers’ businesses.”

Consider an industry solution.

While every accounting system is built on the same foundation of debits and credits, different companies have different needs depending on their industry.

Manufacturers may need to track costs in bills of materials or process formulation. Construction companies need project accounting. Service businesses tend to bill out time and materials. Retailers, restaurateurs, and online companies have unique point-of-sale and e-commerce needs.

Some mainstream accounting systems have templates and add-ons to accommodate industry requirements. Others are built specifically for an industry.

Accounting and financial systems have increasingly added features to address compliance requirements in health care, government, nonprofits, and manufacturing, Hammer said. Farrell said implementation partners with industry experience are also critical in the evaluation process.

“Having a partner that was a former controller or a plant or project manager in your industry is invaluable,” he said. “They’ve walked the walk.”

Finally, focus on your business, not your books.

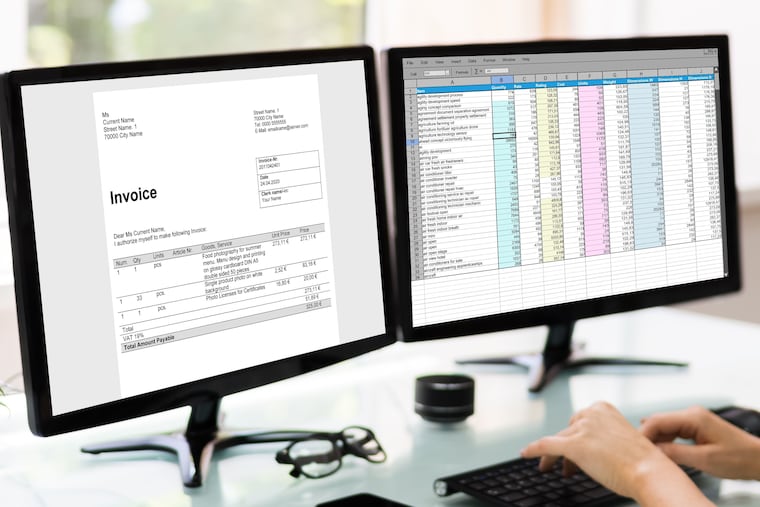

Accounting software isn’t just about a general ledger or sending out an invoice. It’s the core system for any business, and, when implemented the right way, it touches all parts of the company including customer service, production, human resources, and purchasing.

“The biggest thing that businesses need to be concerned about when evaluating a new accounting system is to identify the key areas of the company where it will be used the most,” Farrell said. “Most of the systems available today can do the accounting work, which is why it’s important to focus on the processes in your business that are unique and figure out how the software will work with — or even change — them.”