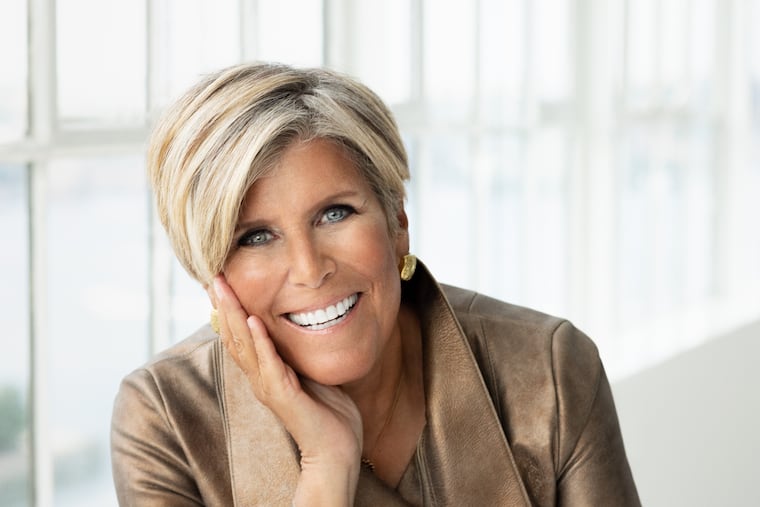

Suze Orman’s post-pandemic finance tips

Orman is expected to draw a crowd online at the Pennsylvania Conference for Women on Nov. 11.

Suze Orman says she knew things were going to get rough in 2020 — though this kind of rough, even a well-known financial adviser could not have known.

Before COVID-19, “If you had listened to my Women & Money podcast, in July 2019 I said that in the first few months of 2020, I expect it to get dangerous,” she said in an interview.

She will be speaking online at the Nov. 11 Pennsylvania Conference for Women, one of a lineup including Hollywood actress Viola Davis and author Tara Westover as keynote speakers. To register, visit paconferenceforwomen.org.

Now, in the COVID-19 era, Orman has recalibrated some of her old advice — she used to be a large holder of municipal bonds — and today says investors should avoid bonds.

Also, if at all possible, scrape together a 12-month emergency fund, instead of an eight-month emergency fund.

Though sometimes criticized for doling out overly general advice, Orman’s books and videos are popular, especially with older audiences who view her PBS specials.

On stocks? “If you need your money a year or so from now, it doesn’t belong in the stock market, and it never should be. But if you have four or five years, I encourage people to not take your money out.”

Not all her predictions are accurate, but Orman stands by her 2019 forecasts, saying she nailed this year’s market volatility.

“My advice was absolutely perfect. It’s been spot on. Obviously, I have an extensive stock portfolio of my own,” she said but refuses to recommend individual stocks.

”If you buy stocks, buy at least 25” and create your own mini-mutual fund.

Brokerages now offer fractional “slices” of stocks such as Amazon, Google, and other high-priced shares. Or there’s the Vanguard Total Stock Market Index ETF (symbol: VTI).

“It’s cheaper than the mutual fund” tracking the same index, she said.

On the current state of our economy: “There’s a tremendous difference between the stock market and economy. Rates have to stay low because of the economy. It’s almost as if a bad economy is keeping interest rates low and that makes the stock market go higher.”

Low rates are punishing savers, but the Federal Reserve policy has given retirees little choice but to reconsider what used to be the safety of bonds. After all, interest rates are bound to go up, and when they do, “you’ll be stuck in those bonds, and the prices will go down, especially long-term bond funds. If you’re retiring, you can’t keep your money in the bank at 0.5% interest. You may be forced into the stock market.”

Orman says she thinks that with the U.S. economy in such bad shape, and so many Americans out of work, the government has no choice but to go into deeper debt.

America’s economy is “in the ICU, it’s in critical care. Do I think it would be worse if we didn’t do it? I do.”

“I’m not an economist,” she continued. “I just let the powers that be have enough intelligence to work our way out of this one. My hope is the administration — whichever — they know what they’re doing.”

At the Pennsylvania Conference for Women on Nov. 11, Orman will take questions from the virtual audience, which is likely to be eager for post-COVID-19 advice.

Beyond her emergency fund advice, she says it’s most important that for many people, “you can no longer assume the job you have or hope to get back, is going to come back.”

In the short term, “employers and corporations have learned, it’s more profitable for the bottom line to not have physical employees in a building they have to pay for.”

Long term, “I would not be secure anymore in my job,” she said. “With artificial intelligence, robotics, there will be automatic cargo flights with no pilots and driverless cars. All these people who never thought they’d lose their jobs ... will be replaced by an entity that cannot get the virus, and doesn’t need health care or retirement benefits.”

In the future, the American tax system requires an overhaul.

“Our tax structure is going to have to change. I pay U.S. income taxes because I want to,” said Orman, who resides in the Bahamas. “My goal is not to avoid paying taxes. I live in the Bahamas because it’s healthy. I don’t lock my doors. There’s no cars on the island. We eat the fish we catch. I’m a U.S. citizen. I’m more than willing to pay more. I love my country. I just want my country to start loving all the people who reside in the U.S, all nationalities.”

Retirement savings in Pa.

Orman is right to warn her fans about saving for retirement, and the Philadelphia-based Pew Charitable Trust has new research on the size of the gap between what Americans save already and what they need.

“The retirement savings deficit affects every part of Pennsylvania, and includes increased public assistance costs, reduced tax revenue, decreased household spending, and lower employment,” said John Scott, Pew’s retirement savings project director.

Even small savings now could offset the current shortfall. If Pennsylvania households saved just $1,170 more a year — or about $98 a month — over the next 15-year period, they could completely erase the gap and allow for a retirement with adequate savings.

Of course, for many households, even that figure is out of reach, especially now. A Bankrate survey this summer found only one in four people has enough savings to cover six months of expenses; 27% had less than three months worth of savings; and 21% had no emergency savings at all since the pandemic.