Vanguard slaps new 0.50% fee on bond mutual fund shares, nudging customers into ETFs

Vanguard noted that “generally, these fees will not apply to transactions coordinated in advance between a client and Vanguard." So call Vanguard if you want to avoid the fees.

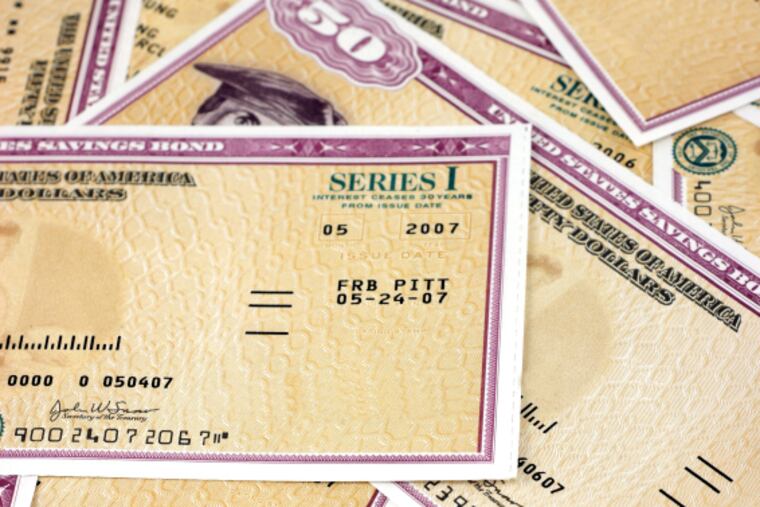

If you want to invest in one of Vanguard’s popular bond index mutual funds, the cost is about to go up.

Vanguard said it will levy a 0.50 percent purchase fee for Investor and Admiral share classes of its Vanguard Long-Term Bond Index fund starting July 10, according to an addendum issued May 10, 2019 by the investment firm.

In its prospectuses, Vanguard also added language allowing the Malvern-based firm to “reserve the right” to charge fees on large purchases of some other bond mutual funds: Total Bond Market Index, Short-Term Bond Index and Intermediate-Term Bond Index funds. The changes appeared on Friday. as well.

Although everyone is liable to pay this fee, it would seem to hit hardest at professional, or “institutional,” frequent traders in and out of this bond fund. Vanguard says it may levy these fees if a client’s purchases over a 12-month period exceed $100 million up to $500 million, depending on the fund.

Vanguard noted that “generally, these fees will not apply to transactions coordinated in advance between a client and Vanguard."

The rules underscore how Vanguard doesn’t seem to like frequent trading, especially if executives don’t know it’s coming. Frequent purchases and sales can raise costs for all shareholders.

Only about 15 percent of the assets in Vanguard’s four original bond index funds are currently held in ETF form, with the bulk of investor money still held in traditional mutual fund shares.

By contrast, assets in Vanguard’s newer bond ETFs far outweigh those in their comparable mutual fund shares, according to Jeffrey DeMaso, editor of the “Independent Adviser for Vanguard Investors” newsletter, which tracks Vanguard funds.

“If Vanguard can run their original bond index funds even cheaper than they have, they’ll be able to continue to lower costs in the fee wars they launched,” he noted.

“So, if you are a large investor looking to buy one of Vanguard’s bond index funds, and you want to avoid the fees, call Vanguard and tell them your plans. Of course, you could also just buy the fund’s ETF shares and ignore the fees entirely,” he added.

“It costs money to go into the market and buy and sell bonds, so this fee covers that. The new money coming in should pay those costs, not existing mutual fund shareholders,” he explained. “That’s the idea, so current shareholders are not impacted by large flows in and out of the fund.”

And therein lies a clue to why Vanguard may be imposing these purchase fees on its bond index funds—to encourage large, tactical traders to use their ETF shares, or find another fund to flog.

Why now?

“It seems this is aimed at either RIAs [registered investment advisors] or big institutions, not retail mom-and-pop investors,” DeMaso said. “Perhaps Vanguard’s trading costs have gone up in the bond markets, because of reduced liquidity.”