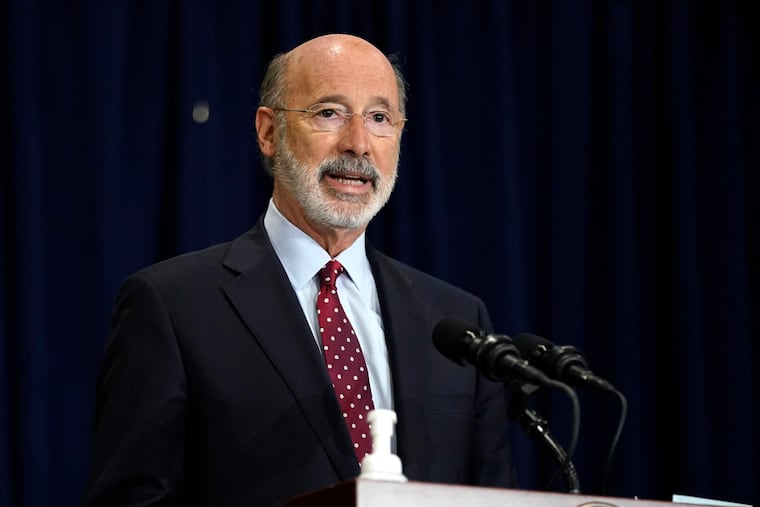

Gov. Tom Wolf wants to raise Pa. income taxes and give $1.5 billion more to schools

The proposal was cheered by education advocates but appeared likely to face opposition in the Republican-led Legislature.

As he looks to Pennsylvania’s post-pandemic future, Gov. Tom Wolf is returning to familiar ideas: more money for schools, paid for with more tax dollars.

On Tuesday, Wolf’s administration unveiled highlights of the budget proposal he’s expected to deliver to legislators Wednesday. It features an extra $1.5 billion for public education — in what would be the biggest financial boost for schools since he took office in 2015 — accompanied by a roughly 50% increase in the personal income tax rate.

While sweeping proposals from earlier in his tenure fell short amid stalemates with the Republican-led legislature, the Democratic governor appears to be renewing his push for broader changes to Pennsylvania’s taxation system as the pandemic continues to upend the state’s public schools.

The plan — which also includes tax credits that officials said would exempt two-thirds of Pennsylvanians from the increase — was cheered by public education advocates, who said it would steer needed resources to underfunded schools and marked a step toward addressing stark funding gaps between districts.

But it appeared likely to face opposition in the legislature, where some GOP lawmakers immediately criticized the tax increase.

“Proposing middle-class tax increases during a pandemic shows how out of touch Gov. Wolf is and how he is not taking Pennsylvania’s return to normal seriously,” said Jason Gottesman, spokesperson for House Republicans.

Wolf administration officials said Tuesday that the governor’s proposal would raise Pennsylvania’s personal income tax rate from 3.07% to 4.49% as of July 1. Tax credits would be expanded, though, and most Pennsylvanians will have their taxes remain the same or get a tax cut, they said. Under the plan, for instance, a married couple with two children and less than $84,000 in income would qualify for a tax cut.

“We’re going to stop asking working families to pay the same tax rate my family does,” Wolf, who was a multimillionaire business owner when he was first elected, said in a statement. “I want to help working families get ahead by reducing their taxes.”

The changes to the income tax rate would yield the state an additional $3 billion, officials said — enough to underwrite the new spending on schools.

» READ MORE: Federal aid is keeping Pa. schools afloat, but state will need to step up with funding, report says

Wolf proposes to add more than $1.3 billion to the main state subsidy for public schools — close to a 20% increase over the current $6.8 billion in aid. But his plan isn’t limited to adding money.

Wolf would redistribute all existing aid through a state formula that directs funding to needier school districts. He would then spend most of the new funding — $1.15 billion — to ensure no schools lose money in the redistribution.

That’s a big change: Currently, only 11% of state education aid is distributed through the formula, and most money is given out based on what schools received in the past. Because Pennsylvania’s public schools are funded primarily through local taxes, advocates say the state’s failure to more fully use its formula has contributed to wide disparities between wealthy and poor communities.

“We think this is a huge step in the right direction,” said Deborah Gordon Klehr, executive director of the Education Law Center, which along with the Public Interest Law Center is representing plaintiffs suing the state over school funding. “For years, our system has allowed the students who need the most to get the least.”

An analysis commissioned for the plaintiffs last year found Pennsylvania schools that are inadequately funded — most of the state’s districts — need an additional $4.6 billion. Wolf’s budget proposal wouldn’t close that gap, Klehr noted.

» READ MORE: Pennsylvania schools need an additional $4.6 billion to close education gaps, new analysis finds

Wolf’s plan also includes an additional $200 million for special education, a proposal Klehr and other advocates highlighted as particularly important, after years of costs there outpacing increases in state aid. The governor also renewed his call for changes to charter school funding, including for cyber charters — which are privately run but funded by school districts based on enrollment and which have drawn a surge of new students amid the pandemic.

“The governor is demonstrating his commitment to public education and we are hopeful and cautiously optimistic that this focus will shine a light on the many long-standing issues that need to be addressed in public education,” said Nathan Mains, chief executive officer of the Pennsylvania School Boards Association.

Neither his association nor others representing public school officials commented directly Tuesday on Wolf’s plan to redistribute aid through the state’s funding formula. Some said they were waiting to review additional information.

A spokesperson for Senate Republicans declined comment until after Wolf’s budget address, though some individual lawmakers voiced disapproval. “Nothing new with the governor’s progressive tax proposal,” tweeted Sen. Kim Ward (R., Westmoreland). “It’s a typical cookie-cutter mantra that we hear over and over from the left wing of that party.”

Pennsylvania has one of the lowest personal income tax rates in the country — in part because it has a flat rate rather than a graduated rate based on income level.

The state can’t maintain that tax rate and “expect to have a modern state with a quality education system,” said Donna Cooper, the executive director of Public Citizens for Children and Youth and onetime policy chief under Democratic Gov. Ed Rendell. While there’s a “knee-jerk reaction” against raising taxes, she said, the proposal would shield lower-income Pennsylvanians from increases.

Given the ongoing court challenge to the state’s school-funding system, lawmakers may be forced to confront the funding problem, Cooper said. They could wait until a court ruling — though by then, she noted, “some of them will be Republicans who want to run for governor.”

For Wolf, the 2021-22 budget will be the second to last he delivers during his tenure, and maybe the best chance to make lasting impact.

“We will defeat COVID, but we can’t yet say when it will be safe for life to return to normal — and it’s hard to know what ‘normal’ will even look like,” he said in his statement Tuesday. “But I refuse to tell any young family in Pennsylvania that they just happen to be starting out at the wrong time — that, with everything going on, 2021 just isn’t going to be the year we get around to lifting the barriers that stand between them and the future they hope to provide for their children.”