This N.J. hospital ER billed thousands for a stomach ache. The patient fought back — and won.

Emergency department bills can be expensive and especially jarring for young adults with little savings to pay.

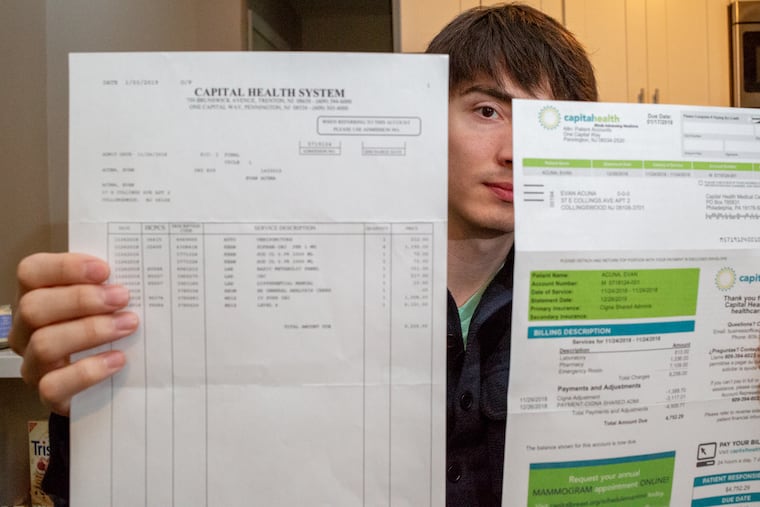

Who knows whether it was the stuffing, cranberry sauce, or that vegetable casserole, but something at Thanksgiving dinner didn’t sit right with Evan Acuna.

Two days after the big feast he was still feeling the effects of what the 27-year-old suspected was food poisoning. When he couldn’t even keep down water and started to get delirious from dehydration, Acuna’s girlfriend took him to Capital Health-Hopewell, outside Trenton.

In the hospital’s emergency department, Acuna received two IVs of fluids and within a couple hours was feeling better and sent on his way.

It seemed to be a minor medical episode, as far as ER visits go. But when he got the bill a month later, Acuna realized how wrong he was: This was a $9,200 tummy ache.

Acuna’s Cigna health plan negotiated a lower rate of $7,870 and paid $3,117. Acuna was responsible for $4,752 because he had not yet met his plan’s $5,000 deductible.

“I was just almost in tears,” said Acuna, of Collingswood. “I can’t pay this. I’ve never in my life had a bill I couldn’t pay.”

Emergency departments are notoriously expensive because they must be prepared to respond to a wide range of scenarios on the spot, around the clock, which enables them to charge more than clinics or urgent-care centers and pricey fees just for walking in the door. The bills can be especially shocking for young adults, such as Acuna, newly paying for their own care with limited savings.

What adds to the frustration and confusion is how arbitrary hospital pricing can be.

In a fit of panic and outrage, Acuna called the hospital the day after he got the bill and said there was no way he could pay it. The hospital agreed to reduce his portion to $779.

Acuna was relieved but stunned anew: If $779 was an acceptable payment, why had he been charged almost six times as much?

“A squeaky wheel gets a cheaper rate — that’s what it comes down to,” said Ellen Magenheim, president of We Care Advocates in Cherry Hill, which helps patients challenge medical bills.

“They’d rather take some of it than risk losing all the money, and that’s what bothers me is why there’s such a difference in what they charge and what they’ll accept,” she said.

One reason emergency department bills can be so expensive is because of facility fees that ERs charge just for walking in the door. The sicker you are, the bigger the fee. Acuna was designated a level 4 out of 5 acuity, which came with a $6,100 facility fee. Patients being treated for dehydration who require IV fluids fall under level 4, according to guidelines from the American College of Emergency Physicians.

What Goes Into a $9,258 ER Visit

During Evan Acuna's brief visit to the Capital Health emergency room near Trenton for stomach distress and dehydration, he received two IVs of fluid — and a $9,258 hospital bill. Part of the bill was a $6,100 facility fee for walking in the door. Facility fees are based on the acuity of the treated illness, and IV treatments for dehydration are designated as a level 4 acuity of a possible 5. After Acuna called the hospital to complain about the charges, the part of the bill he was responsible for paying was cut from $4,752 to $779.

Shown below are the charges as shown on the itemized bill that Acuna requested. An explanation of each charge — which was not included on the bill — is also shown.

Service description on bill

Explanation

Cost

VENTIPUNCTURE

Blood draw from vein for testing

$212

ZOFRAN-INJ PER 1 MG

(4 units)

Anti-nausea medication, administered through injection

$1,192

SOD CL 0.9% 1000 ML

(2 units)

Salt water solution used to mix drugs administered through IV

$144

$351

BASIC METABOLIC PANEL

Blood test

$217

CBC

Complete Blood Count blood test

$33

DIFFERENTIAL MANUAL

Blood test

$0

ER GENERAL ANALYSIS CHARGE

ER fee

$1,008

IV PUSH INJ

Injection/infusion by IV

LEVEL 4

ER facility fee. Fees typically range from 1-5 depending on patients' severity (5 is the highest). Under American College of Emergency Physicians guidelines, patients who receive IVs are categorized level 4.

$6,101

JOHN DUCHNESKIE / Staff Artist

What Goes Into a

$9,258 ER Visit

During Evan Acuna's brief visit to the Capital Health emergency room near Trenton for stomach distress and dehydration, he received two IVs of fluid — and a $9,258 hospital bill. Part of the bill was a $6,100 facility fee for walking in the door. Facility fees are based on the acuity of the treated illness, and IV treatments for dehydration are designated as a level 4 acuity of a possible 5. After Acuna called the hospital to complain about the charges, the part of the bill he was responsible for paying was cut from $4,752 to $779.

Shown below are the charges as shown on the itemized bill that Acuna requested. An explanation of each charge — which was not included on the bill — is also shown.

Service

description

on bill

Explanation

Cost

VENTIPUNCTURE

Blood draw from vein for testing

$212

ZOFRAN-INJ PER 1 MG

(4 units)

Anti-nausea medication, administered through injection

$1,192

SOD CL 0.9% 1000 ML

(2 units)

Salt water solution used to mix drugs administered through IV

$144

BASIC METABOLIC PANEL

Blood test

$351

CBC

Complete Blood Count blood test

$217

DIFFERENTIAL MANUAL

Blood test

$33

ER GENERAL ANALYSIS CHARGE

ER fee

$0

IV PUSH INJ

Injection/infusion by IV

$1,008

LEVEL 4

ER facility fee.

Fees typically

range from 1-5 depending on patients' severity

(5 is the highest). Under American College of Emergency Physicians guidelines, patients who receive IVs are categorized level 4.

$6,101

JOHN DUCHNESKIE / Staff Artist

Capital Health said it was able to reduce Acuna’s bill because he met the qualifications for financial assistance available to patients with income within 200 percent of the federal poverty level, according to a statement from the health system.

“We care about our patients and want to provide the highest levels of customer satisfaction. If there is an outlier that needs to be addressed, we listen and help the patient accordingly,” Kate Stier, a spokesperson for the hospital, said in a statement.

When Acuna got his new bill in January with a “prompt pay discount self-pay adjustment” he settled the tab.

Financial assistance programs are common at hospitals, but many patients are unaware that help is available. Some may assume they don’t qualify because they have full-time jobs and private health insurance.

Challenging a medical bill can be time consuming, stressful and, in many cases, does not result in a lower charge.

But for those who are able, the effort often pays off.

“In a world where each patient’s circumstances are unique and different, there is some space for negotiation. This patient learned his own voice was an important part of the process in getting the bill reduced,” said Benjamin Chartock, an associate fellow at the Leonard Davis Institute of Health Economics at the University of Pennsylvania, who studies emergency department billing.

Magenheim encouraged people to question every bill they get and take action quickly if they suspect an error.

Medical debt is a top source of personal bankruptcy, and it doesn’t take much for medical bills to become overwhelming.

The bill was especially jarring for Acuna because until a year ago he had been covered by his parents’ health plan and had limited exposure to how much medical care costs.

Unlike his parents’ insurance, the health plan Acuna got through his job at a small technology company has a $5,000 deductible. He’s healthy and, until that fateful Thanksgiving weekend, hadn’t used his plan much.

“The high deductible, which is a tool insurers use to hold down their own cost and to provide the patient some skin in the game, ends up being very, very financially cumbersome for a 27-year-old,” said Chartock.

A study published in the August issue of Health Affairs found that young adults had more medical debt in collections than older generations, despite having fewer medical costs.

The share of people with at least one new medical bill in collections in 2016 and the amount of medical debt peaked at age 27, according to a review of data from the Consumer Financial Protection Bureau’s Consumer Credit Panel. Just over 11 percent of 27-year-olds had at least one new medical bill in collections in 2016, with a median medical debt of $684.

“You tend to have less money, you’re less likely to have insurance, to have savings. Their incomes are generally lower, so you have less resources to pay bills,” Benedic Ippolito, a co-author of the study who is an economist research fellow at the American Enterprise Institute, a public policy research institute in Washington.

More than half of medical bills in collections are for less than $600, according to the study.

After this experience, Acuna will be much more attuned to his health coverage, he said.

When he started his first job out of college, he didn’t consider the company’s health benefits because he was still covered by his parents’ plan.

But recently, health coverage was the deciding factor in accepting a new job, which he started in February. The pay is a little less than what his former employer offered to get him to stay, but the health plan’s annual premium is $2,900 lower — more than making up the pay difference.

Do you have an outrageous ER bill story to share? Contact Sarah Gantz at sgantz@philly.com.