Inspira Health is expanding in Gloucester County. Elsewhere in Jersey, it faces challenges.

Inspira is expanding its busy Mullica Hill hospital in Gloucester County while facing challenges how to best provide services in Vineland and other South Jersey locations.

Inspira Health Network’s hospital in Gloucester County is bustling. One day in June, the 220-bed facility was virtually full with 218 patients.

In neighboring Salem County, by contrast, two small community hospitals also owned by Inspira aren’t even half full, seeing fewer than 25 patients a day on average.

That contrast illustrates how the nonprofit health system with four general hospitals in Southern New Jersey serves two vastly different markets.

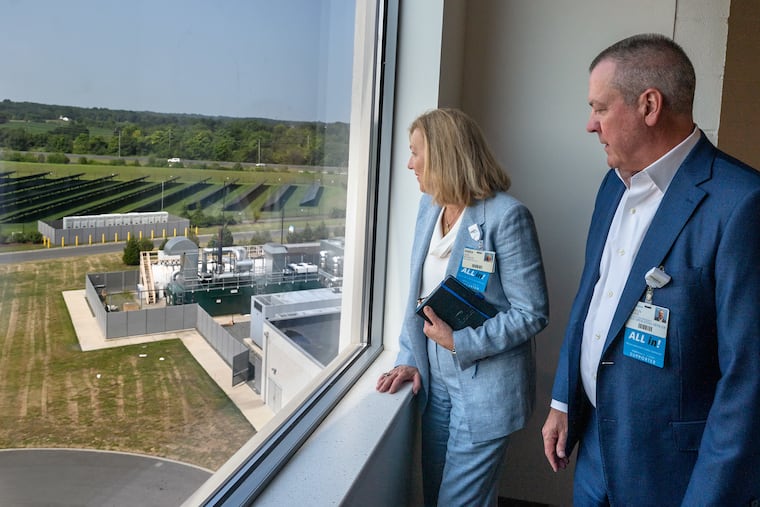

Inspira Medical Center Mullica Hill, in Gloucester County, opened just five years ago and already needs a $220 million expansion to accommodate patient demand, Inspira officials said. “We never had any concept that we’d see this much growth this fast,” said Amy Mansue, who became Inspira’s CEO in August 2020. A second project, starting next spring, will expand maternity services.

Since entering Gloucester County though a 2012 acquisition, Inspira has benefited from the area’s population growth, which has outpaced other southern New Jersey counties since 2010. Gloucester has southern New Jersey’s second-highest median household income, which means more people have better-paying private health insurance.

Business conditions are far different than in Cumberland and Salem Counties, where Inspira has its historical roots. The two counties are among New Jersey’s poorest, have little or no population growth, too few doctors, and poor health outcomes.

“I did not anticipate the challenges that being in Cumberland and Salem Counties, and delivering services here, would have. It’s humbling, the amount of poverty, the violence, the gang violence. It’s a tough world,” Mansue said.

In some parts of the country, large nonprofit health systems have faced criticism for closing facilities in poor communities and building new ones in wealthier areas. Inspira has stayed and even expanded its reach in its poorer areas.

Moody’s Ratings recently assigned a strong A2 credit rating to an expected $256 million bond sale that will pay for Inspira’s planned expansions, despite the system’s high dependency on Medicare and Medicaid, which pay doctors less than private insurance.

“In terms of capital planning and long-term strategy, they seem to be doing a good job of managing the different types of markets that they serve,” said Moody’s analyst Cassandra Golden in an interview.

A game-changing acquisition

Inspira traces its roots to Bridgeton Hospital, founded in 1899 in the Cumberland County seat. The health system’s biggest hospital, the 276-bed Inspira Medical Center Vineland, opened there in 2004, replacing three older hospitals in Bridgeton, Millville, and Vineland. In Salem County, Inspira had acquired Elmer Community Hospital in 1994.

Inspira Health Network in South Jersey

Acute-care hospital Behavioral-health hospital 10-minute drive from acute-care hospital

South Jersey Demographics

Inspira Health Network’s Mullica Hill hospital is in Gloucester County, which is generally wealthier and better-educated, as well as having higher population growth, than Salem and Cumberland Counties, where its other acute-care hospitals are located.

The system turned north with the 2012 acquisition of the 305-bed Underwood-Memorial Hospital in Woodbury, Gloucester County, gaining a foothold in a faster-growing and wealthier area. This ultimately helped Inspira continue serving its historic markets.

Inspira started working on plans to build a replacement hospital for the landlocked Underwood-Memorial soon after the acquisition. The new location was a 100-acre property in Harrison Township near the intersection of two busy highways, Routes 55 and 322.

“We needed the opportunity to make it easier for people to get to us,” Mansue said “Being in this location is a game changer. It changes the entire profile of Inspira.”

In Gloucester County, Inspira competes with Jefferson Washington Township Hospital, which is about six miles from Inspira Mullica Hill, and academic medical centers in Philadelphia. Moody’s said it expects the new wing will help Inspira expand its reach in the market.

Inspira’s overall hospital market share is 54% in its core markets of Cumberland, Gloucester, and Salem Counties, Moody’s said. But the figures are likely far higher in Cumberland and Salem — where Inspira owns the only hospitals — than in Gloucester. A breakdown was not available.

Challenges in Salem and Cumberland Counties

When Inspira acquired Salem Medical Center in 2022, its motivation was not a growth opportunity like the push to acquire Underwood-Memorial a decade earlier.

Inspira’s board leadership decided to acquire the Salem County hospital, now called Inspira Medical Center Mannington, because they thought the community needed it and would otherwise close.

“They couldn’t survive on their own. They needed to be part of a larger system,” Mansue said of the Mannington Township facility. “It really was our board’s decision to say, this is what’s best for the community.”

The demographics are tough. Salem County is the least-densely populated county in New Jersey, according to state data. It has the most severe primary-care physician shortage and the highest rate of premature deaths in New Jersey, according County Health Rankings published annually by the University of Wisconsin’s Population Health Institute with the support of the Robert Wood Johnson Foundation.

Despite the financial challenges in Salem County, it was important for Inspira to own the former Memorial Hospital of Salem County, Mansue said, “so we can really look at, how do we spread the services through the county?” That means the mix of services will likely change as the system tries to operate in a financially sustainable way, she said.

In addition to acquiring Salem Medical Center, Inspira is opening a primary-care office in Millville next month. The $5 million project will expand the office to 10,000 square feet from 2,000 square feet.

Paul DiLorenzo, executive director of the Salem Health & Wellness Foundation, acknowledged the difficulties Inspira faces in Salem County. The foundation was founded with proceeds from the 2002 sale of Memorial Hospital of Salem County to the for-profit Community Health Systems Inc.

“They are trying to juggle, how you can provide medical care to people in Salem County when you’re also trying to deal with the issues around insurance and reimbursements and the low number of patients,” DiLorenzo said. “It’s a complex environment that Inspira’s working in.”

Inspira’s growth

In Gloucester County, Inspira’s challenge is keeping up with the demand for lucrative health-care services like stroke and cardiac care, and also for labor and delivery services.

When Inspira opened its $375 million Mullica Hill hospital in December 2019, management thought an expansion might be needed in a decade, Mansue said. The hospital’s occupancy rate is in the range of 87% to 93%.

She attributed some of the faster-than-expected growth at the Gloucester County hospital to a 2021 change in New Jersey law that allowed more heart procedures to be done at the hospital and a joint venture in neurosciences with Cooper University Health Care. Inspira also collaborates with Cooper for heart care, and uses Cooper doctors to care for inpatients.

Separately, Inspira plans to reach a deal with an academic partner for cancer care in the next 18 to 24 months, Mansue said.

The 150,000 square-foot expansion, expected to open in early 2027 will add about 60 beds to Mullica Hill, said Warren Moore, Inspira’s chief operating officer. Inspira needs neurointensive-care beds to support the Cooper program, he said. The five-story wing will also have space for imaging, interventional radiology, and education for Inspira’s increasing number of medical residents.

Away from the hospitals, Inspira more than doubled its number of employed physicians to 260 from 120 in the last three years, according to Moore.

“We bought a lot of small practices, ones and twos,” Mansue said, referring to the numbers of doctors. “You can’t operate efficiently when you’re buying those types of practices, so we need to bring them together, in larger groups.”

That’s what Inspira did in the spring when it opened a $50 million, 80,000 square-foot outpatient center in a former Dick’s Sporting Goods store in Deptford.

While Inspira has significant momentum, it has posted two consecutive years of operating losses largely due to higher expenses, such as for workers, that all health systems have been facing since the pandemic. “We had to make a 20% increase in salaries just to keep us at where everybody else was,” Mansue said.

Moore said he expects it to take five to eight years to get Inspira back to historic levels of profitability, as measured by operating cash flow. In the six years before the pandemic, that figure averaged 14%. In the last two years, it averaged 5%, financial records show.

The financial challenges in health care are expected to persist, but Inspira has no plans to slow down. “We’re going to see over the next four years, five years, that we will continue to make these investments,” Mansue said.