ACA open enrollment began on Nov. 1. Here’s what to know.

Pennie and GetCoveredNJ are opening for 2023 enrollment. Here's what you need to know about signing up for health insurance.

Enhanced tax credits and a fix to the so-called family glitch, which kept some Americans who need health insurance from taking advantage of marketplace subsidies, are two highlights of this year’s Affordable Care Act marketplace open enrollment, which begins Nov. 1.

These Obamacare plans are intended for individuals and families who don’t have access to job-based health insurance, and don’t qualify for other government-funded health programs for seniors or low-income families. Pennsylvania residents can sign up through Pennie; in New Jersey, the online marketplace is called Get Covered NJ.

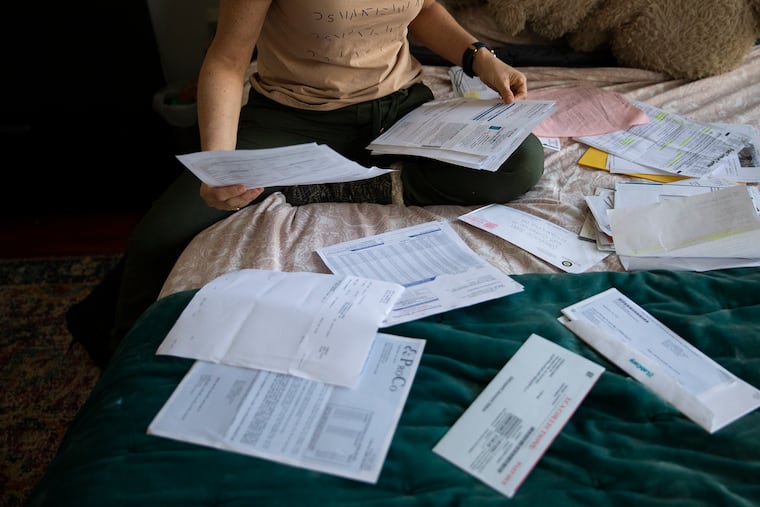

It’s always a good idea to review your health insurance coverage during open enrollment, even if you’re content with your plan. Details, such as covered prescription drugs and cost-sharing rules, may have changed. Plus, you may be able to get a better deal than you have in the past.

“Any changes in your life can affect your financial assistance,” said Antoinette Kraus, executive director of Pennsylvania Health Access Network, which offers virtual, in-person, and over-the-phone help for enrolling in marketplace plans.

Inflation, pandemic job changes, the birth or death of a family members influence the price of your health plan and the size tax credit you’re able to get.

The annual enrollment period for Pennie runs through Jan. 15. Get Covered NJ enrollment ends Jan. 31. Be sure to sign up by the end of the year for coverage starting Jan. 1. Coverage will start Feb. 1 for people who enroll in January.

Here’s what to know about ACA marketplace enrollment this year:

Who is eligible for a marketplace plan?

If you don’t have access to affordable employer-sponsored health insurance, and aren’t eligible for Medicaid or Medicare, consider shopping for coverage through the ACA marketplace.

New for 2023, the IRS eliminated the so-called family glitch, which prevented people from enrolling in marketplace coverage if they had access to an “affordable” employer plan — even if it didn’t cover their family. Now, families are eligible for subsidies through the ACA marketplaces if the cost of an employer plan for the whole family exceeds 9.6% of income.

How do I sign up?

Pennie (pennie.com) is the online marketplace for Pennsylvania residents.

Get Covered NJ (getcovered.nj.gov) is the online marketplace for New Jersey residents.

People who live in a state that does not have its own marketplace use healthcare.gov.

Both Pennie and Get Covered NJ allow people to browse plans with just their zip code.

When you’re ready to sign up, create an account and follow the prompts to enter needed information, such as income and number of household members, for plan prices specific to you.

» READ MORE: Health insurance shopping tips

Where can I get help enrolling in a marketplace plan?

In New Jersey, call 1-833-677-1010 or visit the “get help” page at Get Covered NJ to find in-person support.

In Pennsylvania, call 1-844-844-4440 or visit the “assisters” or “brokers” pages at Pennie.com to find in-person help.

» READ MORE: 10 tips for avoiding health insurance scams

Do I qualify for a tax credit?

Very likely, yes. About 90% of people who enroll in marketplace plans qualify for financial assistance. Tax credits are based on income and ensure that no one pays more than 8.5% of income for a benchmark “silver” plan.

Marketplace plans are ranked by “metal level.” Bronze plans have the lowest monthly premium and highest deductibles, while gold and platinum have high premiums with low out-of-pocket costs. Silver plans fall in the middle and are typically considered the best value.

Your cost will vary, depending on the plan you choose and the size of the tax credit for which you qualify. Some people who are low income may qualify for additional financial aid.

Estimate your subsidy through Pennie or Get Covered NJ, or try Kaiser Family Foundation’s online calculator.

» READ MORE: Everything you need to know about Medicare open enrollment for 2023