Get a lower monthly student loan bill with the SAVE repayment plan

More than 1 million borrowers nationwide will have $0 monthly payments.

For the last three years, due to coronavirus-era economic protections, it was OK to throw caution to the wind and forget about federal student loans, said Will Hall. But that’s all about to change.

“We’ve sort of been in a place where ignorance was bliss when it comes to student loans because there were no consequences for not paying them,” said Hall, who works as the city’s director of economic mobility. “Now, as payments start back up, the worst thing you can do is not have a plan.”

Starting in October, 43 million federal student loan borrowers will have to start paying their monthly loan bills again, with accruing interest beginning this month. For many, this will be the first time they ever repay their student loans, and others who could pay their loans before the pandemic may find themselves unable to pay this time. Since the Supreme Court disallowed the Biden-Harris student-loan debt cancellation, student-loan borrowers are seeking relief wherever they can.

The average student-loan borrower will pay around $200 on their student loan bill next month, according to the consumer credit reporting company Experian. The Consumer Financial Protection Bureau estimates that one out of five borrowers will struggle with these monthly payments.

While the federal government won’t report you to credit bureaus or debt agencies for missed payments until next September, to help borrowers during the “on ramp” period, interest will continue to grow on student loans. After that 12-month grace period, if borrowers miss payments, they could be looking at a 50- to 80-point hit to their credit score, said Tyler Young, manager of financial counseling programs at Clarifi. The Center City nonprofit serves as a Financial Empowerment Center where any resident can receive free one-on-one financial counseling on their student loans.

“You should have options if you can’t make the payments,” Young said. “At least apply for the income-driven repayment plan if it’s right for you because you might be able to get away with no monthly payment at all.”

Through various income-driven repayment plans, federal student-loan borrowers can often get lower monthly payments, freeze interest on student loans, and have their student debt forgiven after a period of time. A new income-driven repayment plan, SAVE, has already put more than 4 million student loan borrowers on the path to affordability.

Here’s how you can benefit from the SAVE student loan repayment plan.

What is the SAVE income-driven repayment plan?

The Saving on a Valuable Education (SAVE) plan allows federal student loan borrowers to have a monthly student-loan payment based on how much they earn. The SAVE plan is the new and improved version of the former Revised Pay As You Earn (REPAYE) plan.

The biggest change is how the SAVE plan calculates your discretionary income (money left after paying taxes and cost of living), which is used to calculate your monthly bill. The calculation takes the difference between your adjusted gross income and the amount of income considered 225% of the federal poverty guideline for your family size and uses that figure to decide your monthly payment. It used to be 150% of the federal poverty guideline, so this increase to 225% makes more of your income exempt from the calculations.

That means single borrowers making $32,800 or less per year, roughly $15 per hour, will pay $0 per month on their federal student loan bill. The same goes for families of four earning $67,500 or less per year. Over 1 million borrowers will pay $0 per month under the SAVE plan.

According to the U.S. Department of Education, borrowers who make up to $60,000 will pay between $60 and $227 per month under the SAVE plan.

Another big win for borrowers under the SAVE plan is that their loan balance won’t grow due to unpaid interest. For example, suppose your student loan accumulates $50 in interest each month, and the SAVE plan lowers your monthly payment to $30. In that case, the SAVE plan will forgive the remaining $20 of accrued interest each month, according to the U.S. Department of Education.

After 20 years of regular payments, borrowers enrolled in income-driven repayment plans will be fully forgiven on undergraduate loans for any outstanding loan balance left. Forgiveness comes after 25 years for any graduate school or professional study loans.

“Your payment plan just became a lot more affordable. It moves up forgiveness for some, it lowers payments for all, and it ensures that loan balances are not going to grow from here on out unless you borrow more money,” Hall said.

In 2024, the SAVE plan will get even more benefits regarding student-debt forgiveness.

For instance, borrowers with an original principal balance of $12,000 or less will receive debt forgiveness for any remaining balance after 10 years of making regular payments. Borrowers with more than $12,000 in student loan debt can receive forgiveness, too. They’ll add one more year to the repayment period for every $1,000 borrowed. For example, if your original principal balance is $15,000, you will see forgiveness after 13 years of making regular payments.

First step to figuring out federal student loan payments

It’s understandable to feel reluctance reaching out to your loan servicer, the company that keeps track of and receives payments for your federal loans, Hall said.

But, realistically, your federal loan servicer should be one of the first resources you tap into when figuring out repayment options, as they’ll collect and report your payments.

“I know loan servicers can be scary because they can feel like the bill collector — and a lot of them are — I’m not saying they have the greatest customer service in the world. But, they generally do have all the answers to your questions,” said Hall.

If you haven’t already, you should also create an account on studentaid.gov. Here, you will be able to use tools that teach about different repayment options based on your circumstances, check your eligibility for plans, and where you will apply for repayment plans.

It can also estimate your monthly payment amount, length of repayment period, and the total interest you’ll pay over the life of your loan with different repayment plans.

Hall said using the tools on studentaid.gov is the easiest and most accessible way to figure out your student loan payment options yourself.

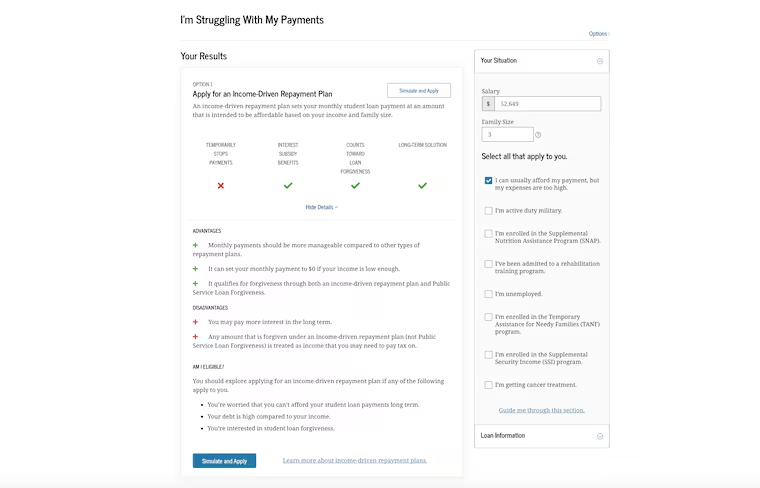

The Loan Simulator tool lets you input pertinent information like your salary, household situation, loan amount, and whether or not you receive government assistance to provide you with possible repayment options.

It even includes pros and cons for each repayment option to help keep you informed. Use the Loan Simulator at studentaid.gov/loan-simulator.

“I would take a look at the calculator on the Department of Education website,” said Hall. “If you don’t feel like all of your questions are answered, at that point schedule an appointment with a financial counselor.”

Free one-on-one financial counseling in the Philly region

One-on-one financial counseling on student loans is free to anyone at Clarifi, the nonprofit organization that staffs Philly’s Financial Empowerment Centers. They also serve the broader region with offices in Philadelphia, Montgomery, and Delaware Counties in Pennsylvania; Camden, N.J. and New Castle, Del. You can learn more at clarifi.org.

To make an appointment, call 215-563-5665 or email ClarifiTeam@clarifi.org.

How to apply for the SAVE loan repayment plan

Apply for federal student loan repayment plans on studentaid.gov. To get started, you’ll need to create an account and navigate to the income-driven repayment plan page at studentaid.gov/idr.

Before you take the plunge into an official application, you can view a virtual demonstration that takes you through the steps at studentaid.gov/idr/application/demo/overview.

The online application is available in English with accessibility options for borrowers with a disability, and a paper form is available in English and Spanish at studentaid.gov/forms-library. You’ll need to mail the completed paper form to your loan servicer.

To complete the application, you’ll need the following information:

Contact information.

Household size and number of dependents (if any).

Federal loan information. You can find this information on your studentaid.gov account and enter it manually or the application can transfer that information for you with your consent.

Financial information. Your salary, retirement plan, health insurance costs, mortgage payments, etc.

The application will take 10 minutes to complete. But borrowers won’t see changes to their monthly loan bill for weeks. According to the Department of Education, most borrowers who applied for the SAVE plan by mid-August will have their new monthly payment amount in time for the first payment in October.

You can check the status of your application at studentaid.gov.