Is it time to delay your small-business tax filing?

Planning precisely when to pay taxes has always been a tough business decision. Amid a pandemic, it's even harder.

The day of tax reckoning is coming. Maybe.

If you run a small business, it’s likely that you file either an S-corporation or partnership tax return. Those returns are normally due March 15 and because any income “passes through” to your individual return — due April 15 — many accountants have long chosen to extend those business returns so that their clients can file everything together.

Extending tax returns is a very common practice, particularly for strategic reasons. “For partnership and S-corporation tax returns, the due date of March 15 comes fast, especially for new business owners to complete their accounting for the year,” said Mitch Gerstein, a senior tax adviser at Isdaner & Co. LLC, a regional accounting firm in Bala Cynwyd.

“Oftentimes, it makes sense to extend because gathering the necessary year-end tax documentation and making smart decisions as to the handling of certain tax and accounting methods impacts the reporting of taxable income or loss.”

Chris Kourmadas, a partner at Philadelphia-based Frankford Tax, says that extending, whether for business or individual filings, often gets a bad rap. “There’s no penalty for applying for an extension, and it doesn’t inherently increase audit risk,” he says.

But the pandemic-assistance CARES Act added another twist. Thanks to the legislation, the due date for individual, calendar year c-corporations and nonprofit tax returns — and any final tax payments from 2019 — was extended to July 15.

In addition, the first two quarterly estimated tax payments for 2020, typically due April 15 and June 15, were also delayed to July 15. The deadline for S-Corporation and partnership tax return remained March 15.

It’s confusing but meaningful. These changes helped both individuals and small-business owners — many who are freelancers and independent contractors — temporarily avoid paying their estimated quarterly taxes and instead conserve that cash for other uses. But be aware: The key word mentioned above is temporarily. Treasury Secretary Mnuchin recently hinted that the July 15 deadline may be extended further, but no action has been taken yet. So if you owe taxes from 2019 or estimated payments for this year, the due date is looming.

Among my clients, there’s a common misperception that extending a tax return also means extending the payment of any taxes due. That’s not the case. Assuming the Treasury Department keeps the July 15 due date the same, and even if you decide to extend your return beyond that new deadline, you still must ensure that your tax payments — both from 2019 and the first two quarters of 2020 — are paid.

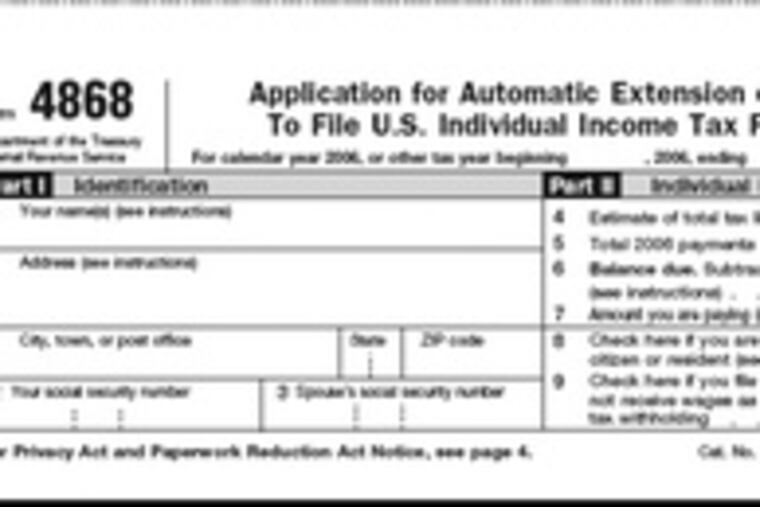

Delaying isn’t difficult. “All the taxpayer has to do in order to extend a personal income tax return,” Kourmadas noted, “is file, or get their accountant to file, Form 4868 by the original tax due date. If the taxpayer is set to receive a refund, no more action is needed.”

The one bright side — if you can call it that — of the economic downturn this year is that for some small-business owners, it has wiped out profits, which means that any estimated taxes due may not be very much. It’s important to talk to your accountant about that now and make these estimates based on your year-to-date numbers. Also, be aware that if you participated in the Paycheck Protection Program, the amounts that are forgiven under the program are not taxable but any expenses used for forgiveness, such as your payroll, rent, utilities, are also not considered deductible.

Another potential bright spot — again, if you can call it that — is that if your business lost money in 2019 and you’re eligible for a refund for the taxes you previously paid, it’s important to file as quickly as possible. It takes up to six weeks for the government to process those checks. In this scenario, extending wouldn’t make sense for you.

Even if you find delay attractive, it may make more sense to file sooner rather than later — if only to lessen the burden on your accountant and thereby reduce the chance of any mistakes.

“Our firm, like many others in the city and across the country, has had our tax seasons completely thrown for a loop,” Kourmadas says. “It’s been a juggling act, having to familiarize ourselves with the provisions of the CARES Act, assisting clients in applying for programs they might qualify for, all while handling the same immense load tax season brings every year.

“Unfortunately, we have been seeing an uptick in taxpayers who are waiting until very close to the deadline to get us documents, which is fairly common, though unadvisable.”

Also, it’s important to note that even if Mnuchin does extend the filing dates again for federal returns, there’s no guarantee that Pennsylvania, New Jersey and Delaware — who all previously pushed back their filing deadlines to July 15 — will follow suit. Although Philadelphia residents saw their business taxes such as the net profit tax and the business income receipts tax extended to July 15, other local taxes such as the school income tax and the earnings tax maintained their April 15 deadline.

Please don’t wait until the last minute. Talk to your accountant now.