PSERS board splits over crypto investor and real estate sales

The school pension board has already pumped over $450 million since 1999 into a New York private equity manager, Insight Partners. But this time six trustees balked.

Trustees of the $70 billion-plus Pennsylvania Public School Employees’ Retirement System, which has six new members since last year, formed novel coalitions Thursday and Friday in divided votes over investments recommended by PSERS staff.

The board, with 14 members for now, approved a proposal to invest as much as $130 million in Insight Partners XIII, an early-stage venture capital fund targeting info-tech and “internet of things” start-ups, but only by a small margin, with six of the trustees voting no.

PSERS had voted to commit $450 million to five previous private-investments funds managed by New York-based Insight Partners since 2018. PSERS staff cited those investments and expected future profits when they pitched the latest Insight fund to the board in a series of meetings since last year.

But not all the trustees were convinced. So far, the state-funded plan has gotten back modest initial returns of $43 million for that $450 million Insight commitment, according to the most recent data posted on PSERS’ website.

To be sure, Insight estimates that the private company shares it still holds for PSERS in those five funds are worth more than $600 million, enough to ensure a comfortable profit if they can be cashed in at that level in the next few years — an open question, with venture-related deals down in the recent chilly investing environment.

Trustee Stacy Garrity, the state’s elected treasurer, cited three reasons for opposing the investment: Insight’s “challenged performance,” which she said was below average, and sometimes in the bottom quarter of similar funds, for the system’s three most recent Insight investments; Insight’s explanations for its investment in fraudulent cryptocurrency exchange FTX, which Garrity said “do not inspire confidence”; and “operational and governance concerns,” which she did not detail.

Insight officials did not respond to calls seeking comment.

Among its many investments, Insight invested a reported $40 million in FTX in July 2021. FTX’s value collapsed as the government seized the firm and arrested founder Sam Bankman-Fried on fraud charges last fall. Insight still describes crypto in its marketing materials as a “clear breakout sector” despite “high volatility.”

Despite its relatively small returns to date, Insight has collected large fees from PSERS.

For 2021, for example, Insight Venture Partners X, LP, where PSERS invested $100 million in 2018, claimed $70.6 million, an amount greater than all Insight payments to PSERS up until that point, as its share of as-yet unrealized PSERS profits in the companies it has backed, through an arrangement PSERS calls “carried interest.”

This kind of profit-sharing for successful investment contractors, which has helped private managers pile up enormous personal fortunes at low tax rates, has been controversial. The U.S. Securities and Exchange Commission has been reviewing such arrangements, and one PSERS trustee, State Sen. Katie Muth (D., Montgomery), has sued the agency in an as-yet unsuccessful effort to force disclosure of secret payment provision language in its investment contracts.

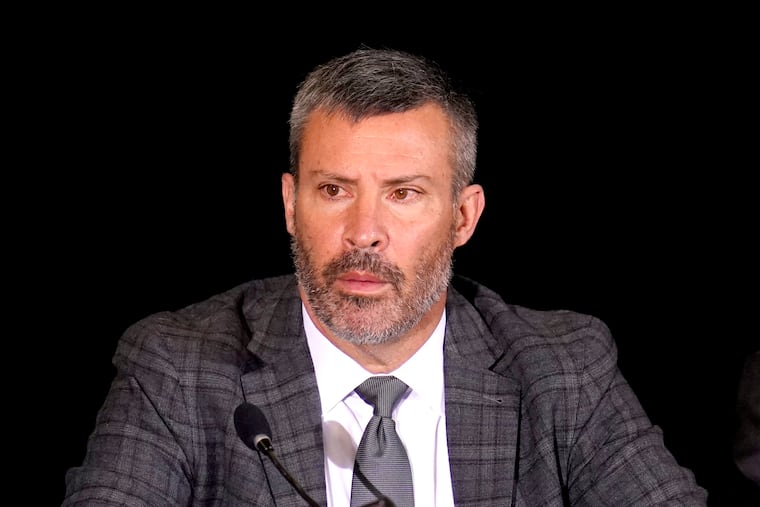

Joining Garrity in voting no on Insight were her two fellow Republicans on the PSERS board — Rep. Torren Ecker (R., Cumberland) and recently appointed Sen. Greg Rothman (R., Cumberland) — along with Muth; a representative of Nathan Mains, who runs the Pennsylvania School Boards Association, whose members split PSERS’ public cost of more than $5 billion a year with state taxpayers; and Chris Santa Maria, PSERS’s chairman, who plans to retire from the unpaid post later this year.

The Insight investment was nevertheless approved, with Santa Maria’s four fellow PSEA teachers’ union members on the board joining their frequent allies Eric DiTullio, a school board rep, and State Rep. Matt Bradford (D., Chester) — plus representatives of Gov. Josh Shapiro’s education and banking departments, who gave Insight the votes needed for approval.

That contrasts with Gov. Tom Wolf’s appointments on the board, who in contested votes more often opposed private investments such as Insight. One of Wolf’s appointments, Richard Vague, is due to return to the board later this year as Shapiro’s representative.

Two other investments won easy approval. The board voted to invest $200 million in PIMCO Commercial Real Estate Debt Fund II and another $200 million in LS Power Fund V, with all in favor except Muth, who abstained.

But trustees split on somewhat different lines in a vote to get rid of another investment. Under chief investment officer Ben Cotton, appointed last year, the board has been trying to sell off an estimated $1.4 billion worth of “direct” real estate investments, some acquired in the 2010s and some much earlier, despite a history of losing money in similar deals in the past.

On Friday, staff proposed that PSERS sell a 20-acre property adjacent to the agency’s troubled Galleria Mall in Fort Lauderdale, Fla. PSERS hopes to raise at least $20 million for the parcel, which it has previously tried and failed to sell or develop.

Five trustees opposed the sale: Garrity, Mains, the two state senators, and Brian Reiser, a Grove City math teacher.

Rothman formerly headed his family’s real estate firm, whose clients have included state agencies such as the Pennsylvania Turnpike and PennDot. He didn’t return a call for comment on his opposition to the sale.

Garrity in a statement said she favored selling off all “direct” real estate holdings but added she believed that the agency could get a better price “by packaging existing properties together.”

As The Inquirer reported previously, though PSERS has not confirmed it, Florida county real estate offices and local business publications late last year and early this year reported the sales to several owners of four apartment complexes formerly owned by the agency, for a total of at least $363 million.

PSERS has had a tough time selling other properties, such as the Atlanta Airport Marriott. Documents obtained by The Inquirer show PSERS staff expect the hotel is unlikely to fetch a price above the $57 million the agency paid for it in 1987. Staff have listed the Galleria Mall’s value at less than $100 million, less than a third of its former valuation. (Taking inflation into account, both are worth even less, compared with what PSERS invested in them.)

The agency is also in talks to hire a manager for three blocks of surface parking lots and the rubble-strewn former sites of two printing plants it demolished as part of an abortive redevelopment project in central Harrisburg east of its own offices.