The father-son duo behind Tony Luke’s have pleaded guilty to tax crimes unearthed in messy family row

Anthony Lucidonio Sr., 82, known as “Tony Luke Sr.” or “Papa Luke,” and Nicholas Lucidonio, 54, kept two sets of books to hide cash they raked in for their signature sandwiches.

The founder of the iconic South Philadelphia cheesesteak spot Tony Luke’s and one of his sons pleaded guilty Monday to hiding millions in revenue from the IRS over a decade.

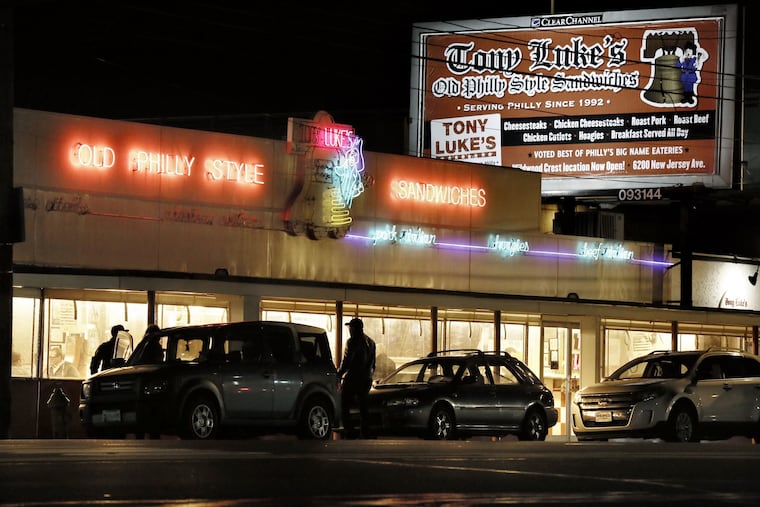

Anthony Lucidonio Sr., 83, known as “Tony Luke Sr.” or “Papa Luke,” and Nicholas Lucidonio, 55, told a federal judge they kept two sets of books to hide cash they raked in for the signature sandwiches they sold out of their storefront at Oregon Avenue and Front Street.

They also admitted to paying their employees large portions of their salaries under the table in cash to evade payroll taxes.

Their guilty pleas — to one count of conspiracy to defraud the United States, punishable by up to five years in prison — come as a result of a family row as messy as the sandwiches that made them famous.

Tony Luke’s, which Lucidonio Sr. opened in 1992 in the shadow of I-95, has grown into a global franchise with more than a dozen locations in Pennsylvania, New Jersey, Washington D.C., Maryland, Texas, and Bahrain.

But Tony Luke Jr. — the prominent face of the brand and the man who led much of that expansion — was not charged alongside his father and brother. His business relationship with his family members soured in 2015, and he was fired.

A lawsuit followed. The company split in two — The Original Tony Luke’s, which operates the Oregon Avenue store, and Tony Luke’s franchises, which are run by Lucidonio Jr.

And two of Lucidonio Jr.’s sons, who previously worked at the sandwich shop, stole payroll and sales records detailing the business’ tax fraud scheme and turned them over to the federal investigators.

Those documents showed the Lucidonio Sr. and Nicholas Lucidonio sought to hide the financial success of their restaurant between 2006 and 2016 by purposefully keeping cash profits out of their business bank accounts and developing a complicated method of paying their workers to avoid taxes.

Only a portion of employees’ hours would be reflected on the checks they received each payday. Workers were instructed to endorse those checks back to their manager, who would redeposit them in the business’ accounts and then hand employees envelopes of cash reflecting the compensation for the real number of hours they worked, according to court filings.

When Lucidonio Jr. was fired from the family business in 2015, his father and brother became so concerned their scheme would be exposed in the resulting court battle that they amended several tax returns to reflect their true earnings, prosecutors said.

But they attempted to offset their new tax obligations by claiming phony business expenses, according to court records.

Lucidonio Sr. and Nicholas Lucidonio have said little publicly about that family fallout since they were charged in 2020. But they have accused Lucidonio Jr. in court of instigating their prosecution after previously threatening to turn them in to authorities unless they agreed to settle the civil suit between them for $500,000.

They were once again silent on the subject Monday as they entered guilty pleas during a brief hearing before U.S District Judge Gerald A. McHugh.

“Have you in fact committed the crimes to which you are pleading guilty?” McHugh asked.

“Yes, I have,” the elder Lucidonio replied.

Nicholas Lucidonio added: “Yes, your honor.”

Afterward, their attorneys — Walter Weir Jr. and Ian M. Comisky — said the pair took full responsibility for their misdeeds and look forward to putting the matter behind them.

“The Original Tony Luke’s will continue to serve its faithful clientele and provide gainful employment for its loyal employees and their families,” the lawyers said in a statement.