How Donald Trump’s conservation donations may benefit him

Critics question the size of his tax deductions. Trump says it's another "witch hunt."

When Donald Trump launched his presidential run in 2015, he released his own summary of his charitable giving.

“I give to hundreds of charities and people in need of help,” Trump said at the time. “It is one of the things I most like doing and one of the great reasons to have made a lot of money.”

By his own accounting, the biggest share of his giving was in the form of “conservation easements.”

The New York Times, in a 2020 news report on his taxes, found the same thing. Of his $130 million in charitable gifts, the paper found, fully $119 million came in the form of easements — restrictions on property deeds that bar development.

Time and time again, Trump turned to this technique to reap tax benefits after first failing to launch developments on his real estate holdings.

Advocates say easements can keep valuable land undeveloped and protect historic buildings from harmful alterations. In Trump’s case, however, critics have repeatedly raised questions about how charitable the donations actually were — and whether Trump put down exaggerated figures to claim bigger deductions.

Along with his Seven Springs estate in Westchester County, N.Y., Trump has received substantial tax breaks tied to land and building conservation pledges for several other properties across the United States.

» READ MORE: Chester County land trust helped Trump save millions. That’s just one of its deals.

For more than two years, New York State Attorney General Letitia James and the Manhattan District Attorney’s Office have been investigating Trump’s finances. In a detailed filing in January, James said her civil inquiry was investigating whether Trump had made “fraudulent or misleading” valuations of real estate to get bigger tax breaks or to mislead banks. However, Manhattan District Attorney Alvin Bragg recently put the brakes on a parallel criminal investigation, prompting the two prosecutors leading it to resign, the New York Times has reported.

Trump has sharply criticized the investigations as another meritless “witch hunt” targeting him. He said the probes “reveal the vile and malicious intent that underlies the nonstop barrage of insults and threats aimed at me and the Trump Organization.”

Here is a look at other Trump real estate charitable tax breaks:

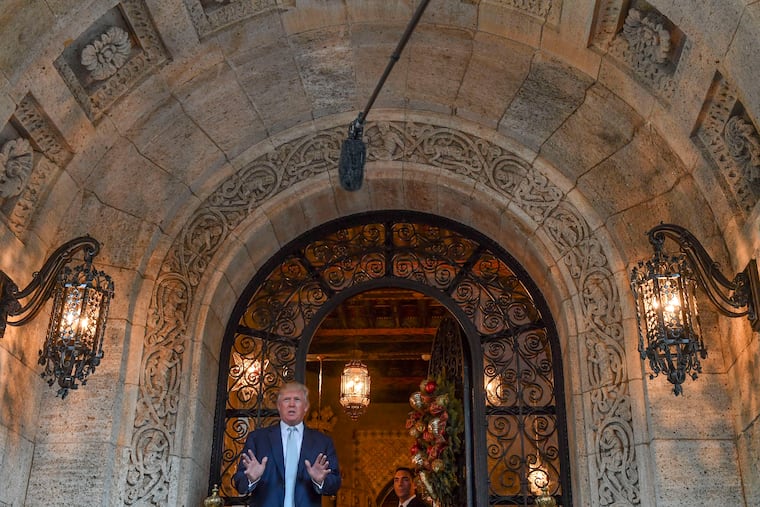

Mar-a-Lago Club in Palm Beach, Fla.

Trump bought the 20-acre estate — the former home of cereal heiress Marjorie Merriweather Post — in 1985 for $10 million.

In 1992, Trump floated a plan to build houses on the site but could not win local government approval. In 1995, he agreed to put an easement on part of the property during negotiations with local officials in which they, in turn, permitted him to convert the place to a private club. The easement is held by the National Trust for Historic Preservation in Washington.

In a 2017 investigative piece, the Palm Beach Post made public the deduction for the easement — $5.7 million. The paper also quoted experts who questioned whether the easement really reflected a charitable intent, since Trump used it as a bargaining chip to open the club. The Palm Beach paper said that he floated donating an easement while seeking approval from the town council for a club.

The easement mainly focused on the estate’s 52,000-square-foot mansion, forbidding changes to 21 of its 33 rooms and modestly restricting developments on the grounds.

The club is open to 500 members who pay a $16,000 yearly fee. The one-time initiation fee is now $200,000. However, the easement does mandate some general public access — once a year, it says, up to 100 members of the public may tour the grounds. Up to 20, once a year, may enter the mansion.

Trump National Golf Club in Bedminster, Somerset County, N.J.

In return for signing a deed easement that forever banned the construction of housing on the 506-acre golf course, Trump got a $39.1 million tax break in 2005, public records revealed.

An appraisal determined that the club was worth $49.5 million if it could be broken into 33 lots for estates, but only $10.4 million as a golf course, the Wall Street Journal reported. Trump could use the difference to reduce his taxable income.

“I’ve given up a lot of dollar opportunity, but it’s such an amazing open space, I thought it was the right thing to do,” Trump said at the time after giving the easement to local officials

Trump later also won a cut on local property taxes at the golf course in 2015 under a state farmland protection law. His application said he would grow hay and keep eight goats on the land.

Donald J. Trump State Park near Yorktown Heights, N.Y.

In 2006, Trump gave 436 acres to New York state to create Donald J. Trump State Park, about 20 miles north of his Seven Springs estate.

Trump had originally began buying the land in 1998, eventually spending about $2.75 million on the acreage. In his 2015 summary of his charitable giving, though, he valued his gift to the state at $26 million.

He donated the lands to the state in 2006 only after his development plans for it fell apart. An initial plan for two golf courses on the grounds was rejected by local authorities who said it would harm the area’s water supply. An effort to build houses on the tract also faltered.

The park is referred to by the state as a “passive park,” meaning it has no trails or picnic areas. The state stopped maintaining it a decade ago as part of budget cuts.

Trump National Golf Club near Los Angeles

Trump bought this 261-acre golf club, at Rancho Palos Verdes on the sea, in 2002. His plan was to ring the course with housing. But despite eight years of litigation Trump was never able to get approval to build because of concern that the land was unstable and landslide-prone.

As with other projects, Trump turned to the tax code for help once his plans hit a wall. In 2014, Trump agreed to put a conservation easement on part of the property, obtaining a $25 million tax deduction and permission to keep using the land at issue as a driving range.

In an investigative article last year, Reuters quoted critics questioning why Trump should get a tax break for pledging to build on land that was unstable for construction anyway.

The story also quoted a former president of the Palos Verdes Peninsula Land Conservancy, which accepted the easement from Trump, as saying it appeared to be a less attractive deal than others that had protected parks or hiking trails.

In court papers, Attorney General James said her investigators were in part probing this donation as well as the easement for Trump’s Seven Springs mansion.

The appraisal Trump cited for the driving-range donation near Los Angeles “substantially overstated” the worth of his gift, the prosecutor said.

Her January filing also made public an internal email from Trump’s tax lawyer with doubt about the easement. “Effectively the U.S. taxpayers are paying [Trump] to do what he would already do anyway, and perhaps this isn’t the best use of taxpayer dollars,” the lawyer wrote.