Vanguard hasn’t said it is pulling out of China, despite reports

Chinese business news service Caixin said Vanguard's partnership with Ant Group was over, and Western financial media amplified the claim

Vanguard Group, the Malvern-based, $7 trillion investment giant, is dismissing reports that it has decided to pull out of China and shut down its four-year partnership with Chinese financial technology giant Ant Group.

Bloomberg, Reuters, and the Hong Kong-based South China Morning Post based articles on a single anonymously sourced report from a Chinese news outlet. Those accounts each cited an earlier report from Beijing-based news website Caixin Global, which said “knowledgeable” but unnamed sources claimed Vanguard was leaving.

Reuters also relied on five unnamed “sources with knowledge of the matter” in its report that Vanguard was closing its Shanghai-based operations. But Ant told Reuters the partnership was “operating as usual.”

“We don’t comment on speculation and rumor,” Vanguard spokesperson Emily Farrell told The Inquirer.

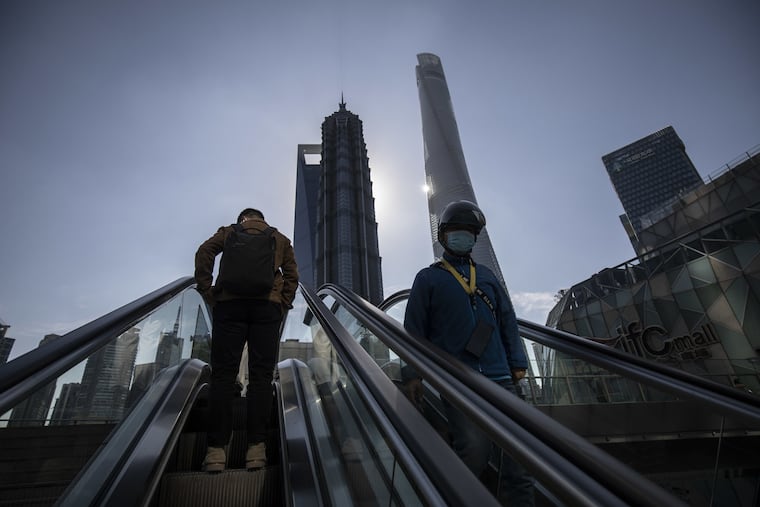

China’s multi-trillion-dollar domestic investor market has attracted Vanguard’s U.S. and foreign rivals in hopes of raising money from a growing population of savers as well as gaining knowledge of China’s investment markets for clients in the U.S. and elsewhere.

Vanguard’s recent history with China

Vanguard and Ant formed a partnership in 2019, promising to “bring a new streamlined and broadly-available investment advisory service to retail consumers in China.”

In 2020, Caixin reported Vanguard was returning $21.6 billion to Chinese government agencies, including the nation’s Social Security and sovereign wealth funds and would no longer seek institutional investments from its Hong Kong base. The Caixin report went on to say that Vanguard would continue to seek individual investors from offices in Shanghai, including through its partnership with Ant.

Caixin wrote at that time that Vanguard considered individual investors more profitable and less “demanding” than the Chinese government, and had similarly focused more on individuals instead of institutional investors in Europe.

Vanguard the following year suspended its efforts to win a China fund-management company license and instead focused on the joint venture with Ant.

At that time, Ant’s largest owner was Jack Ma, billionaire founder of the Alibaba consumer site. Ma has since stepped aside from Ant under pressure from Chinese officials seeking to curb technology leaders’ influence on financial companies. In 2021, the once-outspoken Ma disappeared from public view for several months, and has since maintained a lower public profile.

An encouraging tone

China is the most populous country, and its economy is larger than every other nation’s, except the U.S. U.S. imports of Chinese products grew rapidly, especially since 2000, as the country was accepted into international trade agreements, and U.S. companies such as DuPont, TE Connectivity, and Tesla built more factories there. But relations have turned frosty in recent years as Chinese leader Xi Jinping has consolidated power, jailed dissenters in Hong Kong and other cities, and beefed up the nation’s military presence in the South China Sea.

President Donald Trump boosted U.S. tariffs on Chinese exports, and under President Joe Biden officials are pushing for additional limits on technology exchanges that could benefit the Chinese military. Yet investment contacts between the two countries remain far more pervasive than those between the U.S. and Russia, for example, with public pension funds and other large investors maintaining large portfolios of Chinese securities and private investments.

Vanguard, like rival U.S. investment giants, continues to invest in China-based companies, on behalf of investors in its index funds and international investment products. Vanguard officials brushed aside requests for information on the company’s staffing in China, the current value of its China investments, and the reasons for its change in direction in 2020 and 2021.

In an economic report posted to Vanguard’s website last month, the company sounded an encouraging tone on future investment opportunities: “The reopening of China’s economy [following the COVID-19 pandemic] and the increased consumption we expect it to engender will likely benefit Asian emerging markets through tourism and trade,” Vanguard wrote, adding that it expects China and its neighbors will grow more rapidly this year than, for example, Europe.