The student loan debt crisis did not emerge by accident — it is the result of political decision-making

This issue extends beyond personal finance; it undermines millions of Americans’ economic stability and political agency.

As a graduate student at Temple University, I have witnessed firsthand the detrimental impact of student loan debt. This issue extends beyond personal finance; it undermines millions of Americans’ economic stability and political agency.

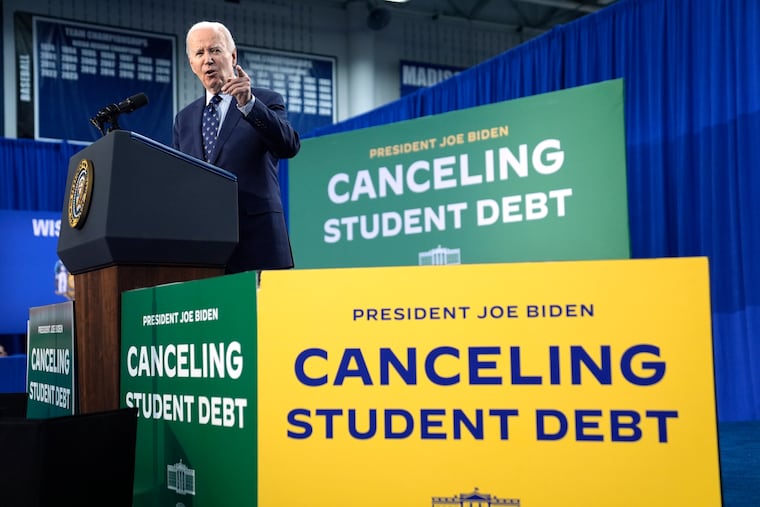

As an overwhelming number of Americans struggle with this burden, there is a pressing question of whether promises of debt forgiveness are merely a political tool to rally voters or a genuine social issue that President Joe Biden aims to tackle in order to ease the overwhelming anxiety and stress faced by students across the U.S.

The student loan debt crisis did not emerge by accident. It is the result of decades of political decisions that have systematically defunded public higher education, shifting the cost burden onto students and their families.

According to the Center on Budget and Policy Priorities, state funding for public colleges and universities remains well below historic levels, with average state funding per student still lower than in 2008. This defunding has forced institutions to raise tuition, compelling students to take on more debt.

» READ MORE: The Supreme Court decision on student debt disappointed me. Still, I hung my flag on the 4th. | Opinion

The federal government’s role in expanding loan programs without adequate borrower protections further exacerbated the problem. The result? A generation of students saddled with unmanageable debt, struggling to achieve financial independence.

Student debt is not just a financial burden; an argument can be made that it is a tool of control. High levels of debt discourage risk-taking, reduce the likelihood of starting a business, and limit career choices to those that offer immediate financial security rather than long-term fulfillment.

People preoccupied with financial survival are less likely to participate in the political process.

Furthermore, student debt undermines political participation.

Research from the American Political Science Association suggests that debt burdens can depress voter turnout and civic engagement, as people preoccupied with financial survival are less likely to participate in the political process. This dynamic disproportionately affects young people, people of color, and low-income individuals — groups who are already marginalized in political discourse.

The student loan debt crisis exacerbates existing social inequalities. Black and Latino students are more likely to take on debt and borrow larger amounts than their white counterparts. According to the Brookings Institution, Black graduates owe an average of $25,000 more than white graduates four years after graduation. This disparity is a direct result of historical and systemic discrimination that limits access to wealth and resources for communities of color.

Women, who hold nearly two-thirds of all student debt in the United States, face unique challenges. The American Association of University Women reports that women owe an average of $31,276 compared with men’s $29,270. The gender pay gap further complicates their ability to repay loans, perpetuating a cycle of economic disadvantage.

Despite the clear need for reform, political will has been lacking. The debate over student loan forgiveness exemplifies the political gridlock. Proposals for widespread debt cancellation have faced fierce opposition, often framed as fiscally irresponsible or unfair to those who have already repaid their loans. However, this narrative ignores the broader economic benefits of debt forgiveness, including increased consumer spending, higher homeownership rates, and greater economic mobility.

» READ MORE: Please don’t forgive my student loans. Change the system instead. | Opinion

The following reforms would clear roadblocks and begin to address the systemic inequalities that are at the root of the crisis:

Widespread debt cancellation: Forgiving student loans would provide immediate relief to millions, stimulating economic growth and reducing inequality. This can be targeted toward low-income borrowers and those in public service careers to ensure equitable distribution of benefits.

Tuition-free public college: Investing in tuition-free public college would prevent future generations from falling into the same debt trap. This approach has proven successful in several countries, demonstrating that higher education can be accessible without financial hardship.

Interest rate reductions: Lowering interest rates on federal student loans would prevent debt from ballooning over time and make repayment more manageable.

Strong borrower protections: Implementing robust borrower protections and simplifying access to income-driven repayment plans would help those struggling with debt manage their repayments more effectively.

It is imperative that we view the student loan crisis through the lens of social justice. Education should be a pathway to opportunity, not a financial trap. Policymakers, educational institutions, and society at large must work together to create a fairer, more equitable system. By addressing the structural inequalities that underlie the student loan debt crisis, we can help ensure higher education fulfills its promise as a driver of social mobility and economic opportunity.

Albania Luciano-Wilmo is a master of social work student at Temple University.