What’s in the stimulus bill? Here’s how you can benefit, from checks to healthcare to tax credits and more.

Congress has passed the long-awaited $1.9 trillion coronavirus relief package known as the American Rescue Plan Act. But what benefits are you eligible for? We broke it down.

Congress has passed the long-awaited $1.9 trillion coronavirus relief package known as the American Rescue Plan Act, with aid for individuals, industries, and other groups throughout the country, as well as in Pennsylvania and New Jersey specifically.

“This is the most popular economic rescue plan in my lifetime,” Rep. Brendan Boyle, a Philadelphia Democrat, said Wednesday. “To the American people, help is finally on the way.”

The package includes additional economic impact payments for many individuals, extended unemployment benefits, health insurance provisions, and aid for schools, transit agencies, vaccine distribution, and more.

But what benefits are you eligible for? Here is what’s in the bill:

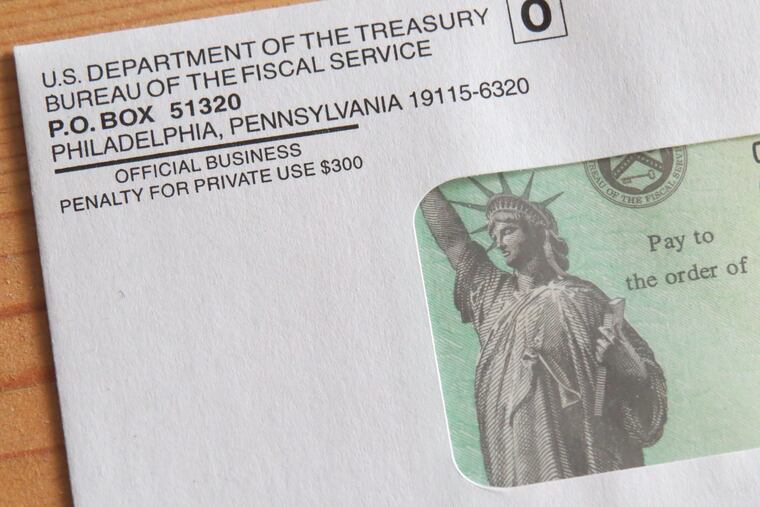

How much is the third stimulus check?

You will get a full stimulus check payment of $1,400 if you make up to $75,000 annually, are the head of a household and make up to $112,500, or a couple who file jointly and make $150,000.

If you make more than that, your stimulus check will be smaller. And you will not get a check if you make $80,000 or more a year, are the head of a household who makes at least $120,000, or jointly file as a couple at $160,000.

When will I get my check?

Possibly late March.

» READ MORE: Stimulus Q&A: Who gets $1,400 and when? Can my stimulus money be garnished for debts?

What if you didn’t get the first one?

If you did not receive earlier Economic Impact Payments but were eligible, you can take a credit against your 2020 taxes. Up to eight million households were entitled to previous payments but didn’t receive them because of issues like processing delays and application problems, according to a Department of the Treasury fact sheet.

To claim your credit, you will need to fill out the “Recovery Rebate Credit” section on line 30 of the 2020 Form 1040, which can be found on the Internal Revenue Service’s website. For more information, visit the IRS economic impact payment website, or the IRS Taxpayer Advocate website. The amount of your tax credit will vary depending on your individual circumstances, so talk to your accountant.

» READ MORE: Stimulus bill poised to send $1,400 checks to millions who were left out of the first payments

If you have kids or dependents:

The relief package also gives aid to parents, primarily through increased SNAP benefits, increased child tax credits, and stimulus checks for dependents.

Extension of the $27 monthly increase in SNAP benefits, providing additional aid to some 1.8 million people in Pennsylvania, and 788,000 in New Jersey.

Expanded child tax credits, with up to $300 a month if you have kids under 6, and $250 a month for other children. The bill also allows you to claim child tax credits at their full amount, up to $3,600 a year for kids under 6, and $3,000 for other children. Often, lower-income earners don’t pay enough taxes to get the full benefit, but that changes under the new legislation.

Expanded eligibility for $1,400 stimulus checks for adult dependents, including the elderly, college students, and people with disabilities (including an estimated five million people who were left out of prior payments).

“Mixed-status families” — or those with one undocumented parent — are also eligible for stimulus checks, though undocumented parents will not receive payments.

If you make less than $65,000 a year — putting you in the bottom 60% of earners — you could see an 11% increase in your income from the combination of relief checks and tax credits, according to estimates from the Institute on Taxation and Economic Policy.

» READ MORE: Stimulus bill poised to send $1,400 checks to millions who were left out of the first payments

If you have a pension:

It’s especially good news if your pension plan is failing. The new stimulus package sets aside $86 billion to rescue about 200 failing pension plans across the country, which could guarantee full pension payment for about one million retirees and workers nationwide.

Philadelphia-area plans that will receive assistance under the new legislation include:

Teamsters Local 115

Carpenters Industrial Council of Eastern Pa. Pension Fund

IBEW Eastern States Pension Plan

The pension plan of the NewsGuild, which represents many workers at the Inquirer and Daily News.

The pension bailout plan will give money to failing pensions directly from the U.S. Treasury as grants, not loans as originally proposed. So, if your pension is with one of these plans, you will get 100% of the pension benefits you have earned.

If your pension benefits were cut, there’s also help. In 2014, Congress allowed flagging pension plans to cut benefits for current retirees as a way to save money for future retirees — and about 20 funds did so. This new legislation restores those cut benefits, and accounts for past losses, according to the staff of Rep. Richard E. Neal, a Massachusetts Democrat who chairs the House Ways and Means Committee.

» READ MORE: Congress bails out troubled pension plans for teamsters, Acme, carpenters, electricians, and others in Philly area

If you’re unemployed:

If you get the $300-per-week supplemental federal unemployment benefit, that program has been extended. And federal taxes will reportedly be waived for up to the first $10,200 of those benefits received in 2020 for people with an adjusted gross income of less than $150,000.

It also extends federal Pandemic Unemployment Assistance program (PUA) and the Pandemic Unemployment Compensation program (PEUC) benefits. PEUC is designed to help you if you have already exhausted your state benefits; the latest legislation would extend it for up to 48 weeks. PUA, meanwhile, assists freelance, gig, and contract workers who have been financially impacted by the pandemic, and would be extended for up to 74 weeks, Forbes reports.

» READ MORE: Congress bails out troubled pension plans for teamsters, Acme, carpenters, electricians, and others in Philly area

If you need health insurance:

If you need insurance, or want to pay less for your plan, help may be coming. The stimulus package helps subsidize COBRA coverage and bolsters the Affordable Care Act, which has “served as a safety net” throughout the pandemic, says Krutika Amin, associate director at Kaiser Family Foundation.

Specifically: ACA-created marketplace tax credits will increase and more people will be eligible to use them this year and next. ACA tax credits vary depending upon your age, location, and income level, and until now, you were only eligible if you are within about 400% of federal poverty (about $51,000 for an individual). The new stimulus package eliminates that cap, so more people are eligible for reduced health insurance premiums. Older adults could see the most significant benefit, since insurance prices can rise sharply if you are in that group and weren’t previously eligible for a credit.

You will not have to pay back tax credits from 2020 if your income was higher than you estimated during enrollment. That might affect you if you had an unpredictable income during the pandemic. And currently, the ACA marketplace, as well as state-based marketplaces such as Pennie in Pennsylvania and Get Covered NJ in New Jersey, are open for a COVID-19 enrollment period through mid-May — so you can enroll if you lost coverage during the pandemic, or change your selection if you have already made one.

If you were laid off recently, COBRA subsidies under the new stimulus package may keep you from needing to find a new plan. It subsidizes the entire cost for COBRA if you are eligible, and you can stay on your employer’s health-care plan for 18 months. Typically, COBRA requires laid-off employees to pay the full premium for an employer’s health-care plan, which leads to its being underutilized due to high costs.

» READ MORE: Stimulus bill boosts health coverage by expanding Obamacare tax credits and subsidizing COBRA

If you own a restaurant or venue:

There’s about $25 billion in assistance for restaurants and bars, but it isn’t yet clear how that will be distributed throughout the region.

There is also about $1.25 billion earmarked for the Shuttered Venue Operators Grant (SVOG), which will help music venues, promoters, and other kinds of performance space — such as local theaters — that have been closed during the pandemic. Previously, club and theater owners had to choose to apply for SVOG funds or “PPP2″ loans, but can now use the loans to continue operations as they await SVOG money.

» READ MORE: Here’s what Pennsylvania and New Jersey are getting out of the $1.9 trillion stimulus package

What the city/region will get:

Local schools, transit agencies, and local governments, along with other groups, will get some money, too. Pennsylvania will receive an estimated $13.7 billion in state and local aid, with about $1.1 billion going to Philadelphia, and New Jersey will get $10.2 billion, the House Oversight Committee says.

K-12 schools in Pennsylvania, for example, will get about $5.1 billion in aid, as well as additional money for universities and colleges. New Jersey K-12 schools will get $2.7 billion. The bills enables schools to spend the money to hire staff, avoid layoffs, and perform upgrades to ventilation systems.

There is also help for renters. Pennsylvania will also get $670 million in emergency rental assistance, while New Jersey will receive $466 million. More than half of the populations of Philadelphia and Camden are renters, so that aid is essential to stem an eviction crisis, said Rachel Garland, managing attorney for the housing unit at Community Legal Services of Philadelphia.

The vaccine effort will also get money. Nationwide, there is about $14 billion earmarked for vaccines, and $7.6 billion to hire 100,000 public health workers to distribute them — though details on how that money can be spent locally are currently unclear. But in Pennsylvania, there is $60 million in funding to help provide vaccine outreach and education to seniors, as well as meals and support for caregivers.

Additionally, Pennsylvania will get about $1.28 billion for transit assistance, with $650 million going to SEPTA and $115 million for Philadelphia International Airport.

» READ MORE: Our best Philly tips: Read our most useful stories