SERS moves $600M out of index funds to buy foreign stocks, hedge fund

Although it is a state-funded agency, SERS declines to make public the formulas it uses to pay the hundreds of private money managers it has hired.

The $29 billion Pennsylvania State Employees' Retirement System board has moved $600 million in pension investments out of low-cost stock and bond index funds and into three companies that buy foreign investments.

The money moves, approved by the pension board at SERS' January meeting, appear to partly reverse what Gov. Wolf and elected state Treasurer Joe Torsella had recently called a favorable trend by state pension funds to rely more on low-fee indexed investments. The switch was backed particularly by SERS board member Vincent Hughes, a Democratic state senator from Philadelphia, say people familiar with the decision. (Like Hughes, Wolf and Torsella are Democrats.)

The governor and treasurer have been prodding state agencies to move public money to lower-fee and indexed investments, such as those made popular by Malvern-based Vanguard Group. That's on the theory that more-exotic funds and their high-fee private managers tend to trail index funds over time, cost more, and risk corrupting officials who hire them. Two of Torsella's three immediate predecessors, Rob McCord and Barbara Hafer, pleaded guilty to criminal charges connected to payments from money managers who sought state business.

But SERS staff and board members and their consultants have defended hiring some higher-fee investment managers, which they say can provide higher returns than U.S. bonds, if not U.S. stocks. The system is also committed to hiring well-run "emerging" investment managers, which can include small, minority- or women-owned firms.

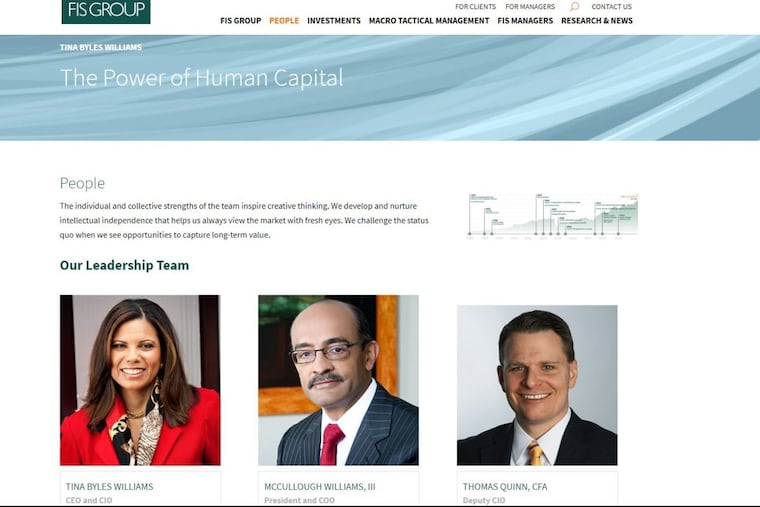

In the Jan. 31 meeting, the SERS board voted to take $400 million out of Mellon Capital Management (MCM)'s Russell 1000 Index stocks portfolio, and split it between two foreign-focused firms: $200 million for San Francisco-based investment manager Leading Edge Investment Advisors LLC, to invest in money managers that buy stocks in "emerging markets" around the world, and $200 million in FIS Group Inc., a Philadelphia firm, to invest in managers who buy non-U.S. small-company stocks.

FIS is headed by founder Tina Byles Williams, a former chief investment officer (when she was Tina Byles Poitevien) for the Philadelphia city and Philadelphia Gas Works pension plans and a former member of the Pennsylvania Public School Employees' Retirement System board (PSERS). FIS, along with a larger Philadelphia firm, PFM, were previously paid by the Philadelphia pension system to find investment firms run by women, minorities and disabled people, but the city pension board voted to terminate FIS and PFM in 2013 after a staff, board and consultant review noted underperformance by money managers they hired.

SERS board member Glenn Becker abstained on the FIS vote because his own investment-management firm, Swarthmore Group of Philadelphia, has done business with FIS, according to SERS spokeswoman Pamela Hile. Williams didn't return calls to her Philadelphia office or her New York public-relations representative.

SERS also voted to move $200 million out of the Mellon Capital Management Bond Index Portfolio and into Eaton Vance Management's Global Macro Absolute Return Advantage Strategy, a hedge fund founded in 2010. Eaton Vance says that fund, which both invests in, and also shorts (bets against), securities in Russia, India, Mexico and other emerging markets, has typically returned higher profits than U.S. investment-grade bonds. But the Global Macro Absolute Return Advantage Strategy portfolio has also trailed yields from junk bonds and U.S. stocks, according to its own promotional materials.

Although it is a state-funded agency, SERS declines to make public the formulas it uses to pay private money managers it hires.

SERS does report how much it pays contractors directly each year. For the Russell 1000-indexed stock portfolio, which invested $4.6 billion for SERS, according to last year's annual report, the pension system paid just $266,000 in annual management fees, or less than 1 percent of 1 percent (less than one basis point) of the SERS assets it manages. MCM charged around four basis points for the bond-index fund.

By contrast, one of SERS's current foreign-stock investment managers, Scotland-based Walter Scott & Partners, an "active" money manager that picks investments for its clients and is not an indexed fund, charged SERS $2.7 million in fees for investing $687 million. That works out to around 0.4 percent of assets per year, or 40 basis points — more than 40 times what MCM charged for the stock fund, and more than 10 times its bond fund fee.

SERS' strategic investment plan for 2016-17, adopted at the Dec. 2015 board meeting, included a resolution to "research the viability" of an "emerging investment manager program" to bring in managers such as FIS, whose founder is an African American woman, and Leading Edge, some of whose top officers are Asian Americans, said spokeswoman Hile.

Last winter, the SERS board approved the move toward "emerging investment managers" and took $400 million from its cash accounts and gave it to the MCM stock index fund while it looked for emerging managers to hire.

SERS, which faces a multibillion-dollar gap between its investment assets and its expected pension obligations, is funded largely by direct state payments from taxpayers, partly from a percentage contribution from public-worker paychecks, and partly from investment gains it collects in years when the investments make money.