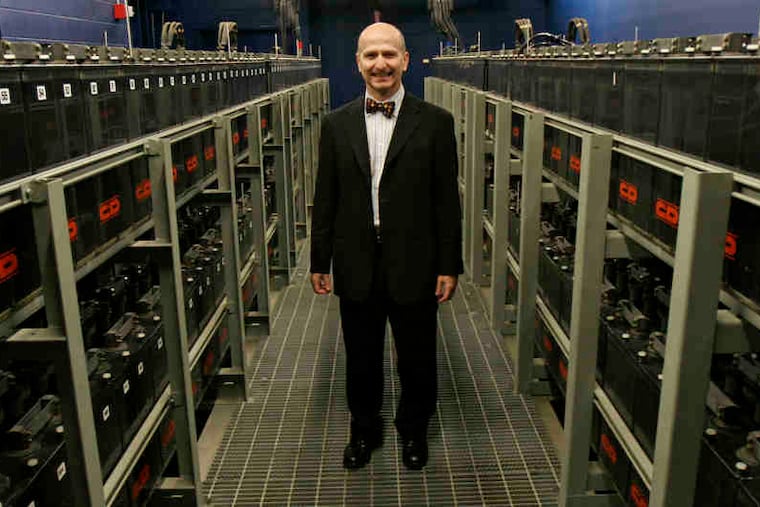

PhillyDeals: Cristobal Conde to leave as head of SunGard Data Systems

Cristobal Conde is leaving his job as boss at SunGard Data Systems, the $5 billion (yearly sales) Wayne data-recovery, financial, college, and government software company he has headed since 2002.

Cristobal Conde

is leaving his job as boss at

SunGard Data Systems

, the $5 billion (yearly sales) Wayne data-recovery, financial, college, and government software company he has headed since 2002.

Conde will be replaced May 31 by outsider Russell Fradin, a former executive at insurance broker Aon Hewitt and bank-tech giant Bisys Group.

Conde remains an "important shareholder," says SunGard spokesman Brian Robins. "This is an amicable transition, and the timing is right."

SunGard's four main businesses showed sales declines last year. The company has reported a loss each year since 2005. Robins says that's due partly to amortization of the $11 billion that Silver Lake Partners and other buyout firms paid to buy SunGard that year. He said that cash flow was improving and that SunGard was paying down its debt.

SunGard employs 20,000, including 2,000 in Wayne, Malvern, Center City, and other Philadelphia-area sites.

SunGard's Availability business, which grew from Sunoco's data-recovery unit, is facing Web-based competition. Conde is a veteran of SunGard's growing financial-services business, which he welded together from companies SunGard acquired in the 1990s and 2000s, and counts the world's biggest banks as clients.

Workers cut, bosses stay

M&T Bank, whose owners include billionaire Warren Buffett, says it's going to cut 630 workers at Wilmington Trust Co.'s two Wilmington high-rises by the end of the year as it consolidates Delaware's largest bank, which it has bought for $351 million.

But the troubled lender's leaders will stay on. Wilmington Trust's last chief executive, Don Foley, joins M&T's board. And Robert V.A. Harra, Wilmington Trust's last president, has been named an M&T senior vice president for community and customer relations.

Atwood "Woody" Collins 3d, head of M&T's Mid-Atlantic region, calls this a tribute to Harra and the useful connections he's made in his 40-year Delaware banking career. Harra won't be in charge of any loans.

M&T plans to keep Wilmington Trust's investment and tax-shelter businesses intact. But it will replace Wilmington Trust's sales-oriented development-loan culture, which wrecked the bank under past CEO Ted Cecala. M&T will focus on small-business lending.

"We were able to lend through the recession, while Wilmington Trust was forced to shrink," Collins said.

M&T has paid off Wilmington Trust's $330 million federal TARP (Troubled Asset Relief Program) investment, Collins added.

American owned

3i Infotech Ltd.

, of Mumbai, says it has agreed to sell

J&B Software

, of Blue Bell, and

Regulus Group

L.L.C.,

of Edison, N.J., to

Cerberus Capital Management

, the New York-based buyout firm that owned

Chrysler

, for $137 million.

3i bought J&B in 2007 and Regulus in 2008 and combined them into its global billing and payments group. J&B, started by veterans of Unisys Inc. in the 1980s, develops and sells payment software, including a bank-by-phone system, to banks and retailers. Regulus outsources U.S. payment-service jobs to India.

J&B employed about 400. Kathy Hamburger, based in Edison, will keep her job as head of both J&B and Regulus. She said Cerberus plans to expand the group.

Copyright penalty

The U.S. Court of Appeals for the Third Circuit, based in Philadelphia, on Monday upheld a $23.6 million damages and interest award to Philadelphia's William A. Graham Co. against its rival USI Midatlantic Inc.

A federal jury found in 2009 that USI used copyrighted documents stolen by an ex-Graham employee to compete with Graham, starting in the early 1990s. USI called the verdict excessive, but a three-judge panel affirmed the award.

USI will appeal to the U.S. Supreme Court, USI general counsel Ernest Newborn said. USI's controlling owner is Goldman Sachs Capital Partners.

David J. Wolfsohn, of Woodcock Washburn in Philadelphia, won the appeal for Graham, with help from Henry E. Hockeimer Jr., of Ballard Spahr L.L.C. Floyd Abrams, of Cahill Gordon & Reindel, of New York, argued for USI, with help from lawyers at Pepper Hamilton L.L.P. in Philadelphia.