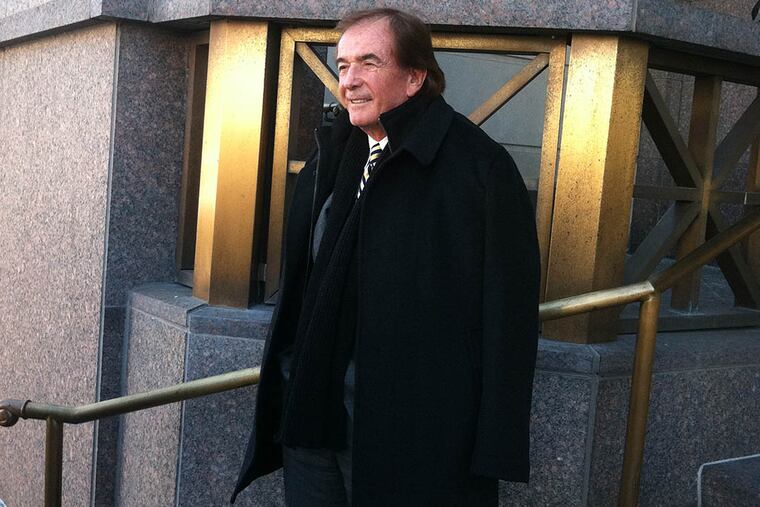

Revel buyer Straub: A businessman with his own point of view

As South Florida investor Glenn Straub takes over the bankrupt Revel Casino Hotel in a deal scheduled to close Tuesday, he brings something to Atlantic City that has been in short supply:

As South Florida investor Glenn Straub takes over the bankrupt Revel Casino Hotel in a deal scheduled to close Tuesday, he brings something to Atlantic City that has been in short supply:

Cash.

Last week, just days before his expected purchase of Revel for $82 million, Straub put $26 million into escrow for another possible deal, acquiring the former Showboat casino from Stockton University.

But the 68-year-old native of Wheeling, W. Va., also brings a no-holds-barred business style that has left many deeply embittered by their encounters with the serial buyer of distressed properties such as country-club developments, golf courses, and yachts.

"He's not someone who's going to consider the other person's point of view. If you want to deal with Straub, you have to deal with him from his point of view," said Robert Budnick, a Pleasantville, N.J., native who lives in Tesoro, a high-end resort community in Port St. Lucie, Fla., that Straub bought in a 2009 bankruptcy liquidation for $11 million.

"It's usual, when you speak to people, you talk about things like humanity and compassion and all of those things. They're not in his lexicon," he said. "Does that make him terrible? No, it makes him someone we judge by our standards. But he has totally other standards."

Budnick, who has observed Straub in the context of the Tesoro Homeowners Association, which Straub controls, said it made sense for Atlantic City to welcome Straub's money, even though Straub does not have a record of creating businesses from scratch.

"You can say a lot of things negatively about Glenn Straub, and I would be on that bandwagon, too, in some regards, but you have to say he's ready to come to the table and make a commitment, and stand by it," he said.

Straub, whose business ventures have taken him from car dealerships in West Virginia to asphalt plants in Ohio and Western Pennsylvania, country clubs and yachts in South Florida, and, now, to shell-shocked Atlantic City, apparently has untold millions to throw around.

But a review of public records and media reports on Straub did not reveal a series of high-priced deals.

Instead, it shows that Straub buys distressed properties, sometimes does not hold onto them for long, sells pieces to get his initial money back, lets some acquisitions deteriorate, and typically leaves a trail of litigation, often winning.

In the late 1990s, for example, Straub pursued a wage dispute involving $11,023.21 all the way to the Supreme Court of Appeals of West Virginia.

The Revel deal, Straub said, is not his largest.

"It's probably the third from largest," he said in an interview Saturday, impatient to get off the phone because he was touring the restaurants in Revel, which opened three years ago at a cost of about $2.5 billion.

Straub said Tri-State Asphalt Corp., based in Wheeling, was his biggest acquisition. That was when he was 27, Straub said. He was in business then with his older brother, George, who died in 2004.

"It was probably the same dollar amount, but it was back when the dollar was a dollar," Straub said.

There were no signs of activity outside Revel just hours after U.S. Bankruptcy Judge Gloria M. Burns signed an order calling for the sale to Straub Tuesday. He has touted a $500 million, eight-part plan including not just Revel, but also an extreme-sports complex, two marinas that can host super yachts, and an equestrian facility on 81 acres close to the beach with the capacity for 1,000 horses.

This is not first time he has floated plans for a big equestrian facility. After he bought Martin Downs Country Club in Palm City, Fla., for $4.75 million in December 2007, Straub wanted to turn one of the club's two golf courses into a polo facility.

When the polo facility did not come to pass, Straub closed the golf course in 2010.

"He ran half of the [club's] members off, including me. I live there and I dropped out," said Joe Catrambone, whose home is on what used to be the fourth hole of the Crane Creek Golf Course.

Since Straub closed the course, all the greens have been become overgrown, said Catrambone, president and chief executive of the Stewart/Martin County Chamber of Commerce.

Straub sold Martin Downs facilities in three transactions through October 2012 for a total of $4.46 million, slightly less than he paid, according to public records.

At Tesoro, where homeowners said golf-course amenities have deteriorated under his ownership, Straub was more successful, selling some of the 353 lots he acquired for $14.7 million, public records show, and more than getting his money back.

Straub later sued successfully to enforce the right to collect country-club fees from lot owners in a separate but related Tesoro development.

Tesoro also illustrates Straub's dealings with tenants who try to operate businesses at properties he controls. The Racquet Club at Tesoro, for example, is closed. Two operators tried to run it on a leased basis under Straub, the latest lasting just six weeks, according to Tesoro residents.

Straub said he is not motivated by money.

"I don't do things for economics; I do things for what is right, right now," he testified at a March 12 Revel bankruptcy hearing.

215-854-4651 @InqBrubaker