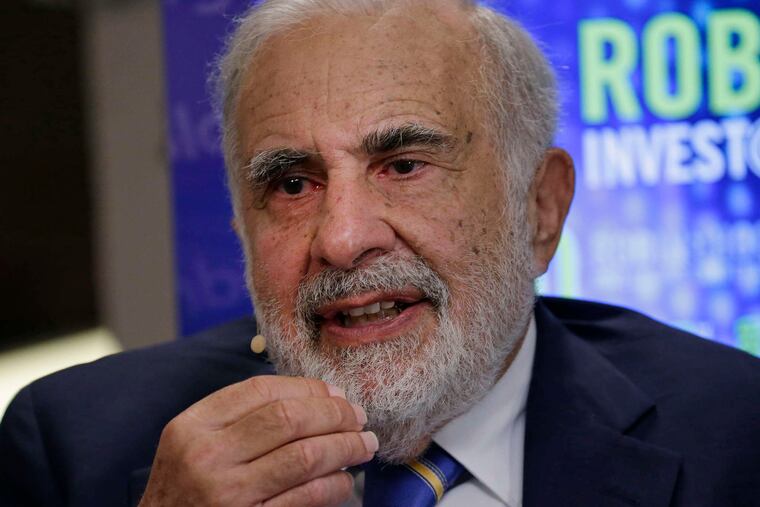

Icahn talks of top-level shake-up at AIG

Billionaire investor Carl Icahn said he may seek to shake up the leadership at American International Group Inc. after chief executive officer Peter Hancock rebuffed his plan to split the insurer into three companies.

Billionaire investor Carl Icahn said he may seek to shake up the leadership at American International Group Inc. after chief executive officer Peter Hancock rebuffed his plan to split the insurer into three companies.

In a statement on his website Monday, Icahn said he would push for a measure that would let shareholders communicate directly with the board and possibly seek the addition of a director "who would agree in advance to succeed Mr. Hancock as CEO if asked by the board to do so."

The conflict with AIG began in late October, when Icahn disclosed a stake in the New York-based company and mocked Hancock for failing to meet the insurer's return targets. Hancock, 57, who became CEO last year, has said that AIG benefits from having a diversity of operations and that separating into three would be harder than Icahn thinks because of hurdles from regulators and credit-rating firms.

"In all of our discussions with Mr. Hancock, it was abundantly clear to us that he is not willing to take the bold steps that we, and so many other shareholders, believe are long overdue," Icahn said. "He failed to lay out any alternative strategic plan with the potential to unlock value for shareholders or to provide compelling reasons as to why these businesses belong together."

Icahn's firm has more than 42 million shares of AIG, giving him a 3.4 percent stake, according to a regulatory filing Monday. That would make him the fifth-largest investor in the company, according to data compiled by Bloomberg.

"Our sense is, a breakup of AIG is unlikely in part because it depends on cash flows from the U.S. life and retirement-services business to support debt service and funding significant share buybacks," Jay Gelb, an analyst at Barclays Plc, said in a note to clients Monday. "Even so, increased pressure on AIG's board should intensify the pace of improvement and likely benefit AIG shares."

The insurer's stock closed Monday at $62.76 a share in New York Stock Exchange trading. That compares with $60.92 on Oct. 27, the day before Icahn sent a letter urging the company to split into separate companies, one selling life insurance, another offering property-casualty protection, and the third backing mortgages.

Icahn seeks to take action through a consent solicitation, which would allow shareholders to collectively engage with the board and possibly put someone new on the board without the need for a shareholder meeting. The company's bylaws say written actions may be approved if a majority of the company's shares are represented.