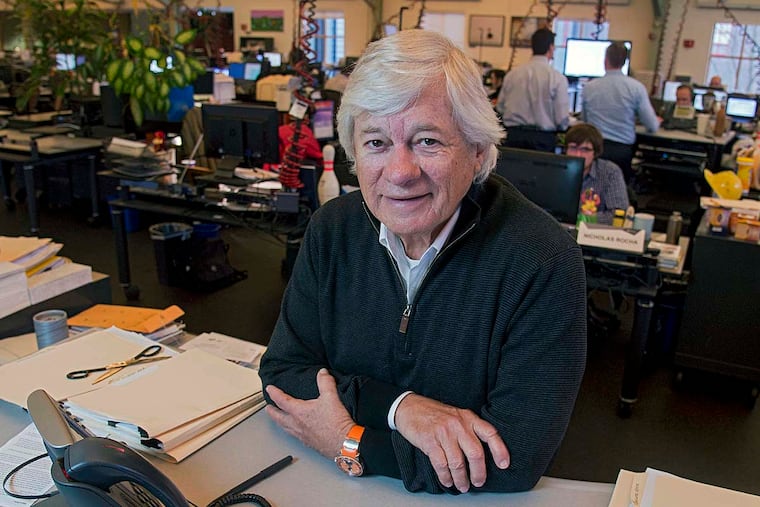

Talking investment strategy with Alfred West Jr.

SEI Investments Co., the Oak-based financial services company, manages or administers $670 billion, and, in 2015, commanded $1.33 billion in revenues and turned a profit of $331 million.

SEI Investments Co., the Oak-based financial services company, manages or administers $670 billion, and, in 2015, commanded $1.33 billion in revenues and turned a profit of $331 million.

Founder and chief executive Alfred West Jr., 73, earned $1.76 million a year, according to the most recent proxy. At one time, although not now, his wealth put him on Forbes magazine's billionaire list.

So what is his investment strategy?

"I invest in SEI," West said, adding that he occasionally sells shares when he wants to buy "real estate I use."

He and his family trusts own 13.1 percent of SEI's shares.

"I've kept it as simple as possible, because how SEI does is more important to me than any investment I could make elsewhere," he said.

Through its software, SEI administers billions for banks, trust funds and wealthy clients, making trades and generating monthly reports.

You've started and support WestBridge, a nonprofit residential program to treat men with mental illness and substance use disorders. Why?

My middle son is afflicted with schizophrenia and mental illness and substance abuse. We would go back and forth between drug treatment and mental illness treatment, and the two groups never talked. So we put together an organization that took care of them both at the same time, and that has worked out well.

Did your son's issues give you a new perspective?

Certainly. I learned tons through dealing with his illnesses as a parent. It was quite a road. As a parent, you have expectations and you have to get over them. It isn't about you. It's about them. You might have said, 'I'd love him to do this, this and this.' But he's got another life and it's rewarding for him. You have to take the hand you're dealt and do the best you can with that.

And the thing is, wealth is no protection.

My son was homeless for a number of years. When we started WestBridge, we thought it was for other people, that we wouldn't be able to get him back. He was in and out of different places. With Alcoholics Anonymous and other 12-step programs, they believe you have to hit bottom. With mental illness there is no bottom. Your thought process is not rational. Well, it's rational, but not rational like other people without the affliction.

How is your son now?

He's had an uphill battle, but he's doing very well.

Has this impacted your business leadership style?

Yes, it seems to me that I'm less quick to judge. I have more patience with people. I accept people as they are and I try to make them better at what they are good at, rather than try to change them.

CEOs are used to having a lot of control. Yet, you couldn't control what happened to your son.

Yes, that's what I'm saying. I'm not a control freak at all. I give people their own rope. We're trying to be innovative and creative and one of the things that fosters that the most is that we're not afraid of failure. You're not punished for failure and I think that it all stems back to having no control over [my son's issues]. It taught me that we actually want to foster failure. We want to fail fast and we want to learn from failures. If you aren't failing, you aren't trying hard enough.

So, should you try to fail?

I wouldn't say you try to fail, but if you stretch enough, failure is often an outcome. We looked in the company and [listed] 27 things - big things we were successful with and that everyone could be proud of. And 27 - it turned out to be exactly the same number - were things we tried that didn't work. Some of those failures led to successes.

What do you think of the trend of robo investing? Is it for millennials?

I think it's going to work out well, particularly for the smaller investor. It seems that the millennial is more interested in it, but I think that's also because millennials yet don't have a lot of money.

You are 73. Any retirement plans?

Not anything that's firm. I've not picked a date, but it's at least five years out. I don't look too much further than five years out.

Interview questions and answers have been edited for space.

215-854-2769@JaneVonBergen

ALFRED WEST JR.

StartText

Titles: Chairman, chief executive.

Home: Near Coatesville.

Family: Sarah Walter; children, Paige, Albert, Palmer.

Diplomas: Georgia Tech, aerospace engineering; University of Pennsylvania, master's in business administration at Wharton.

Vacations: Quail hunting at his ranch in Texas. "It's very congenial. You can have conversations while you are waiting for the dogs to find the birds."

To relax: Jigsaw puzzles.

At work: Doesn't have a private office or an assistant to schedule appointments. "I do my own. I've been able to get by." EndText

SEI INVESTMENTS

StartText

Where: Oaks.

Business: Financial administration services and software. Investments.

Ownership: Publicly traded on NASDAQ (SEIC), founded by West in 1968.

Clients: Processes 1.8 million end-investor accounts as of December 2014. Works with 9 out of 20 of the nation's top banks.

Employees: 2,902 worldwide. 2,430 in Oaks.

EndText

StartText

Oscars: West faults feds for the Big Short (crisis, not film) www.philly.com/jobbing

EndText