Kensington homeowner proves you can fight Philadelphia city hall over assessment

Philadelphia made it hard for homeowners with tax abatements to appeal the assessment of their taxable land, but a Kensington actuary fought back and got some relief in the Court of Common Pleas.

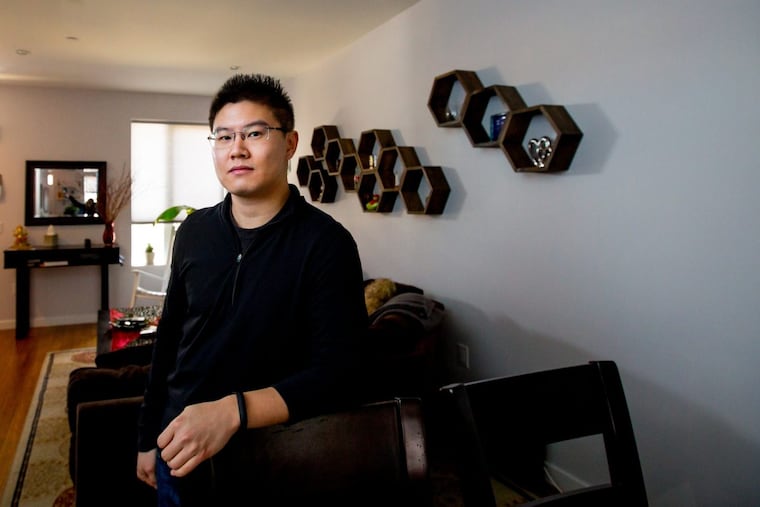

Ruokai Chen is among the thousands of Philadelphia property owners who were shocked in 2016 to learn that their taxes were going up even though they had a 10-year tax abatement.

The city changed the allocation of the total market values between the land and the building or other improvements citywide, claiming that it was making the assessed values of the land more accurate. In Chen's case, the city increased the taxable land assessment to $113,150 from $16,300 and said he could not contest that, only the total market value.

Chen, 29, fought back and last month scored a rare victory in the Philadelphia Court of Common Pleas when a judge set his land value at $79,000 for 2017, 30 percent less than the city's value. Chen, who represented himself, says he believes he is the first to get a favorable court decision in a case involving the 2016 land-only reassessments of 15,000 abated properties.

"The most important part of this to me isn't necessarily that I got $900 back, although just to be fair no one will be sad about getting some money back," said Chen, a 2010 clarinet graduate of the Curtis Institute of Music who works as an actuary for a health-care consulting firm. "The most important thing for me is that a precedent has been established," perhaps making it easier for others to win their appeals of land values only.

The city said Wednesday that it would not appeal Judge Gene D. Cohen's Feb. 5 decision. It downplayed the significance of Chen's case, saying the judge's decision was based on the specifics of Chen's property.

Real estate lawyers said it appears that the city is trying to get around the 10-year abatement on new construction and improvements.

"If land goes up by 10 percent, they are allowed to increase the taxable land by 10 percent, but if the city says 'well, the land may have only gone up by 10 percent, but now that you built a nice building on it, the land is worth twice as much as before,' to me that's bad faith because the ordinance says any increase in value due to the improvements should be abated," said Larry Arem, a partner at Klehr Harrison Harvey Branzburg LLP.

For people such as Chen, who had just purchased his house in Kensington for $415,000 in 2015, the city made it hard to contest the increase in land assessments by insisting that taxpayers could appeal only the total market value. How could he say the market value was inaccurate when he had just bought the property? The Philadelphia Office of Property Assessment was not increasing the total value.

"You really cannot appeal the land value separately. You can appeal the total market value," an Office of Property Assessment official emailed Chen the week before his March 16, 2017, hearing at the Board of Revision of Taxes. The official told Chen that all the land under the new and rehabbed properties on his block was assessed at 27 percent of the total market value, suggesting that he could withdraw the appeal.

Chen kept at it, but was rebuffed by the BRT.

"Under applicable state law, the BRT — and in turn the Court of Common Pleas if a BRT decision is appealed — is charged with determining value for an entire parcel and not just some portion or component of a parcel," the city said by email Wednesday.

"If true, it would mean that anyone who has a tax abatement would have no recourse to ever challenge their taxes, because the land value is the only thing that matters to them," said Steve Silver, a lawyer who was at Chen's BRT hearing representing other clients.

Silver, who moved to Portland, Maine, in April, but was in Philadelphia for the last of his appeals hearings in November, said he doesn't know anyone else who won one of these cases. Before leaving Philadelphia and selling his house, Silver was dealing with a reassessment of his taxable land near the Italian Market to $100,890 from $7,500. Empty lots on that block are still assessed in the $7,000 to $8,000 range.

Chen said he knows of three other cases similar to his pending in court. In his case, the judge accepted the value proposed by city's expert witness, an outside appraiser.

"Just the fact that the city would even take the stance it did before the BRT I think is very unsavory in that the appeals process is actually a very important part of getting property taxes right," Chen said.