Bala Cynwyd businessman claimed $378M in revenues; FBI said it was $2M and the feds charged him with fraud

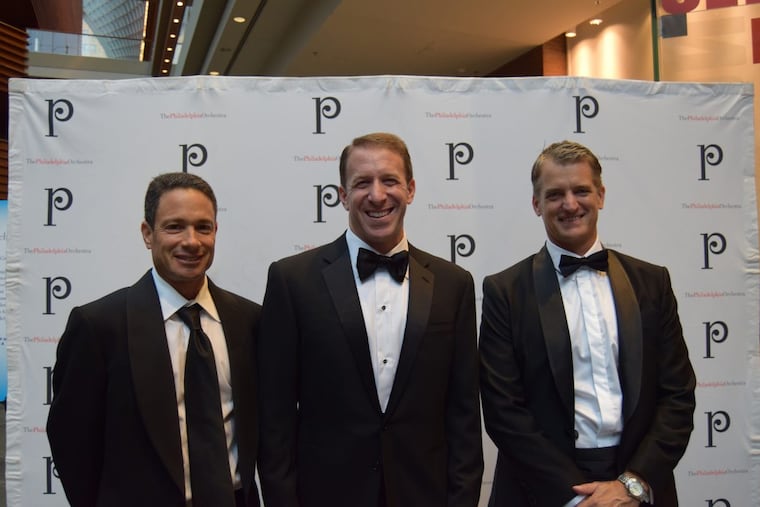

Federal prosecutors on Friday charged Gary Alan Frank with a massive fraud; He sat on the boards of the Philadelphia Orchestra and Philly Pops.

Federal prosecutors on Friday charged a Bala Cynwyd businessman who sat on the boards of the Philadelphia Orchestra and Philly Pops with a $30 million loan fraud made possible by a massive overstatement of the size of Legal Coverage Group Ltd., which provides legal services as a benefit that employers can offer their workers.

An FBI affidavit said Gary Alan Frank's Legal Coverage Group (LCG) had less than $2 million in revenues last year and fewer than 10,000 people enrolled in its benefit program, while the firm's bankruptcy filing earlier this year claimed LCG had $378 million in revenue last year, $42 million in profit, and three million people enrolled.

Frank, 47, was arraigned Friday afternoon, and a condition of his release was that certain condominium properties in Old City and Bala Cynwyd be turned over to the bankruptcy estate of LCG, Frank's criminal attorney, Robert Welsh, said. If convicted, Frank faces up to 20 years in prison, three years of supervised release, and full restitution, the U.S Attorney's Office in Philadelphia said.

Frank is listed on the orchestra website as a member of the executive committee. His LinkedIn profile says he is chairman of the Philly Pops board, but that organization's spokeswoman said he resigned March 1, which is when law enforcement searched his office.

Frank's world started unraveling in 2015, just after Prudential Insurance Co. of America agreed to provide up to $40 million in debt financing to help LCG expand. The loan agreement called for LCG to provide copies of its audited financial statements. LCG's Jan. 26 bankruptcy filing in Philadelphia was designed to fend off Prudential, which claimed $34 million in damages.

After LCG failed repeatedly to provide the audited statements, Prudential last August exercised its right to obtain LCG's bank records. What Prudential found, according to an October lawsuit in the Supreme Court of New York, was that "the only substantial funds deposited into the deposit account were the $30 million in proceeds from Prudential's financing."

The account records showed revenues from at most two customers. In its internal financial statements provided to Prudential, LCG said it had a total of $546.7 million in revenue in 2015 and 2016. The bank account showed just $109,009 in revenue from customers.

It appeared to Prudential that the loan repayments by LCG were made with money borrowed from, among others, a Philadelphia bakery.

LCG's creditors list shows a $1.1 million loan from Phil Seefried, a cofounder of a Denver investment bank that helped secure the loan from Prudential; a $925,000 loan from George Croner, who is retired from the Philadelphia law firm Kohn Swift & Graf PC; a $550,000 loan from Michel's Bakery in the Crescentville section of Northeast Philadelphia; and a $316,250 loan from Michel Zion of Blue Bell.

The four individual lenders either declined to comment or did not respond to requests for comment.

Prudential's analysis of LCG's bank records found trips to Hong Kong, Las Vegas, and Atlantic City, plus expenditures for entertainment "that cannot be related to a legitimate business purpose since, based on deposit account records, the company appears to have virtually no customers or revenues," the New York lawsuit says.

LCG also had a Bank of America account that was not disclosed to Prudential when the loan was made. When those records were finally delivered in January, they were falsified, according to the FBI affidavit. LCG provided records to Prudential showing that it had $2.77 million in the Bank of America account in December.

The real record provided by Bank of America listed a balance of $211.96.