Hey, Tesla 3 buyers: Don't hold your breath

Going green is turning a tentative Tesla buyer purple.

In theory, a nonpolluting Tesla Model 3 electric car is the perfect ride for Jamie Holt, a Wayne-based founding partner with the environmental mitigation company Evergreen Environmental. But getting hold of one? That's starting to look like a distant dream, he fears.

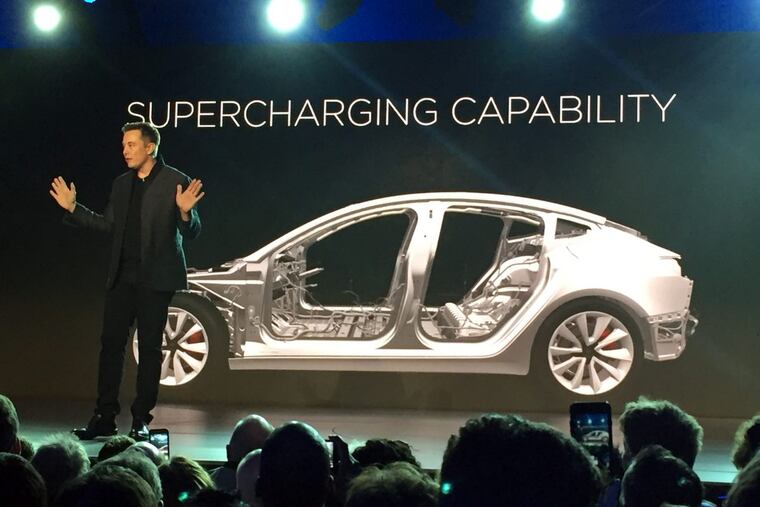

Last week, Tesla founder and CEO Elon Musk told shareholders that the handsome Model 3 — the company's most affordable, mass-appeal car — was on track to start production July 1 with deliveries at month's end. The good news about this "starting at $35,000" Tesla — for which at least 400,000 customers such as Holt have already plunked down deposits — excited Wall Street again. So, too, did Musk's revelation of two more models, the Tesla Semi and the Model Y, that are in the planning stage for introduction as soon as 2019.

Tesla company stock — already rated, astonishingly, as more valuable than that of General Motors or Ford — rallied anew. Tesla's market capitalization even briefly surpassed that of BMW, which last year generated $104 billion in revenue vs. $7 billion at Tesla, noted Bloomberg.

Holt, himself in the business of swapping and creating green-zone offsets for wetlands-paving airports and highway authorities, kindly characterizes Tesla as a "magnificent, but eccentric, company" and calls Musk a genius. Still, he's puzzled by the company.

Pumped by Musk's momentous pronouncement on first deliveries, Holt called his local Tesla store on Lancaster Avenue in Devon and asked excitedly when his Model 3, reserved on the first day possible, would be delivered. The eager buyer was shocked to learn he could wait as long as a year.

"I was told they are considering delivery in the following order, regardless of the queue — first to California buyers, then Midwestern buyers, then East Coast buyers — and that the reason was geographic proximity 'makes it quicker for them to deliver to California buyers.' So, Tesla can put a satellite in orbit but is flummoxed by delivering a car to Pennsylvania?"

Adding insult to injury, the lengthy delay could put good-faith buyers such as Holt at an economic disadvantage. They could lose out on the generous, early-adopter $7,500 per electric vehicle federal tax credit offered to the first 200,000 buyers of all Tesla vehicles. The full tax credit is reduced to 50 percent, or $3,750, at the beginning of the second calendar quarter after the 200,000-threshold. It further shrinks to 25 percent, or $1,875, at the beginning of the fourth quarter, and is eliminated at the beginning of the sixth quarter.

With a total Tesla sales count of about 120,000 (including a reported 84,000 last year), the availability of full tax credits may be coming to an end. And the credit could be reduced as early as the first quarter next year, but more likely in the third quarter of 2018, suggested an analysis by CleanTechnica data cruncher Loren McDonald.

"Having them sell the first Model 3 cars to employees — as Musk said he will — makes sense for production monitoring purposes, to get fast feedback, and fix problems that might arise," Holt said. "Putting early adopters of the first Tesla S and X models second in line also makes sense, because these are the supporters who helped get the company off the ground. But after that, the West Coast-centric strategy seems patently unfair to folks like me and the other 500 people who stood in line here on March 31, 2016, to put down a $1,000 deposit. … It's either arbitrary, or there's some backstory."

Recent reports suggest that Tesla is way over its head in terms of promises made, delivering the goods, and making a profit at it.

"We think they are going to be burning close to $650 million to $1 billion a quarter for the next handful of quarters," said investor Jim Chanos, who bet famously on Enron's failure. Tesla "has its big test ahead of it, the Model 3," Chanos said last week at the Bloomberg Invest New York Summit. Tesla "has been losing money selling $120,000 cars, but it hopes to make money selling a $35,000 car."

The Fremont, Calif., factory that Tesla bought from Toyota in 2010 for $42 million is already "bursting at the seams" making Model S sedans and Model X crossovers and preparing another line for the Model 3, Musk acknowledged. A recent report by CBS News challenged the stress and strain on workers, citing an accidents report from the advocacy group Worksafe. "Everybody in our area is burned out. We're trying to run as hard as we can," CBS was told by John Galescu, a body repair technician who has been pushing Tesla workers to unionize.

To lower stress and reduce injuries, Tesla has moved from two long shifts a day, in which 4,500 workers collectively produced as many as 2,000 cars a week last year, to its current three-shift schedule. But ramping up production to a targeted 400,000, or even 500,000, next year — with weekly Model 3 production alone rising to "5,000 vehicles per week at some point in 2017 and to 10,000 vehicles per week at some point in 2018" — seems a heady promise from Musk.

Borrowing a page from BMW, Tesla has a sell-up strategy to turn a $35,000 Model 3 into a $40,000+ purchase with some potential for profit. While the sole options for early buyers will be for color and wheels, a software package downloadable to the car's computer to then transform the Model 3 into a tech-forward, self-driving highway cruiser is likely to go for $6,000 or more.

And if you venture to the Tesla website, a chart comparing a Model 3 with a $70,000+ Tesla S asks impatient Model 3 order holders, "Wouldn't you really rather have an S?"

Musk cheerfully calls it an "anti-sell" tactic.

Holt calls it "ridiculous."