Vanguard 'greatly concerned' over changes like Congress' proposed cap on 401(k) plans

Are we living in an upside-down, world where lawmakers want us to save less - instead of more - for retirement? Apparently.

Are we living in an upside-down bizarro world where lawmakers want us to save less — instead of more — for retirement?

Apparently.

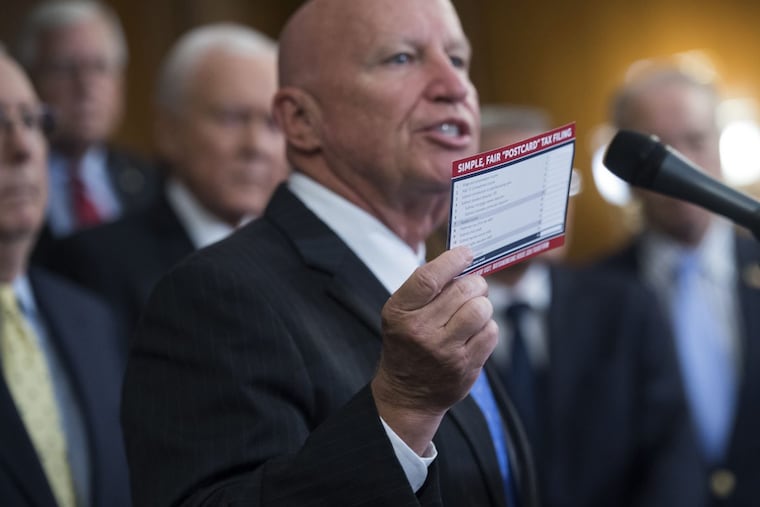

Wall Street can't be happy about Congress' proposal to cap our yearly 401(k) contributions at $2,400 — that's the tax-deferred amount we would be able to sock away in a retirement plan, down from $18,000.

What does local mutual-fund giant Vanguard think of the idea?

"The 401(k) plan is the cornerstone of the future retirement security of millions of Americans. As such, Vanguard is greatly concerned over any legislation that would negatively impact investors' ability or incentive to save for retirement. Proposals that mandate contributions be made after tax should be carefully reviewed to take into account their impact on incentives to save," according to Vanguard spokeswoman Laura Edling.

The congressional proposal is an accounting gimmick lawmakers believe will help book tax revenues today and balance the budget in the short-term while forgoing much heftier tax revenues in the future.

"It's a shell game Congress is using to make the budget revenue-neutral under the 10-year time frame," said David Danziger, who runs Tax-Advantaged Retirement Plans in Southampton for retirement-savings clients. "It's insane."

Jeff Winkleman, tax partner with Marcum LLP in Center City, explains that Americans under the age of 50 can contribute up to $18,000 annually to their traditional 401(k) plans, and that was set to increase to $18,500 in 2018. We make contributions with before-tax dollars, and pay taxes when we pull money out. If Congress lowers the maximum annual contribution to $2,400, that would prompt many Americans to switch over to Roth 401(k)s, where the money is taxed upfront, not when it's withdrawn.

If this dumb idea becomes law, which tax-deferred or other vehicles can we use to save instead? Steven Brett, president of Marcum Financial Services in Melville, N.Y., outlines a few:

Deposit after-tax dollars into a Roth IRA instead of a 401(k), a phenomenon Danziger refers to as "Rothification."

Open a Health Savings Account to save for health-care expenses down the road. You can deposit pretax dollars, then pay for nursing care, long-term care, insurance deductibles, hospital bills, etc. The account grows tax-free. As long as you use the HSA money for health care, you can also withdraw those dollars without taxation.

If self-employed, open a SEP IRA or solo 401(k), which Congress hasn't yet targeted for any limits.

As always, discuss any retirement-savings changes first with your financial adviser, tax attorney, or accountant.

Pa. retirement task force

Meanwhile, Pennsylvania Treasurer Joe Torsella convened a hearing Thursday in Allentown of the newly created Task Force on Private Sector Retirement Security. It was the first of three regional hearings across the state exploring the retirement crisis facing the more than 2 million working Pennsylvanians who lack access to employer-sponsored retirement plans.

Almost 44 percent of Pennsylvanians, or 2.18 million private-sector workers, "do not have access to employer-sponsored retirement plans, and we believe this number will increase," Torsella said in a statement.

"Access to a workplace retirement-savings plan dramatically increases retirement-savings rates, resulting in profoundly positive effects on retirement security," he said. "Leaving this group of workers without the opportunity to easily save for retirement through payroll deductions exacts a heavy cost upon both their future economic security and fiscal prospects for the commonwealth."

The task force heard from Diane Oakley, executive director of the National Institute for Retirement Security; Daniel Eck, executive director, employee financial services, Ernst & Young; Keith Weigelt, professor at the Wharton School; Ellen Magenheim, professor at Swarthmore College; and Patricia Hasson, president of Clarifi, a nonprofit credit-counseling agency.

Future hearings will include expert testimony on "Barriers Impeding Private Employer Support for Effective Employee Retirement Savings," to be held in Pittsburgh on Nov. 17, and "Options to Address the Retirement Savings Crisis in Pennsylvania," in Harrisburg in January. They're open to the public, so check for more details at PATreasury.gov.

For a comprehensive look at how America saves — IRAs are the chief vehicle, with $7.2 trillion in assets, defined contribution at $5.3 trillion — refer to a just-released GAO report on retirement security in America, available at https://www.gao.gov/assets/690/687797.pdf.