Philly DA Krasner's company owed $37K in property taxes in 2015

This is Krasner's third prior tax delinquency that has come to light in recent weeks.

Philadelphia District Attorney Larry Krasner has fallen behind on his taxes not once, not twice, but multiple times over the last decade.

In the latest example, the Inquirer and Daily News have learned that a Krasner-owned company was so behind on its taxes that city lawyers attempted to seize control of its property via a receiver in order to collect the debt. The business, which Krasner had a major stake in, failed to pay more than $37,000 in overdue real estate taxes.

The unpaid bills spanned multiple years, dating to at least 2009, according to public records.

During the 2017 district attorney's race, one of Krasner's primary opponents made headlines because more than $190,000 in tax lien judgments were filed against him. The overdue bills carried extra weight because then-DA Seth Williams had recently announced that he wasn't running for reelection after making "regrettable mistakes" involving his finances and personal life.

Krasner's tax issues were not uncovered by the media until this year. Williams later pleaded guilty in a federal bribery trial.

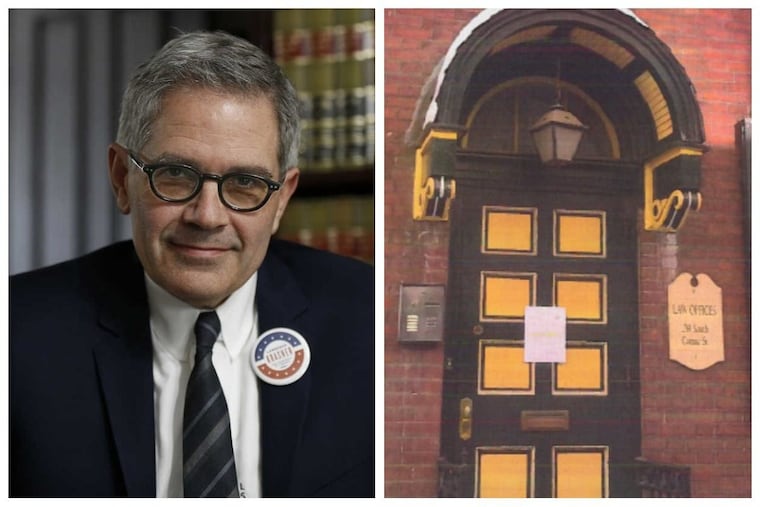

Krasner's most recently exposed debt originated at a Center City building, owned by his company, where his now-closed law office was located. The property, recently valued at $910,000, also served as Krasner's campaign's headquarters in 2017.

Before being sworn in this year as the city's highest-ranking law enforcement official, Krasner worked as a defense attorney and had a stake in several real estate companies.

To collect back taxes on the Center City building, the city attempted to use a rarely used tool meant to fight tax delinquency: It filed a petition asking for a judge to appoint a "sequestrator" to manage the property and direct any potential rental income toward the tax debt.

"Tax revenue is essential to the recovery of the city of Philadelphia's economy, and, in particular, to the future well-being of its school district," municipal lawyers wrote in the case. "The city has continued to seek collection of the subject taxpayer's real estate tax delinquency without success."

Ben Waxman, a spokesman for the District Attorney's Office, said Krasner and other business partners have owned companies whose properties have "at times" fallen into arrears "due to vacancy, late payment of rent by tenants, or economic downturn."

He added that Krasner's wife "was not an owner in these commercial properties and was not involved in or aware of the details of those activities. Those details, including any lateness in payment, belong to Larry and the other owners — not her."

Krasner's wife, Lisa Rau, is a judge in the city's Court of Common Pleas.

Waxman said Krasner's company, known as 239 S. Camac St. LP, entered into a payment plan with the city to pay off the debt of about $37,000 in April 2015, shortly after the city filed its sequestration petition. The city discontinued its case the same month.

Waxman said the balance was fully paid off by 2017, the year Krasner won the city's DA election. Krasner used his personal funds to satisfy the back taxes, his spokesman said. Waxman did not respond to a question about whether Krasner's company negotiated a final sum lower than $37,000 for the Center City property.

Financial records, which Krasner filed during his campaign, showed that his interest in 239 S. Camac St. LP "varied between [approximately] 49 percent and 98 percent during 2016." The document lists Krasner as an "owner/partner" of the business.

Asked if Krasner has any financial problems, Waxman said, "No."

"Larry ran a successful law firm for over 25 years and has never declared bankruptcy either in business or personally," he said. "The real estate tax was an oversight that was corrected with a personal check. The other issues are related to commercial properties that were owned by multiple partners for more than a decade."

The city also filed numerous judgments against Krasner's company because it apparently did not pay the Center City property's gas bills. They were subsequently caught up.

WHYY reported earlier this month that the property where Krasner's law office was located was behind on its 2017 property taxes as well. Krasner and his wife moved into the building, which they now own personally, after selling their longtime home in Mount Airy for $416,000 last year.

Krasner paid the $10,000-plus debt from 2017 after WHYY's inquiry. His spokesman called it an "oversight."

Last week, City & State Pennsylvania reported that another real estate company tied to Krasner, named Tiger Building LP, previously owed the School District more than $130,000 in unpaid use-and-occupancy taxes. Waxman said Krasner's business is currently in a payment plan with the city to pay down the debt, which it negotiated down to about $89,000.

Waxman said the DA currently "only has an ownership stake in one active commercial property": the "Tiger Building" in Center City.

Krasner is paid $175,000 annually. His wife's salary is in the six figures.