PhillyDeals: His goal of creating 'livetime' Web content

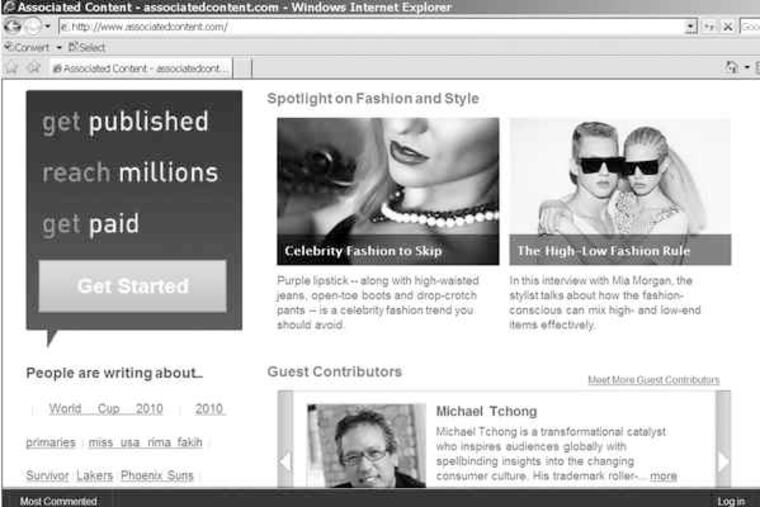

Yahoo Inc. just bought the company Patrick Keane runs, Associated Content, for a reported $100 million. Associated posts stories, pictures, and videos by what it claims are 400,000 volunteer and amateur contributors, who get paid, a little, if their stories bring in lots of hits.

Yahoo Inc. just bought the company Patrick Keane runs, Associated Content, for a reported $100 million. Associated posts stories, pictures, and videos by what it claims are 400,000 volunteer and amateur contributors, who get paid, a little, if their stories bring in lots of hits.

"We don't want to be in the news business," Keane told me, with a Yahoo operative listening in. "I get the New York Times, the Post, the Wall Street Journal every day, and will in perpetuity."

He reads The Inquirer online "because I'm a big Phillies-Eagles-Flyers fan" (he grew up in Wynnewood). Plus, Keane played soccer at Penn Charter ('88) and still checks Inter-Ac League standings. But newspapers aren't good at the "math and science" of generating traffic, he said. "News is ephemeral. But if you create content that's livetime, you can monetize that."

Keane's career has charted the Internet. After Penn Charter, he graduated from Trinity College and worked for a New York medical-communications firm. "Enthralled" with the early Web, he talked his way into a newsletter editorship at Jupiter Research by age 25, where he was attached as a consultant to young Web bosses like AOL chief Steve Case. "There were no experts, so I was able to become an expert in a vacuum," Keane told me.

That led to a job with Google sales boss Tim Armstrong in 2002. Keane left Google four years later, as head of sales strategy and marketing. After a stint at CBS Interactive negotiating with Apple for iTunes coverage, he joined Associated.

What's Yahoo's plan? "We want to do with content what eBay did with auction."

That means trying to summon thousands of phone-camera-wielding free-lancers to make shaky video of big events (the Chile earthquake, an NHL victory riot) and compiling batteries of amateur travel and feature stories. All of which, over time, will include better pieces that will drive traffic and ads to the site, Yahoo figures.

Don't work too cheap

One in every six adult Americans is out of work, but low-wage U.S. employers still have a tough time filling jobs.

On Wednesday, shares of American Apparel Corp. tumbled after the California-based retailer and maker of women's clothing said it might default on its debt.

Sales have been recovering, says the chain, which includes stores at King of Prussia and Cherry Hill Malls and in Center City and University City. But it's faced sharply higher recruiting and labor costs since U.S. immigration agents forced it to fire 1,500 workers at its clothing plants last year because they could not prove they were in the United States legally, American Apparel said in a statement.

On Tuesday, The Inquirer reported, an old bus rolled on Westmoreland Avenue in Port Richmond, sending 16 day laborers to the hospital.

The workers weren't heading to the blueberry fields of Hammonton. They were recruited by a contractor on the street corners of Kensington to labor at the Bellmawr bakery belonging to J&J Snack Foods, a fast-growing publicly traded firm that supplies to Wawa, ShopRite, and office, factory, and college cafeterias.

"I think what this says about J&J, and many of the companies I follow, is that it's hard to find a consistent labor pool for lower-skilled jobs," food-company analyst Mitchell Pinheiro, of Janney Capital Markets, told me.

Even in this recession, he said, "it is probably easier for large companies to outsource the job of finding quality employees that show up for work consistently than spend the time and expense in-house" to find people.

J&J investor Bob Costello, owner of $40-million-asset Costello Asset Management in Huntingdon Valley, says it's a function of unemployment compensation, which has been extended by Congress and the president to prevent people who still haven't found jobs in the long recession from going broke.

"They have no incentive to go to work for these jobs that pay $8 an hour," he said.

Even among stock-owning investors, Costello said, he knows clients who have been out of work a year but "won't touch a job for less than $80,000 a year, because they're still collecting."