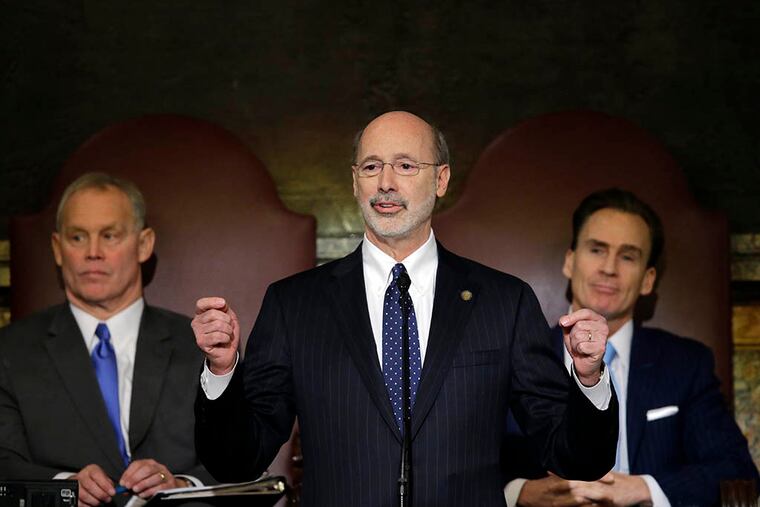

A $4B question: How big is Wolf's budget?

HARRISBURG - The legislative battle over Gov. Wolf's budget proposal began in earnest Monday - starting with a dispute over just how much money is at stake.

HARRISBURG - The legislative battle over Gov. Wolf's budget proposal began in earnest Monday - starting with a dispute over just how much money is at stake.

Wolf has described his proposal as a $29.8 billion spending plan. But GOP lawmakers say it is closer to $33.8 billion.

Matthew Knittel, chief of the state's unaffiliated budget arbiter, the Independent Fiscal Office, told lawmakers it depends on how one counts it.

Testifying before the House Appropriations Committee at the start of three weeks of budget hearings, Knittel said the Republicans' higher estimate factors in pension payments and proposed new and increased taxes.

Knittel described the economic forecast as rosy for the coming year, citing projected increased revenues, a higher rate of new jobs, and wage growth.

He said he believes the state's projected deficit for 2015-16 is closer to $1.5 billion or $1.6 billion than the $2.3 billion shortfall cited by Wolf and Democrats.

Rep. Joe Markosek (D., Allegheny), the ranking Democrat on the Appropriations Committee, said he was sticking by the higher estimate. "We have a proven record of putting out fair numbers," he said after the hearing.

Wolf's spokesman, Jeff Sheridan, said the fiscal office in its deficit estimate does not include one-time transfers of funds used by former Gov. Tom Corbett.

The lower deficit estimate gives opponents a stronger argument against Wolf's plan to raise sales and income taxes and impose a natural gas severance tax.

In his budget proposal, Wolf said he wanted to close the deficit, pump more funds into public schools, provide property tax relief, and reduce corporate taxes.

Republican lawmakers vigorously questioned Knittel on various aspects of Wolf's revenue-generating proposals.

"Do you agree that the increase would put at risk wage and job growth?" asked Rep. Warren Kampf (R., Chester).

Knittel said the direct impact was unclear at this point, but predicted a "trade-off" with the menu of new taxes and tax reductions.

When asked about the impact of property tax reduction, Knittel said: "It would increase disposable income for middle-income families."

GOP lawmakers also hammered acting Revenue Secretary Eileen McNulty with an item-by-item dissection of Wolf's plan to raise the sales tax from 6 percent to 6.6 percent, and expand the tax to include dozens of additional items and services - from diapers to caskets.

McNulty described the tax plan as a holistic plan to respond to underfunded schools, the deficit, and rising local taxes.

"All the pieces work together to provide more money to Pennsylvania taxpayers and address our obligations," she said.

Rep. John Galloway (D., Bucks) agreed. "Taxpayers desperately need relief from the reliance on property taxes," he said at the hearing.

Knittel said there were too few budget details at this point to provide hard estimates of the overall costs - with the exception of the proposed 10 percent hike in the personal income tax, which he and the Wolf administration agree would raise about $2.7 billion when fully phased in.

Knittel said his office is studying Wolf's plan to impose a 5 percent tax on natural gas drilling that the governor says would raise close to $1 billion. While the extraction tax would increase the tax burden on drillers, he said, it would be offset by Wolf's proposal to cut in half the corporate net income tax.

GOP lawmakers were unmoved by the arguments supporting Wolf's budget.

"This is a gigantic tax increase," said House Appropriations Chairman Rep. Bill Adolph (R., Delaware) after McNulty testified. "I don't believe the plan was well thought out. ... A lot of work has to go into it."