Charter school expansion emerges as obstacle in Pa. budget talks

HARRISBURG - Negotiators inched toward an agreement Tuesday that would impose new taxes on cigarettes and digital downloads in Pennsylvania, but a proposal to loosen caps on charter-school enrollment emerged as a sticking point in striking a budget deal, top senators said.

HARRISBURG - Negotiators inched toward an agreement Tuesday that would impose new taxes on cigarettes and digital downloads in Pennsylvania, but a proposal to loosen caps on charter-school enrollment emerged as a sticking point in striking a budget deal, top senators said.

Critics of the proposed changes say they would leave Philadelphia and other cash-strapped school districts with little say in managing the surge of charters within their borders - and the added costs they can bring.

Sen. Pat Browne (R., Lehigh), chairman of the Appropriations Committee, called the Philadelphia charter-school issue the "600-pound gorilla in this conversation," and signaled that resolving it might have to wait until the fall.

He spoke after legislators reconvened Tuesday afternoon - and then recessed only a few hours later - without announcing a firm deal on how to fund the $31.5 billion spending plan that lapsed into law at 12:01 a.m. Tuesday. The chambers are expected to return Wednesday morning to begin voting on a tax package that will raise new revenue for the budget.

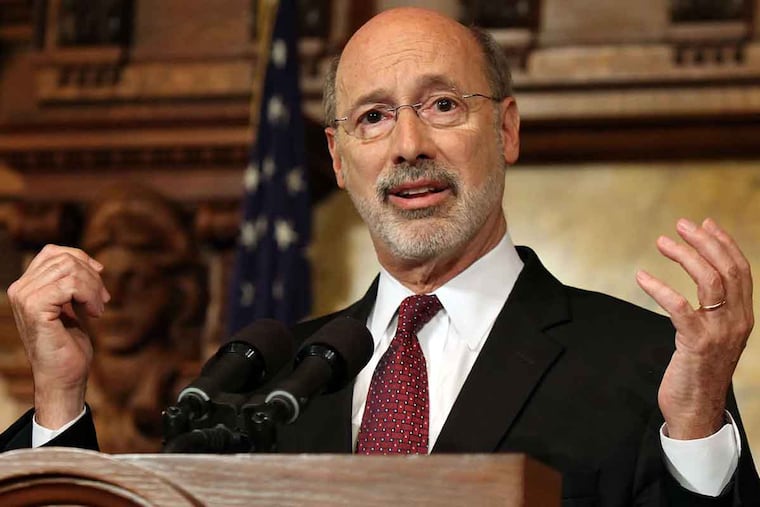

Gov. Wolf allowed the spending blueprint to become law without his signature because he believed the Republican-dominated legislature would swiftly be able to deliver a plan to pay for it.

But disagreements have lingered over how to raise the roughly $1.3 billion needed to close a shortfall in the plan and bring the budget into balance. The state constitution requires a balanced budget.

Rank-and-file legislators have been saying privately for days that they expect they will be dismissed for the summer if a deal cannot be reached by midweek.

Asked about that as he entered the Senate chambers Tuesday, Senate President Pro Tempore Joe Scarnati (R., Jefferson) said: "Leaving here and not getting this done would put us off a steep cliff."

Scarnati acknowledged that the proposed charter-school changes had become a wedge issue in talks, although he noted that the legislation for it also proposes a list of changes to make charters more accountable.

"As someone who keeps sending money into Philadelphia, and funding into our public school system, I think it's a fair ask to get some accountability and some reforms," Scarnati said.

He added: "Just because you are born in a school district and you have a bad school, you should not be destined to have to stay in that school. That is not the American dream and Philadelphia needs to understand that all kids - all kids - should have the choice of going to a good school."

Nearly 70,000 city students were enrolled in the 83 charter schools operating in the district in the school year that just ended. The district's $2.8 billion budget for the current fiscal year includes nearly $875 million for charter schools, including transportation.

In a letter to legislators representing the city, Philadelphia School Superintendent William R. Hite Jr. urged them to vote against the bill that would loosen the enrollment caps.

He said the proposal, as initially written, would let charter schools enroll more students than they had agreed to in their operating agreements, add grades at will, and enroll students from surrounding districts.

Hite said that at a time when the district has begun to stabilize its finances, the bill would "dismantle" the district's ability to manage its own funds and threaten its long-term financial health.

Browne said the talks over the charter issue had turned more divisive than negotiations on taxes - long an albatross on efforts to achieve on-time budgets.

"It's amazing," he said.

House Republicans have proposed raising roughly $1 billion from expanding gambling, allowing private entities to sell wine, hiking taxes on tobacco products and instituting a tax amnesty program.

Browne said Tuesday that all those pieces were likely to be part of a final agreement on new revenue. He said negotiators have settled on a $1 hike in the tax on a pack of cigarettes - raising it to $2.60 - and will impose wholesale taxes on smokeless tobacco and electronic cigarettes, which had been exempt.

Cigars would continue to be exempt. Browne said that is because there are wholesale cigar distributors in Pennsylvania, and legislators fear they would shutter their business and move to Florida, which does not tax their products.

Negotiators have also settled on imposing the 6 percent sales tax on digital downloads, including music, movies, books and apps, he said.

Browne signaled that the legislature will count on raising roughly $100 million from gambling expansion - but will not actually settle and vote on the legislation until the fall. The House had proposed legalizing online gambling and expanding slots to airports and offtrack betting parlors.

Asked about the risk of deferring a gambling expansion resolution until the fall, Browne said: "One hundred million dollars in the scope of a $31.5 billion budget . . . it's not needed right away. But if it's probable? You can book something that is probable."

717-787-5934@AngelasInk